Doug Oest, CAIA

Partner

Following his election in December 2012, Japanese Prime Minister Shinzo Abe introduced a suite of measures designed to revive the long struggling Japanese economy. Dubbed “Abenomics”, these revamped economic policies sought to revive the economy using three primary “arrows”: monetary easing, fiscal stimulus, and structural reform. As part of this strategy, the Bank of Japan has embarked on an unprecedented open-ended asset purchasing program that will nearly double the country’s monetary base in two years. The move, which seeks to expand the monetary base from ¥135 trillion to ¥270 trillion by the end of 2014, is seen as a massive gamble to lift inflation expectations and boost growth.

The broad results of these policy changes are shown in the chart above. As the monetary base (blue line) has rapidly expanded in 2013, the Japanese stock market has taken off (red line), albeit with a pull-back in the spring. Not unlike the U.S., easy monetary policy has translated into a positive wealth effect for investors holding Japanese stocks.

For U.S. dollar-based investors, the rally has also had an impact on year-to-date returns. Despite a strong sell-off later in the second quarter and headwinds due to the weakening Yen, the broad based MSCI Japan Index is up over 23% year-to-date as of July 12, 2013. With Japan constituting over 20% of the MSCI EAFE index and nearly 15% of the MSCI ACWI ex U.S. index, Abenomics has played an important role in both index fund and active manager returns year-to-date. Many active global and non-U.S. equity managers held a substantial underweight to the country, which has been a drag on returns in 2013. With the U.S. dollar strengthening, particularly against the Yen, active managers’ position on currency hedging has also played a large role in relative returns over the last year. As investment managers continue to evaluate the effects of Abenomics on companies in Japan and the surrounding region, it is clear that Japan’s fiscal and monetary policies will continue to have a large impact on non-U.S. equity performance.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.08.2025

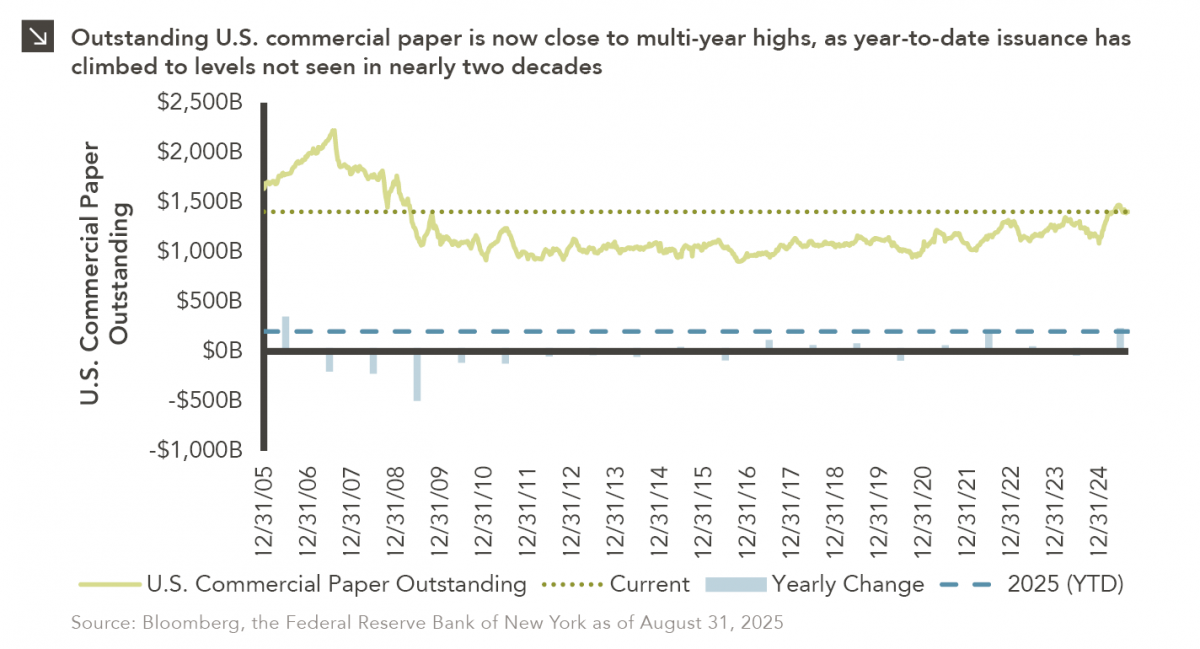

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

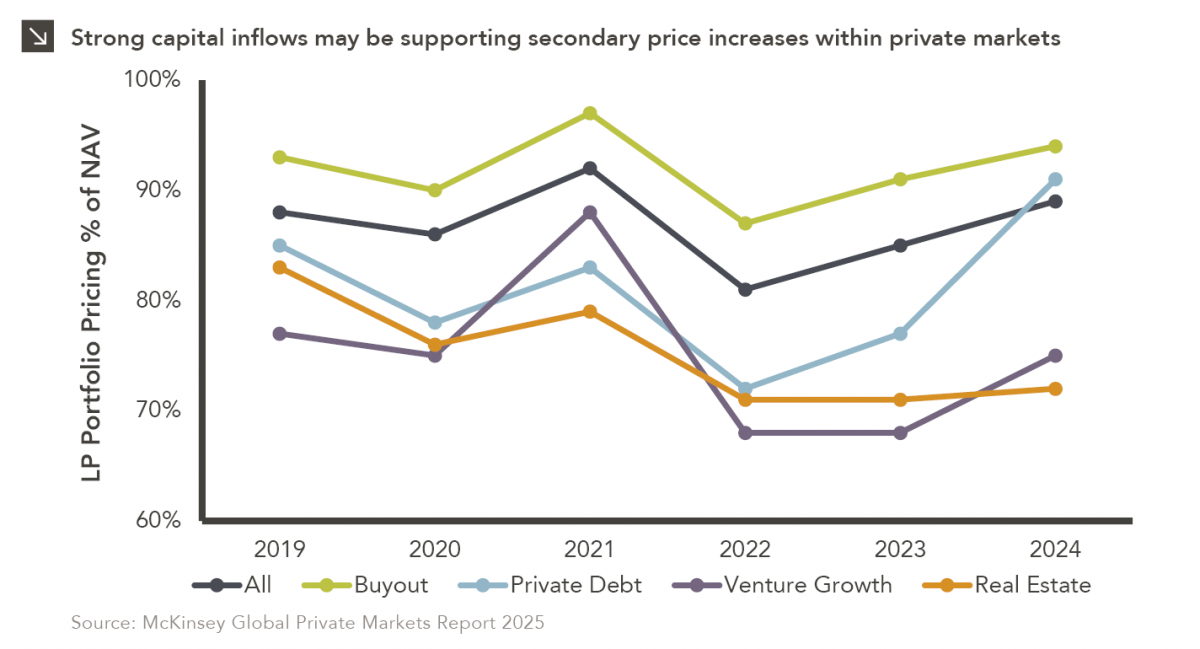

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.19.2025

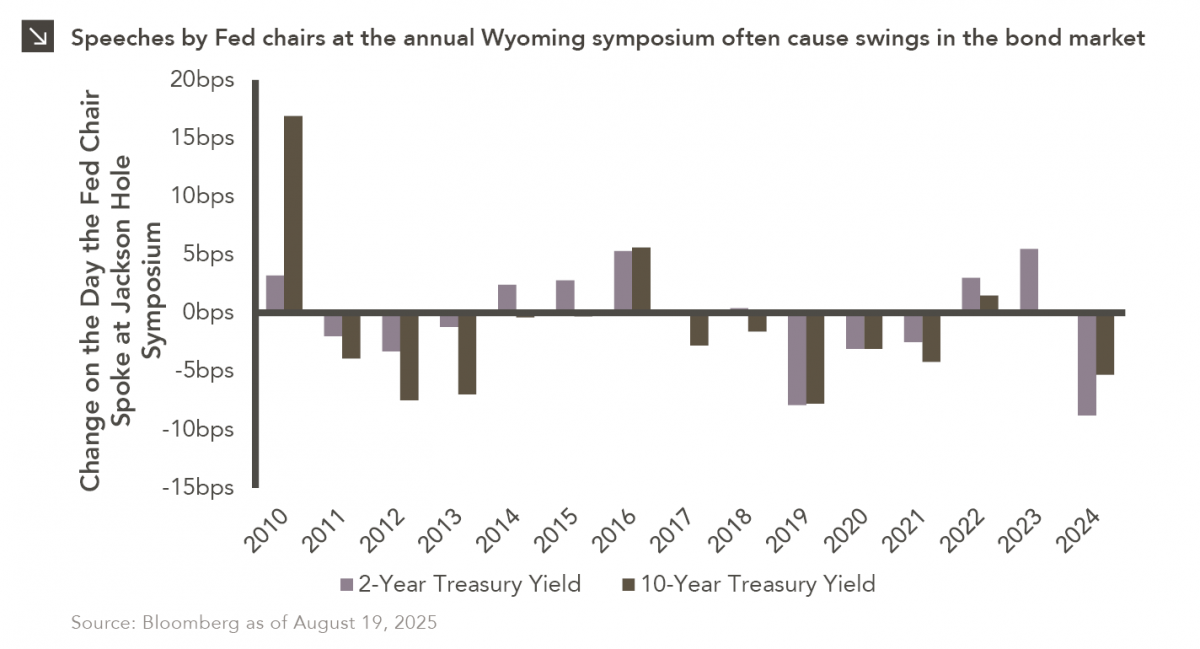

Predictions that the Federal Reserve is set to lower interest rates will be put to the test this week as…

08.04.2025

The U.S. employment report released last Friday by the Bureau of Labor Statistics (“BLS”) painted a significantly weaker picture of…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >