Greg Leonberger, FSA, EA, MAAA, FCA

Partner, Director of Research

As markets swirl and stagflation fears mount, what should investors do?

Our newsletter last week outlined the broad context of President Trump’s new tariff policy as well as the most notable market impacts. Granted, the news seems to change daily, as does the market’s reaction; trying to pen a targeted newsletter is an almost worthless endeavor because by the time the ink has dried, markets have shifted due to another policy pivot. In the short term, the omnipresent cloud of uncertainty will continue to drive market volatility and investor sentiment. The best recipe for investors to weather this storm is patience and discipline, both of which can be difficult to come by in the current environment.

As we step back and take a longer-term view of the future, however, the threat of stagflation is becoming more realistic. Coined as a combination of the words “stagnation” and “inflation,” it is an economic backdrop characterized by high inflation, slow economic growth, and in some cases, high unemployment.

In this edition, we examine which asset classes are most exposed to stagflation and which can offer shelter.

Read > Bracing for StagflationThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

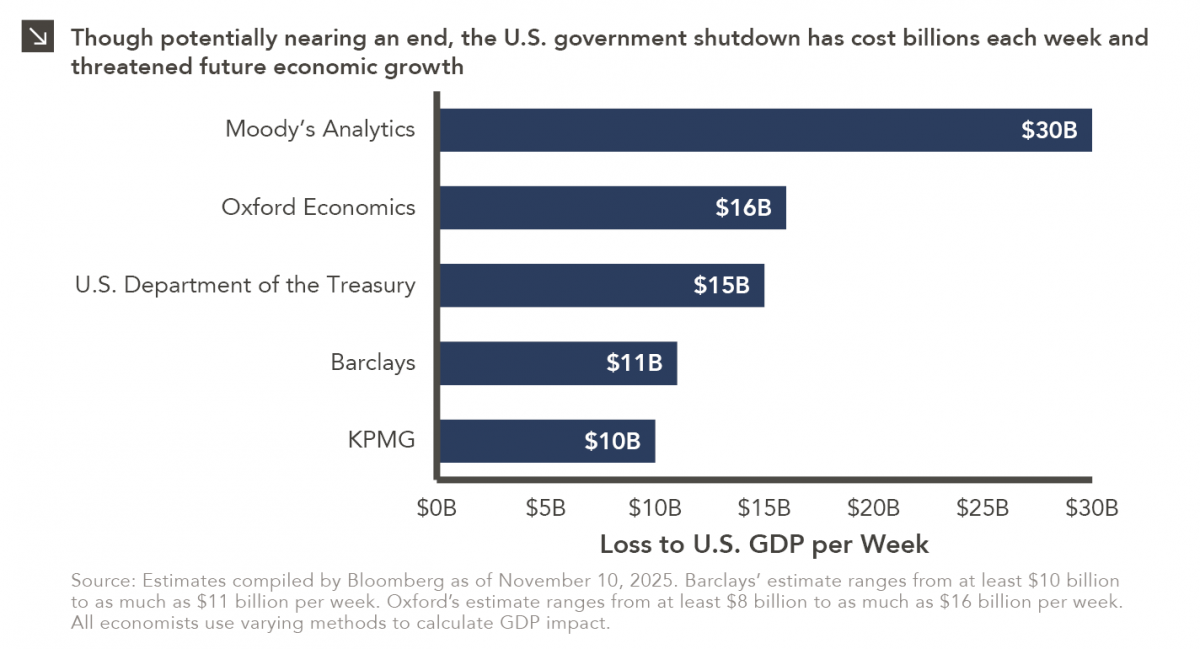

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >