Evan Frazier, CFA, CAIA

Senior Research Analyst

In recent years, most major brokerage firms have participated in a “race to the bottom” with respect to commissions on equity purchases and sales, as well as options trades. This phenomenon, in tandem with the rise in popularity of app-based trading platforms like Robinhood, has afforded retail investors greater access to capital markets. While the democratization of the investment world is beneficial in many respects, it can also lead to irrational behavior and a decoupling of asset prices and fundamentals.

In this newsletter, we analyze the recent frenzied trading activity that has grabbed the headlines, including a summary of what has happened so far and a look at the impact and implications of this behavior.

Read > Fundamental Disconnect: Understanding the Nature and Impact of Recent Frenzied Trading

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

08.19.2025

On August 7, 2025, President Trump signed an executive order to expand alternative investment access in defined contribution retirement plans…

08.19.2025

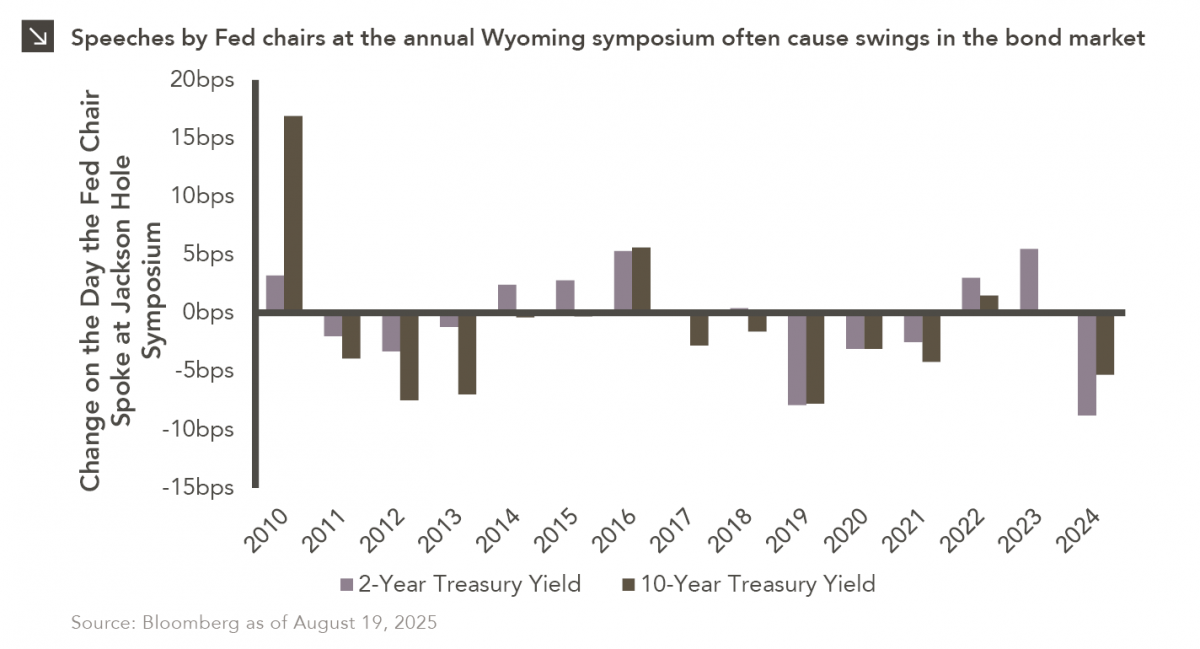

Predictions that the Federal Reserve is set to lower interest rates will be put to the test this week as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >