Evan Frazier, CFA, CAIA

Senior Research Analyst

If recent data points collected by the Federal Reserve are any indication, major financial institutions are bracing for a period of challenged economic activity. The latest edition of the Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices, which surveyed roughly 70 domestic banks and 20 U.S. branches and agencies of foreign banks, found that nearly 40% of these organizations have raised standards for commercial and industrial (C&I) loans to large and middle-market firms over the last several months. According to the survey, these tighter conditions were most widely reported for costs of credit lines, premiums charged on risky loans, covenants, collateralization requirements, and spreads of loan rates over the cost of funds. It is important to note that these tighter conditions are not limited to C&I borrowers, as standards for commercial real estate and credit card loans, as well as home equity lines of credit, are back to levels last seen during the early days of COVID-19. Respondents cited reductions in risk tolerance, decreased secondary market liquidity for commercial and industrial loans, lower competition among lenders, and a less favorable economic outlook as the primary reasons for these higher lending standards.

In a special section of the most recent SLOOS, banks were asked to assess the probability and potential severity of a near-term economic downturn. Roughly 80% of respondents believe there is at least a 40% chance of a U.S. recession in the next 12 months. On a more positive note, none of the banks included in the survey believed the downturn would be severe, with roughly 75% of respondents indicating the recession would likely be moderate and 25% expecting it to be mild. For context, severe recessions have historically resulted in a 3.4% reduction in real GDP and an increase of 3.6% in the unemployment rate, according to Federal Reserve data. Mild and moderate recessions, on the other hand, have seen real GDP decline 0.6–1.1% and increases of 1.1–1.8% in the unemployment rate.

Whether or not these predictions ultimately come to fruition, Marquette recommends remaining invested throughout the economic cycle, as downturns can be notoriously difficult to time. Securities markets also tend to be forward-looking, so much of the pain associated with a possible future recession may already be reflected in the current landscape. As banks and other market participants continue to assess economic conditions, and as markets react, and overreact, to those changing expectations, it is important for investors to maintain diversification across asset classes and remain focused on long-term objectives.

Print PDF > Banks to Borrowers: Tighter, Tighter

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.17.2026

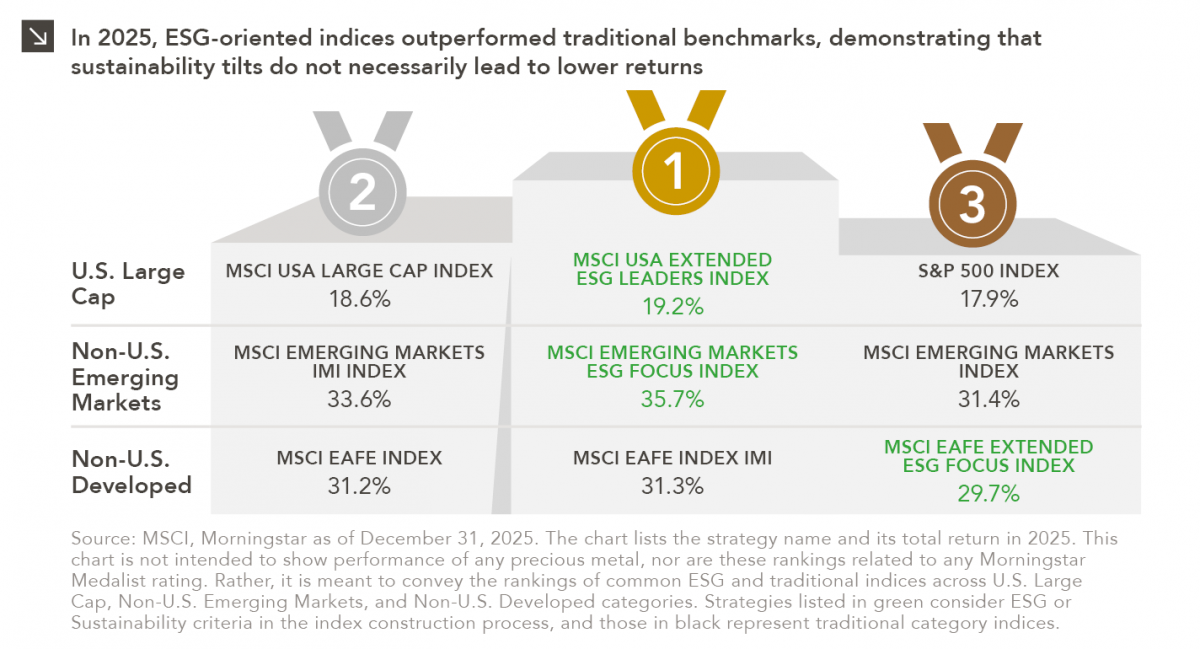

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

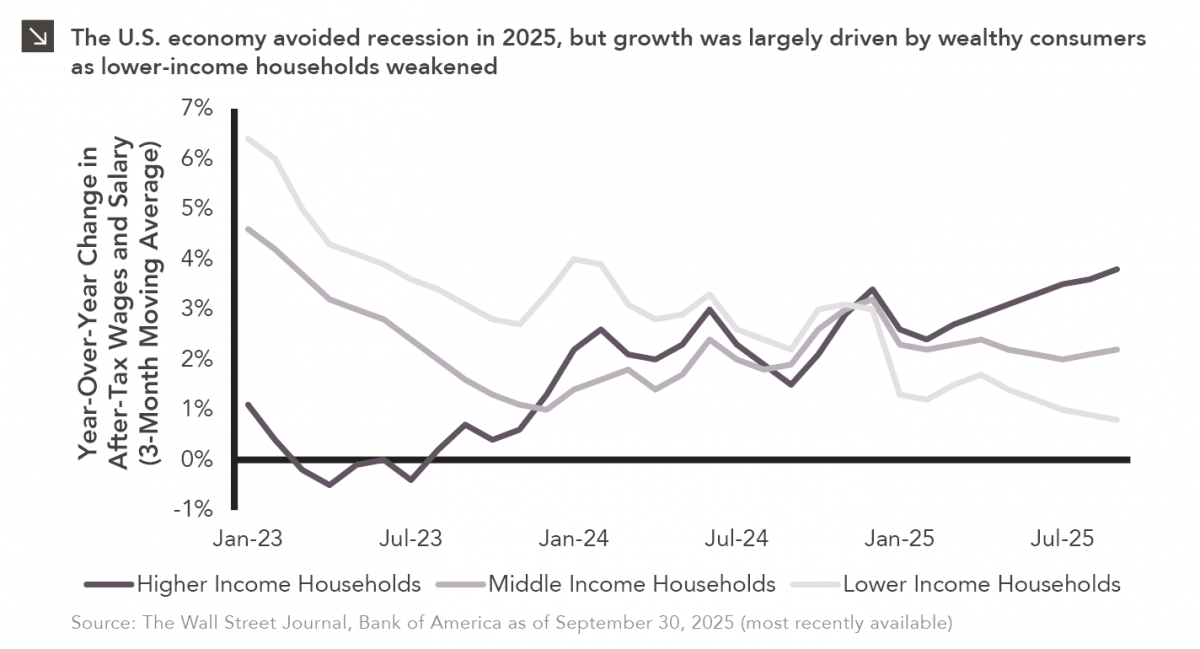

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >