11.17.2025

Central Bank Examination

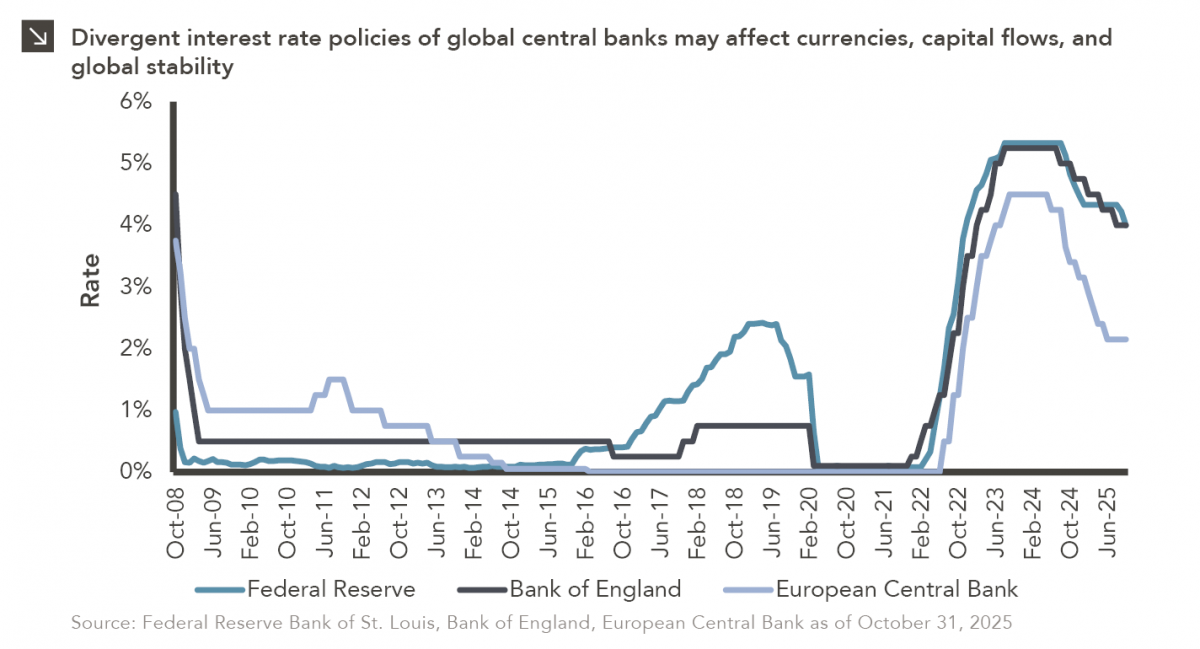

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Given the monumental run of the equity markets in 2013, we have frequently been asked if the stock market (as measured by the S&P 500 index) is overvalued heading into 2014. The answer unfortunately is not a simple yes or no, because it depends on the valuation method and measurement period. This week’s Chart of the Week looks at one valuation measure, the S&P 500 trailing 12-month price-to-earnings (P/E) ratio. We compare today’s P/E ratio with its 10, 20, 30, and 40-year averages.

As the chart shows, there is no clear cut answer when comparing these different averages to the current value — the analysis is very much contingent on the time period utilized when calculating the long-term average. Based on the 20- and 30-year averages one may conclude that the market is fairly priced, if not underpriced. However, the exaggerated P/E ratios as part of the tech bubble likely provide an upward bias to truly objective “long-term” averages. Fortunately, the 40-year average is sufficient to more effectively smooth out the spikes from the Tech Bubble valuations. Using this time period to determine the long-term average, it does indeed appear that the market is overvalued and expensive by historical means. However, this is far from a guarantee that the market will experience a correction in 2014, though we encourage our clients who experienced outsized gains in their equity portfolios in 2013 to consider rebalancing back to their target ranges. If nothing else, one thing is for sure: in order to sustain this current bull market run, the S&P 500 will need to produce strong earnings growth over the next year.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.17.2025

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

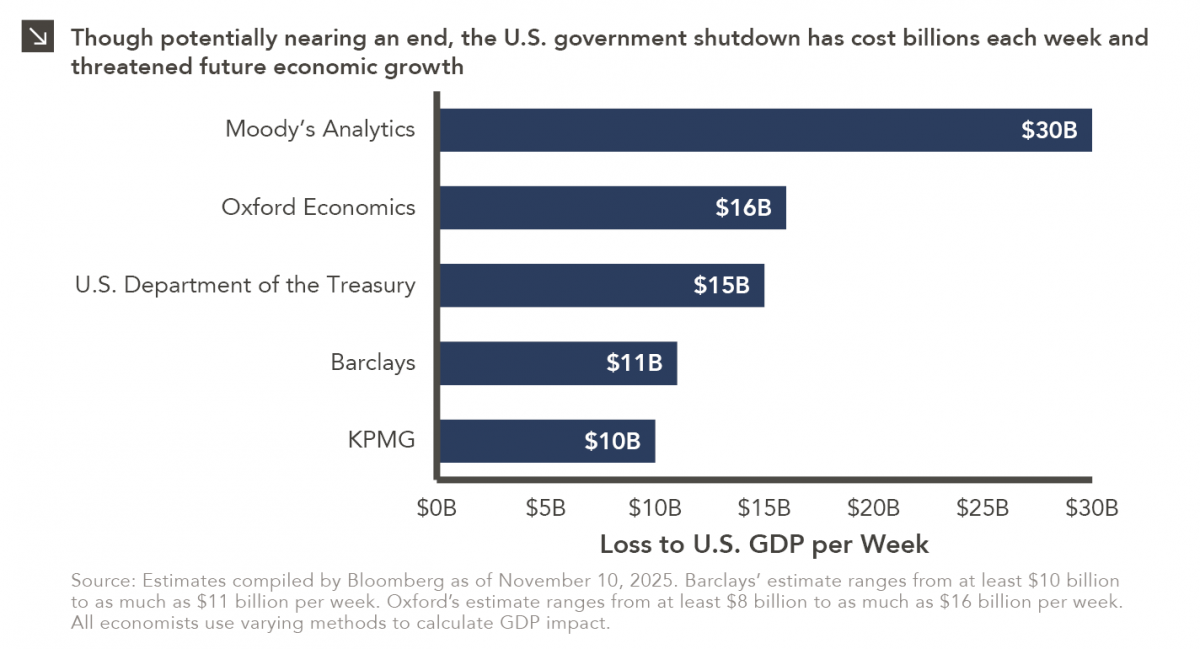

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >