Nic Solecki, CBDA

Client Analyst

Get to Know Nic

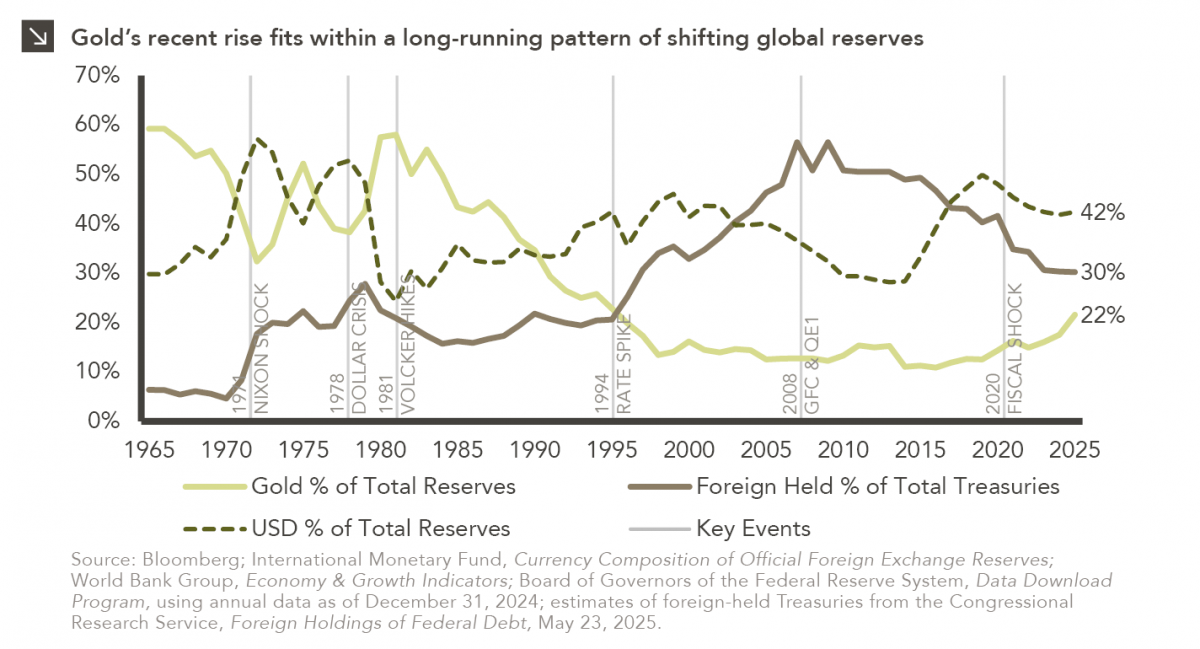

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential role of the commodity in markets and portfolios. Some may view gold’s rise cautiously given shifting perceptions of U.S. policy and debt sustainability, questioning whether the rally reflects a meaningful shift in safe-haven preferences or simply the latest stretch of momentum.

The opinions of most investors have been shaped by an era in which attractive real yields, credible policy, and deep liquidity positioned Treasuries as the world’s premier safe-haven asset. As global reserves and risk frameworks increasingly centered on Treasuries and the dollar, gold’s role as a monetary anchor naturally faded. This week’s chart helps highlight this transition, and the events detailed above underscore how shifts in confidence have shaped market behavior. The Nixon Shock in 1971 ended gold convertibility and closed a monetary era in which trust in the dollar rested on the gold anchor, giving way to one in which confidence hinged on U.S. policy credibility. That credibility was tested early in 1978, when the Dollar Crisis revealed how unsettled the fiat transition remained and required coordinated intervention to steady the currency. By 1981, rate hikes had pushed real yields higher and helped tame inflation, providing the foundation the new system needed. As inflation cooled and credibility strengthened, Treasuries became the stabilizing asset of choice, helping set the conditions for the multi-decade bond bull market that followed (a dynamic that would surface again with the 1994 rate hikes). Decades later, the landscape shifted again with the Global Financial Crisis and quantitative easing by the Federal Reserve. Long-term yields compressed, central bank balance sheets expanded, and the dollar’s share of total reserves began a gradual decline. The pandemic shock in 2020 accelerated these dynamics as debt expanded and real yields turned negative. In recent years, central banks and affiliated institutions have been gradually increasing their gold holdings as a precaution against persistent macroeconomic and geopolitical strains.

Viewed through this lens, gold’s renewed relevance carries a familiar echo. Specifically, the commodity often strengthens when global confidence in the dollar feels tenuous. From this perspective, the recent rally may signal a shift away from a Treasury-centric period rather than any departure from gold’s longstanding function (i.e., a store of value). In that context, conversations regarding the role of gold may broaden from here.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >