09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

In the spring of 1973, the lyrical geniuses Walter Becker and Donald Fagen of the musical group Steely Dan released the song “Reelin’ In the Years.” The third and fourth lines of the first stanza proclaim:

Well, you wouldn’t even know a diamond if you held it in your hand

The things you think are precious I can’t understand

At first glance, the reproving lyrics underscore the disagreement of value between two parties and one’s inability to recognize an object of high value. Arguably, value is subjective as the intersection of what the most pessimistic seller and most optimistic buyer are willing to accept. Fagen and Becker could have been students of economic policy, prophesizing the creation of Bitcoin more than 35 years later and critical of inflation, which would reach 6.2% in 1973 and 11.1% in 1974.¹ While I am hesitant to put Fagen and Becker in the same category as Keynes, Smith, and Friedman, I do believe their words inspire a debate on the meaning of value.

Gold has historically been accepted as an alternative to cash and a hedge against inflation. As expected, inflation has been on the rise this year, with the Consumer Price Index up 4.2% YoY in April, the highest in 12 years.² At the same time, contrary to conventional wisdom, gold has underperformed. Through May 14th, 2021, gold is down 3.4% YTD and up only 2.6% over the past year. Alternatively, the cryptocurrency Bitcoin is up over 50% YTD and over 350% over the past year. While there are a number of different factors behind Bitcoin’s latest rally, its status as “digital gold” may be one of them, with its finite supply and detachment from central bank policy particularly attractive right now.

The discussion around cryptocurrencies and inflation is a complicated one, given the nascency of the asset class and the limited data available given the general lack of inflation over the last several years. Making long-term decisions based on short-term information does not typically lead to beneficial outcomes. With that said, it is often hard to grasp the magnitude of innovation at its earliest stages. As the debate over the value of Bitcoin and the value of gold as an inflation hedge continues, we recommend investors be prudent and diligent in accounting for new data and information while weighing it against past lessons in uncertain periods.

Print PDF > Can’t Buy a Thrill

¹ World Bank, 1960–2019 data. “Inflation, consumer prices (annual %) – United States.”

² Cox, J. 12 May 2021. “Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008.”

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

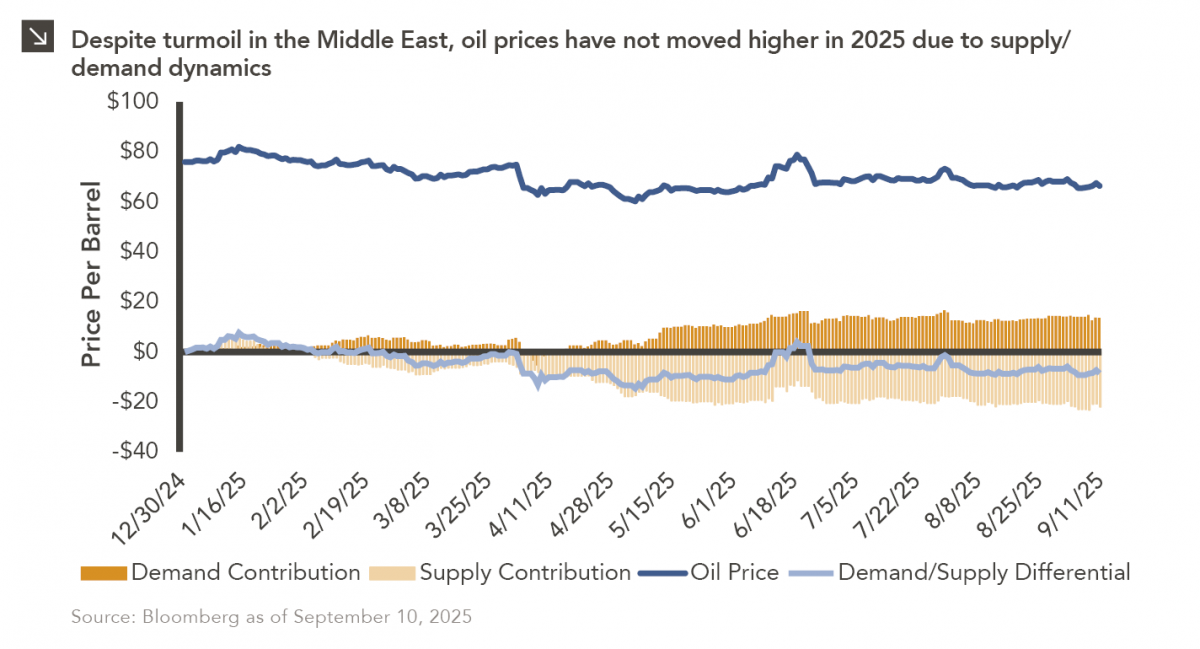

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

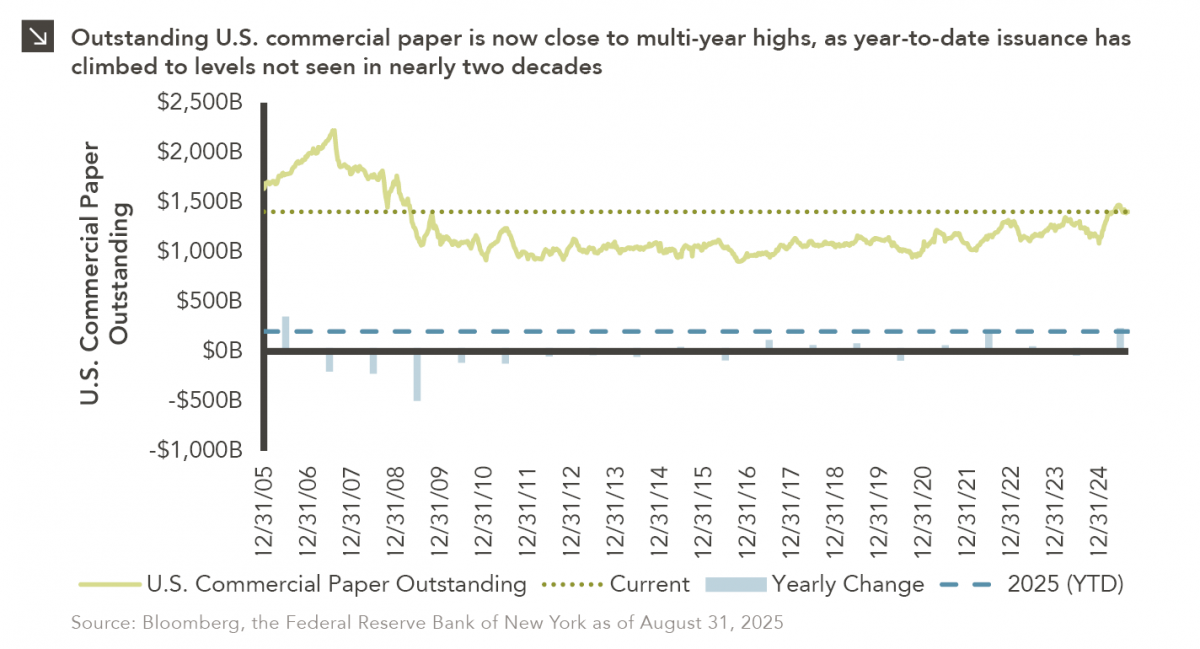

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

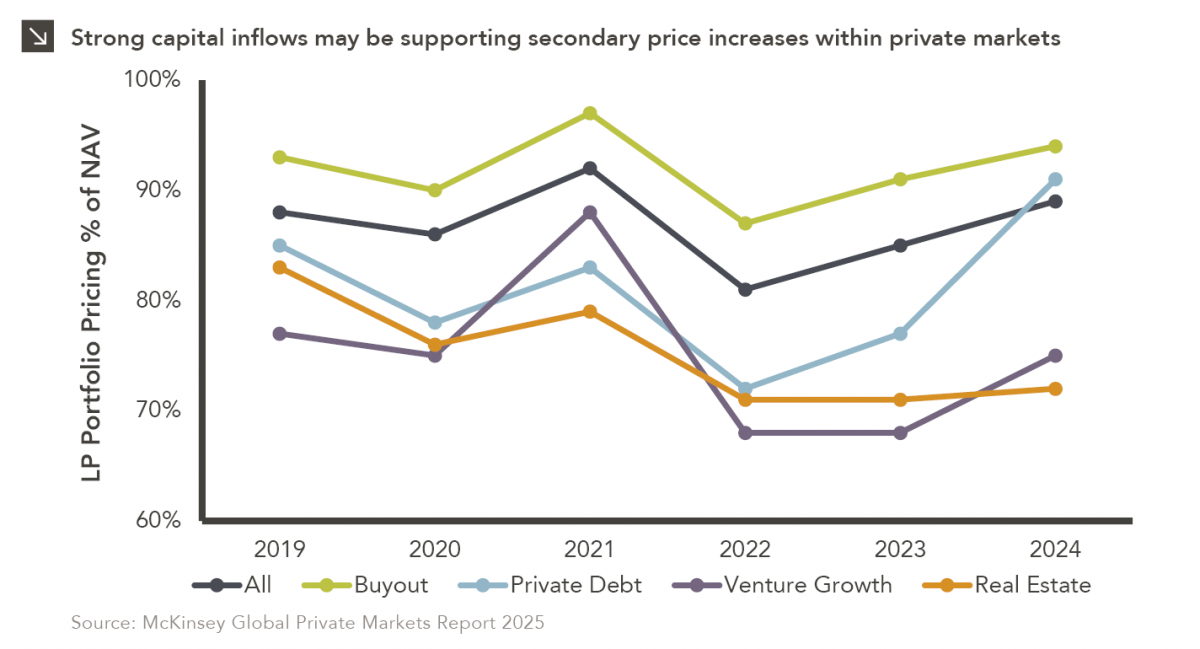

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

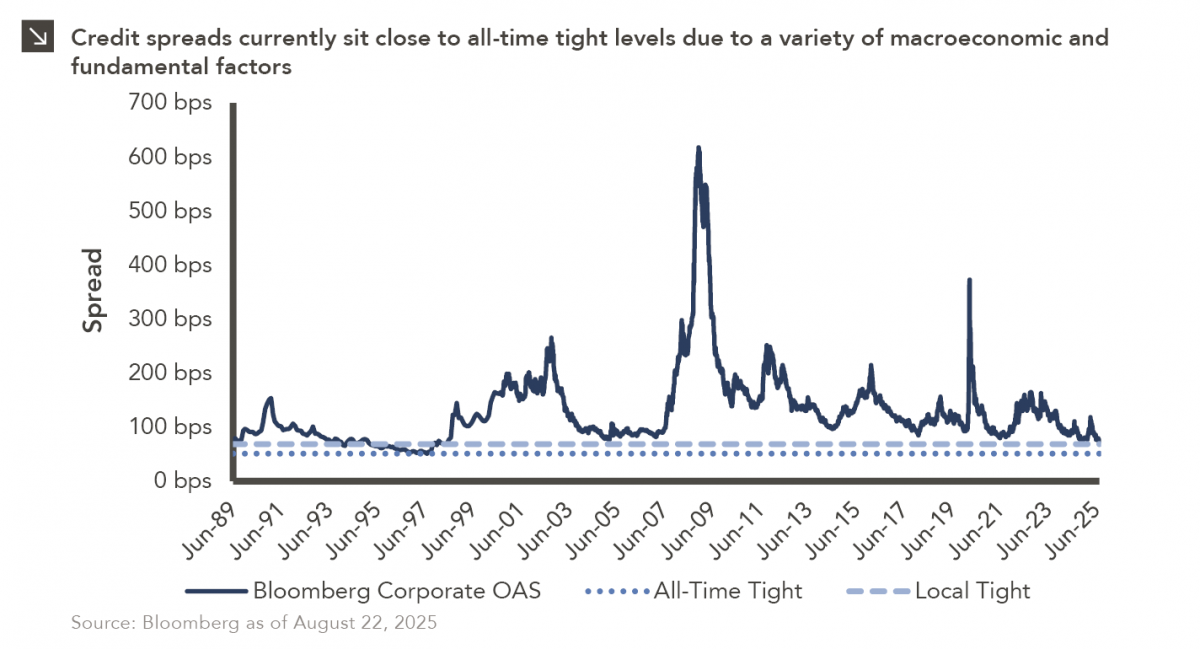

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >