Evan Frazier, CFA, CAIA

Senior Research Analyst

Recent days have proved quite challenging for equity investors. On the international front, the Nikkei 225 — which tracks the performance of large, public companies in Japan — dropped by more than 12% in Monday’s trading session. This figure represents the most significant single-day drawdown for that index in more than 35 years. Other non-U.S. equity benchmarks have exhibited similar pullbacks: The MSCI EAFE and MSCI EM indices are both down roughly 6% on a month-to-date basis as of the time of this writing. Performance has been similarly challenged for domestic stocks, with the S&P 500 and Russell 2000 indices down around 6% and 10%, respectively, over that same period. Perhaps unsurprisingly, the CBOE Volatility Index (“VIX”) reached a level not seen in more than four years during Monday’s trading session as investors grappled with broad market turbulence. Despite some moderation throughout the Monday session, the VIX remains well above its 10-year average after a prolonged period of muted volatility. These dynamics can be observed in the chart above.

As is often the case during market downturns, there is not a single force driving recent performance but rather a variety of factors at play. Some of the factors in this case include the following:

The dynamics described above have further clouded the future. As recently as last month, market participants expected roughly two rate cuts from the Federal Reserve for the remainder of 2024; now that figure sits at around five, with two 25 basis point cuts forecasted at the next FOMC meeting in September. To that point, the yield on the 2-Year Treasury, which closely tracks expectations surrounding Fed policy, briefly sank below 3.7% on Monday before pulling back to around 3.9% later in the trading session.

It is important to remember that the current market decline is not unprecedented. Investors should recall that equity indices are prone to corrections, with the S&P 500 Index exhibiting a drawdown of 10% or greater in 19 of the last 30 calendar years. As always, we encourage investors to maintain a long-term outlook related to their portfolios and not overreact to short-term volatility. A disciplined portfolio rebalancing policy coupled with a long-term strategic asset allocation is the most proven method to achieve risk and return objectives.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

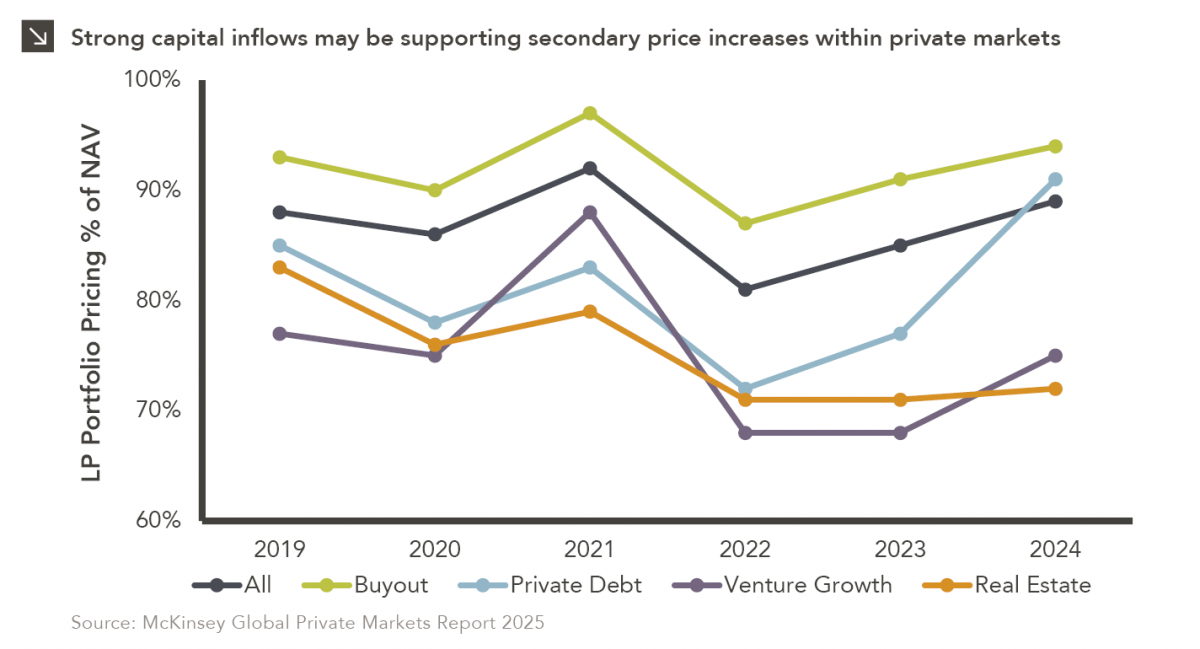

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

08.19.2025

On August 7, 2025, President Trump signed an executive order to expand alternative investment access in defined contribution retirement plans…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >