Grace Colson

Associate Research Analyst

Get to Know Grace

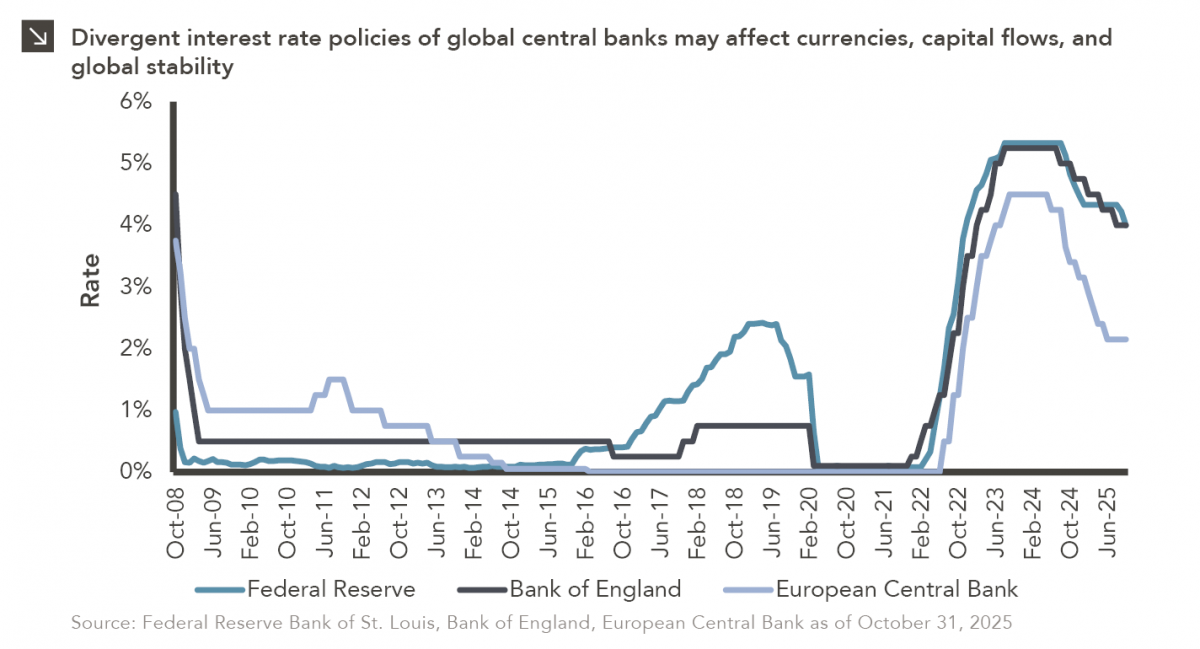

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across the Federal Reserve, European Central Bank, and Bank of England in recent time. Both the ECB and BoE initiated their easing cycles in the middle of last year, ahead of the Fed, which has since followed suit with its latest rate cut coming last month. The target range for the effective federal funds rate is now 3.75– 4.00%. The policy rate of the BoE also hovers near 4% following its August 2025 cut, and the central bank is expected to maintain this positioning through November. Meanwhile, the latest rate reduction by the ECB in June has brought its policy rate down to roughly 2.2% given the relatively weaker growth and lower inflationary pressures faced by the euro area.

While it is critical for central banks to maintain independent monetary policies tailored to the conditions of their respective economies, disparate rate regimes across the developed world could have significant implications. For instance, global currency markets remain highly sensitive to interest rate differentials, and currency movements can meaningfully shift trade balances since goods from the country with the stronger currency become more expensive abroad. Additionally, investors may redirect capital toward regions with higher yields, impacting security prices and creating volatility in global financial markets as funds move across borders. In conclusion, if these central banks opt for different policy paths going forward, an additional layer of uncertainty will likely be added to the broader economic outlook.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >