Jessica Noviskis, CFA

Portfolio Strategist, OCIO Services

All eyes are on rates this week as the Federal Open Market Committee (FOMC) convenes for the third time this year. In the seven weeks since the March meeting when the Committee raised rates an initial 25 basis points, continued inflationary pressures and an increasingly hawkish tone from Chairman Powell and other FOMC members have driven up market expectations for future hikes. The futures market has gone from pricing in a total of six 25 basis point increases and a year-end federal funds rate of 1.94% to ten hikes, including three consecutive 50 basis point increases, and a year-end rate of 2.81%. If market expectations prove correct, it would be the steepest pace of increases since the 1980s.

For a central bank that never quite normalized policy after the GFC, cooling decades-high inflation without tipping the economy into recession amid strained supply chains, a war in Europe, and COVID lockdowns in the world’s second-largest economy will be no easy task. Recent market volatility and sentiment reflect this uncertainty, with both equities and bonds down sharply year to date. While first quarter U.S. GDP “growth” of -1.4% missed expectations, the contraction was driven by trade and inventories as opposed to a consumer slowdown. The U.S. consumer is still strong, but the path forward is uncertain, with the yield on the 10-year Treasury — a key reference point for borrowing costs — briefly surpassing 3% yesterday for the first time since 2018. The Fed has to consider many moving pieces as it plans its path from here, and we look forward to hearing more about that process at Chairman Powell’s press conference tomorrow.

Print PDF > Can the Fed Thread the Needle?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.17.2026

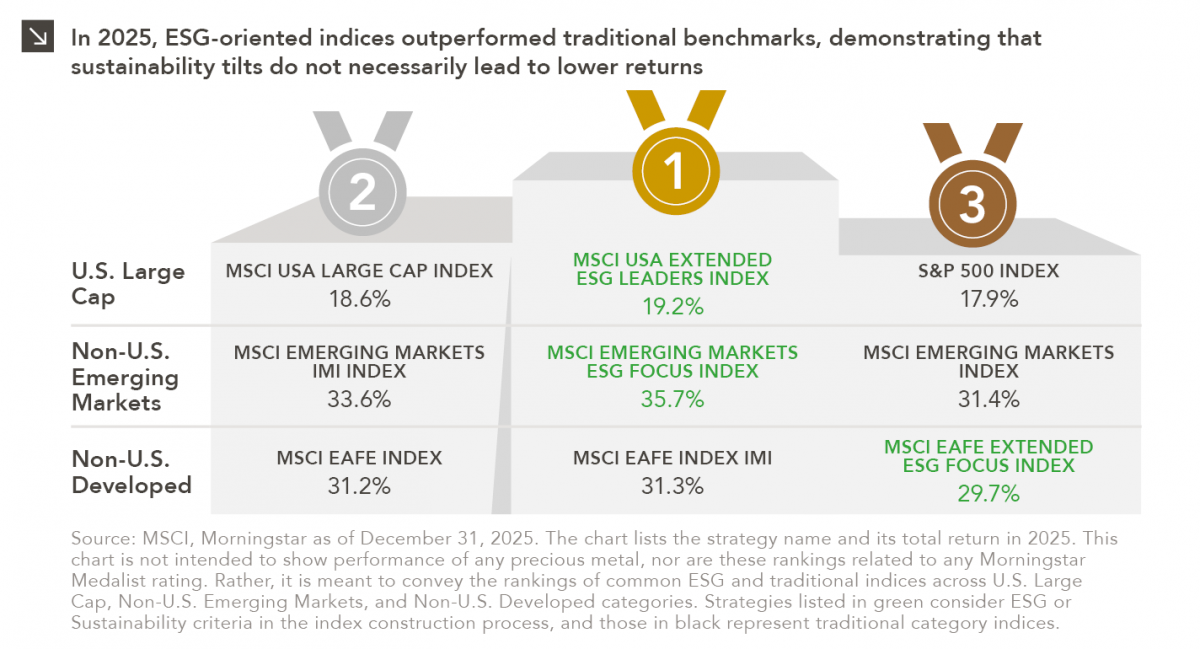

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

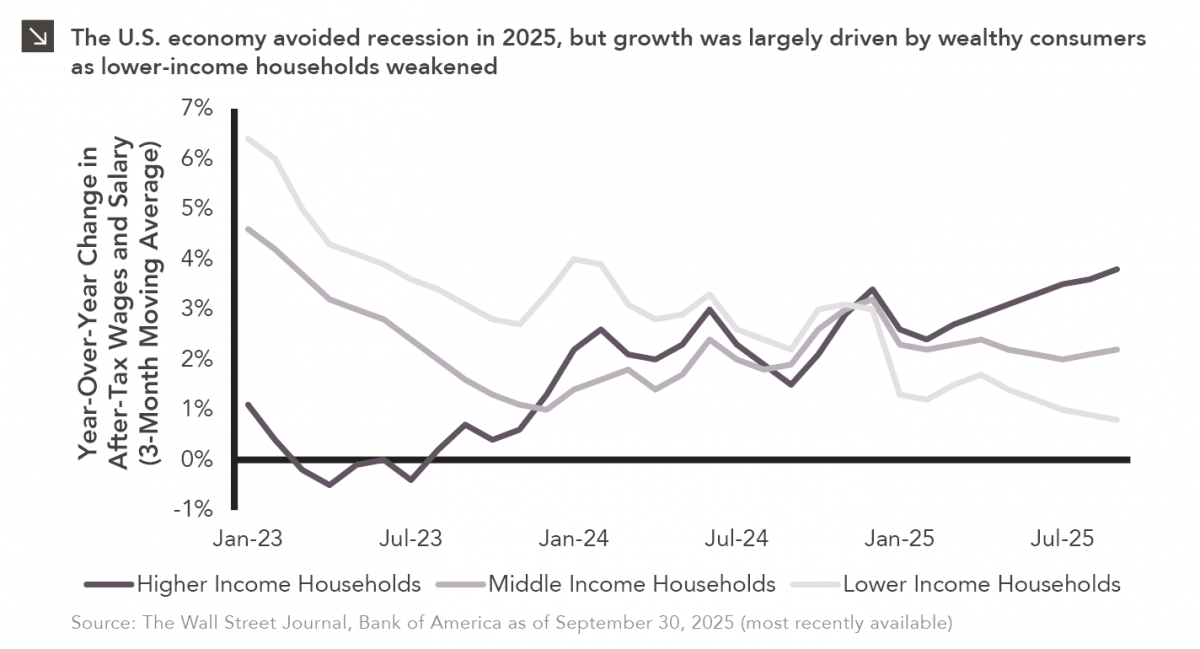

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >