David Hernandez, CFA

Director of Traditional Manager Search

This month marked the somber one-year anniversary of the World Health Organization declaring COVID-19 a global pandemic. In addition to the immeasurable human suffering the disease has caused, the toll on both the financial markets and broader economy has also proven historic in magnitude. After the unprecedented market volatility in March 2020, two questions on many investors’ minds were if a market bottom had been reached and if a recession was underway. The S&P 500 hit an all-time high on February 19th, 2020, and subsequently experienced a fast and furious COVID-induced sell-off resulting in its March 23rd bear market trough. Although at that time, investors could not be certain this was the bottom as economic uncertainty remained high while the pandemic was still in its early stages. To help reason through the two questions noted above, we wrote “Signs of a Market Bottom?” which analyzed four broad categories in an attempt to identify markers of a trough: Technical Data, Valuation Data, Economic Indicators, and COVID-19 Data. This information was examined in the context of bear markets that coincided with recessions, which is an important distinction because one can exist without the other. Our analysis indicated that all but valuation data were useful in identifying a market trough.

Given that it has been over a year since the rapid peak–trough-bull market start, the purpose of this paper is to revisit the four aforementioned categories to see which, in hindsight, were relevant in identifying the 2020 market bottom.

Read > Signs of a Market Bottom: One Year Later

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.01.2025

Please join Marquette’s research team for our 3Q 2025 Market Insights Webinar analyzing the third quarter across the…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

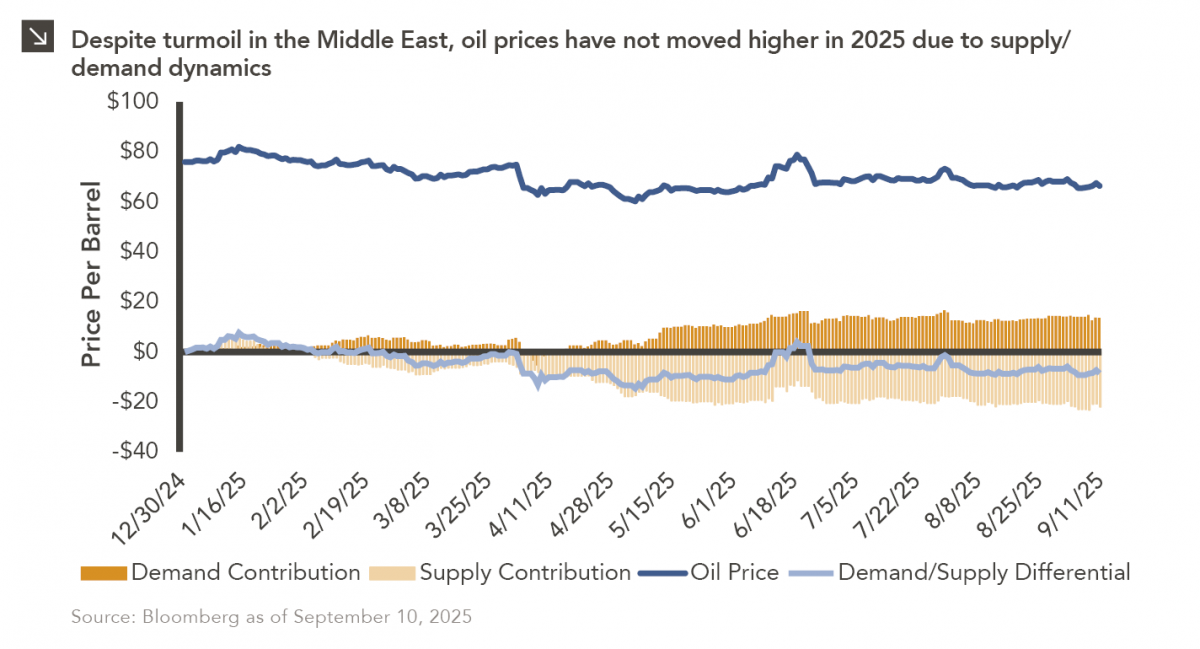

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

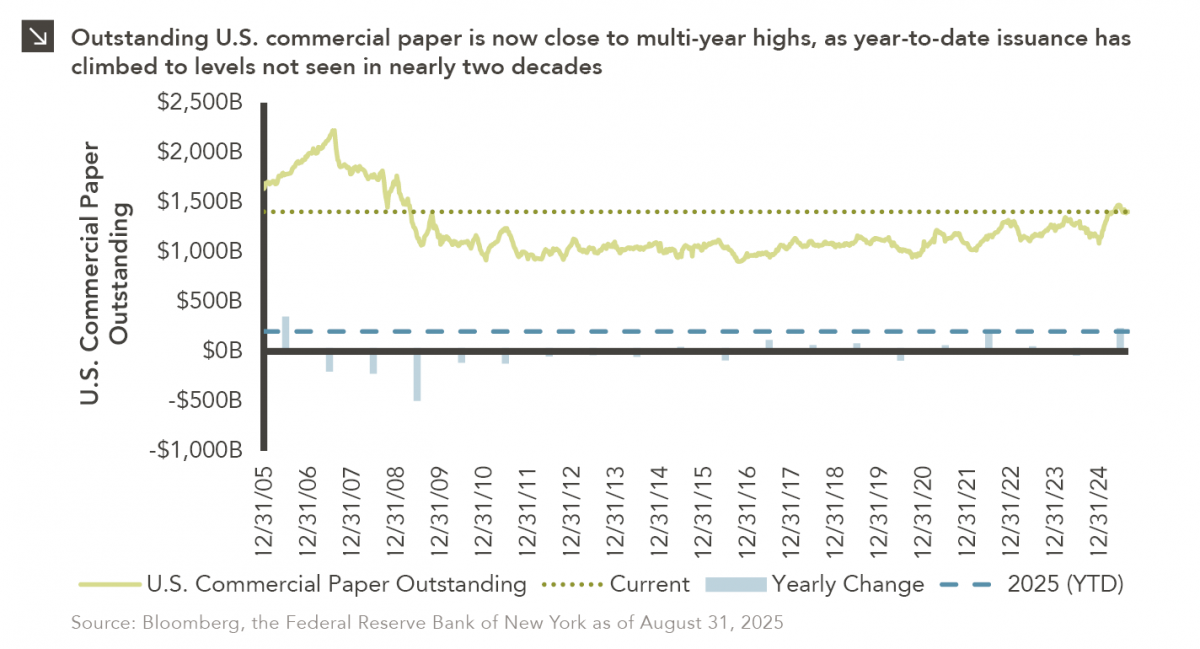

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >