Jesus Jimenez

Principal

A major concern for investors over the last year has been the impact of a stronger dollar on international equity returns. Generally speaking, a stronger dollar translates to lower returns for international equity investments, and in 2014 the currency effect on the EAFE index was -10.9%, a sizable reduction to returns for U.S.-based investors. On the other hand, valuations for international equities – especially those in Europe – appear far more attractive relative to levels in the U.S., and suggest higher upside potential, with the ECB’s asset purchase program offering further upside for European equities.

To date, how has this dynamic played out? Have the compelling valuations abroad been more than offset by the currency drag from the dollar’s strength? Our chart this week examines these very questions, looking at year-to-date performance for major markets and regions. Perhaps not surprisingly, Eurozone equities show the largest downward adjustment as a result of exchange rates, while Japan and China show little to no difference between local and dollar-denominated returns. After the first quarter, international equities have outperformed their U.S. counterparts in 2015 and rewarded investors who were patient with their non-U.S. equity allocations. Though it has only been one quarter, this is a theme that may persist for the better part of the year, as the dollar is still stronger than its historical average versus the Euro, and equity valuations are suppressed relative to those in the U.S.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

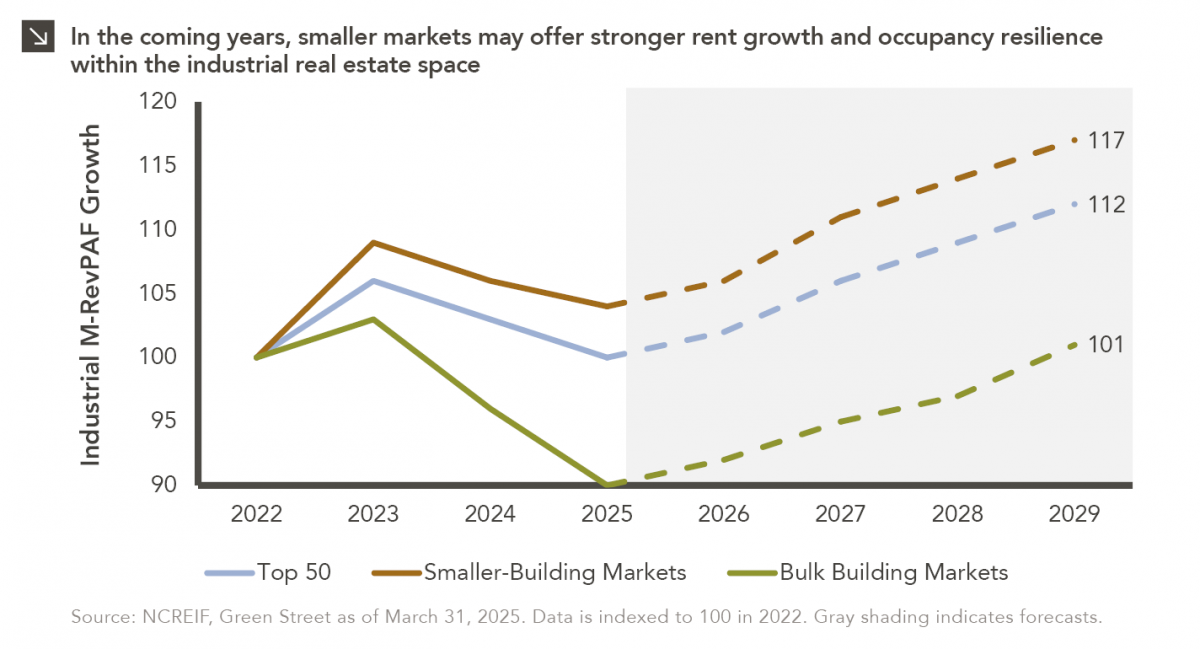

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >