10.22.2025

3Q 2025 Market Insights

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

Amid concerns over the Delta variant and signs of a sharp slowdown in the global economic rebound, many central banks have signaled that they will keep monetary policy loose over the near-to-medium term. U.S. Federal Reserve Chairman Jerome Powell, at the annual Jackson Hole summit on August 25th, maintained that rate hikes were not imminent. Though, on the spending front, Powell did indicate tapering bond purchases may be on the horizon, as long as economic progress continues. We expect to hear a similar narrative at this Thursday’s European Central Bank meeting, with a subtle caveat. Given how well the European economy has rebounded, the ECB is expected to slow the pace of their €1.85 trillion asset-buying program — the Pandemic Emergency Purchase Programme (PEPP) — in the fourth quarter.

The chart above shows monthly net bond purchases made under the PEPP since its inception in March 2020. There was a substantial injection in the first four months of the pandemic, which then decreased as the first wave waned and lockdown measures relaxed. Bond purchases remained at or below €70 billion for the next seven months. However, in response to rising bond yields, the ECB increased PEPP purchases in March 2021 and has kept them at a higher pace since. At the coming meeting, ECB officials are likely to agree to trim PEPP bond purchases to roughly €60 billion per month for the remainder of 2021, a 25% drop from the current pace of €80 billion per month.

What impact will this modest tightening have on the European Union’s economic recovery? The pan-European market benchmark, the STOXX 600 Index, posted its seventh straight month of gains in August, the longest winning streak since 2013, on the back of strong corporate earnings, lower unemployment, an adult population that is 70% fully vaccinated, and continued accommodative fiscal measures. We expect ECB hawks to argue for the need to curtail the current inflation trajectory, citing its potential to outpace expectations given supply chain bottlenecks and resurgent household demand. Inflation, as measured by the Eurozone HCIP, was 3% at August month-end, above the ECB’s 2% target. On the contrary, more dovish members will likely be more concerned with ramping up the existing ongoing asset purchase program once PEPP ends. As COVID-19 variants test the need for further abatement measures and restrictions in Europe and around the world, central banks are under increased scrutiny. Monetary policy decisions, particularly the pace of tapering and rate increases, will have lasting effects on global markets for the remainder of 2021 and the next several years.

Print PDF > Taking the PEPP Out of the Eurozone’s Recovery?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

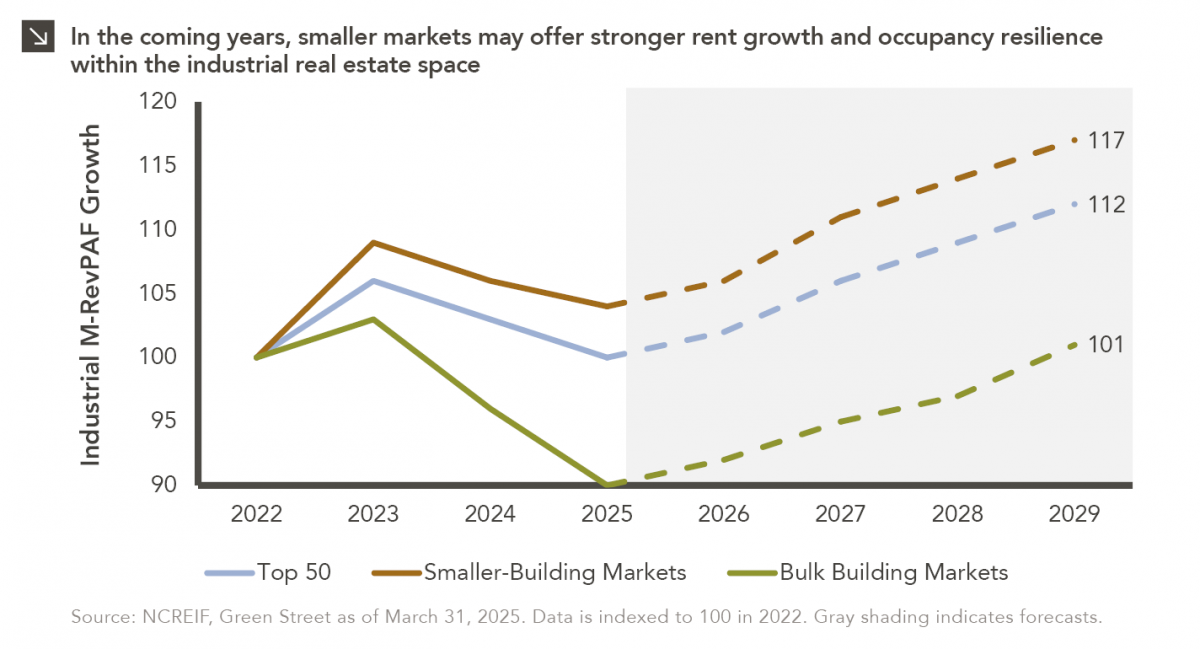

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >