David Lewandowski

Research Analyst, Sustainable Investing

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both chambers of the state legislature. In terms of Environmental, Social, and Governance (ESG) investing, most Republican trifectas and states with divided governments have enacted legislation opposing ESG measures in recent years, while Democratic trifectas have passed bills in favor of ESG. Specifically, 36 states have passed a total of 127 bills either supporting or opposing ESG initiatives since 2020. At the time of their enactment:

While the darkest shades of blue and red in this week’s chart represent the states with the highest number of enacted ESG bills, it is interesting to note that the states represented by the lightest shade of blue (CT, NJ, NM, NY, WA) are Democratic trifecta states that have not passed any ESG bills to date. Readers should also note that ESG investing is federally regulated by the Department of Labor and the Securities and Exchange Commission, with strict disclosure requirements for investment managers to substantiate any ESG-related claims.

Future ESG legislation will likely vary on a state-by-state basis based on political leadership, making upcoming elections particularly relevant. Election outcomes in politically divided states that have yet to adopt any ESG bills will be especially noteworthy when it comes to gauging sentiment. Upcoming gubernatorial races with potential ESG implications include New Jersey and Virginia later this year, as well as Alaska, Arizona, Michigan, Nevada, Vermont and Wisconsin in 2026.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

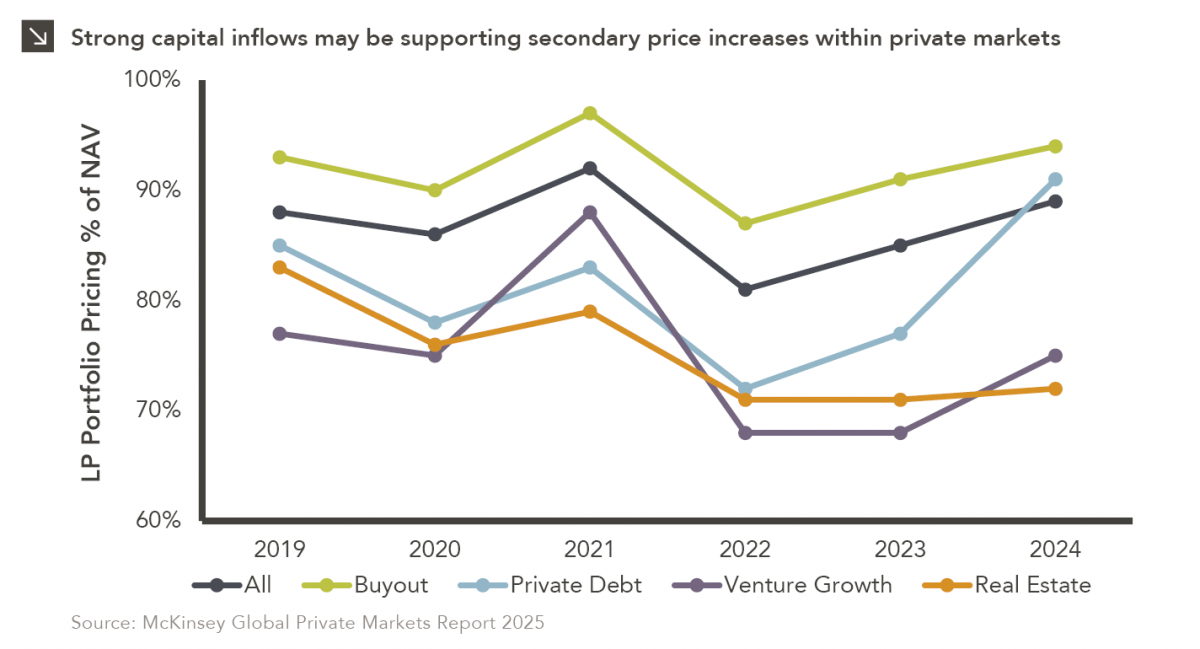

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.19.2025

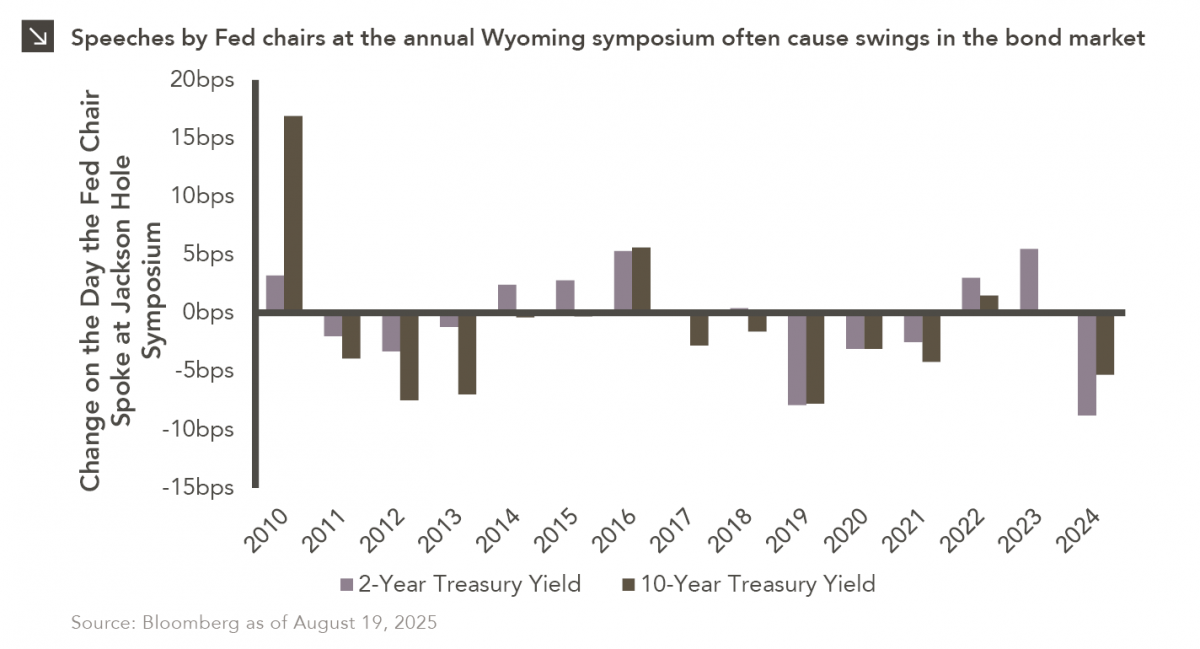

Predictions that the Federal Reserve is set to lower interest rates will be put to the test this week as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >