Frank Valle, CFA, CAIA

Associate Director of Fixed Income

Last month, Marquette published a Chart of the Week that highlighted the aberrational length of the current Treasury curve inversion. As outlined in that publication, a Treasury curve inversion occurs when short-term rates move higher than long-term rates, and a persistent inversion has historically served as a portent of an economic recession. To that point, an inversion preceded each U.S. recession by 18 months at the longest (usually less than a year) since the 1970s. That said, while the current inversion has persisted for nearly two years (and counting), an economic downturn has yet to materialize. Put simply, this time may be different. In fact, according to a recent Reuters poll of bond market experts, nearly two-thirds of respondents opined that the shape of the yield curve no longer maintains the predictive power it once held.

What could account for this shift? There are a few possible explanations, and the first relates to the long end of the curve. Specifically, long-dated bonds, or those with maturities of 10 years or greater, have experienced a multi-decade bull run due to strong demand from pension funds and insurance companies. These entities utilize longer-dated bonds to hedge liabilities, and demand from these plans helps prevent selloffs during periods of rate weakness. These dynamics have served to keep the long end of the yield curve relatively stable in recent time. Indeed, while the effective federal funds rate has climbed by over 5% since the Fed began its hiking cycle, the 30-year Treasury yield has risen by roughly half that amount over the same period. The second possible explanation is related to shorter-dated bonds, as 2-year Treasuries are quite sensitive to Fed policy. Given recent hiking and the central bank’s commitment to holding its policy rate higher for longer, yields on 2-year notes have been pulled higher and currently sit at elevated levels.

In order for the yield curve return to normalcy, short-term yields must fall more sharply than long-term yields. However, a resilient economy will likely keep short-term rates high, and strong technical factors have likely put a cap on yields on longer-dated securities. Given this situation and the changing market dynamics outlined in the previous paragraph, the historical relationship between yield curve inversions and recessions may not hold in the current environment.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

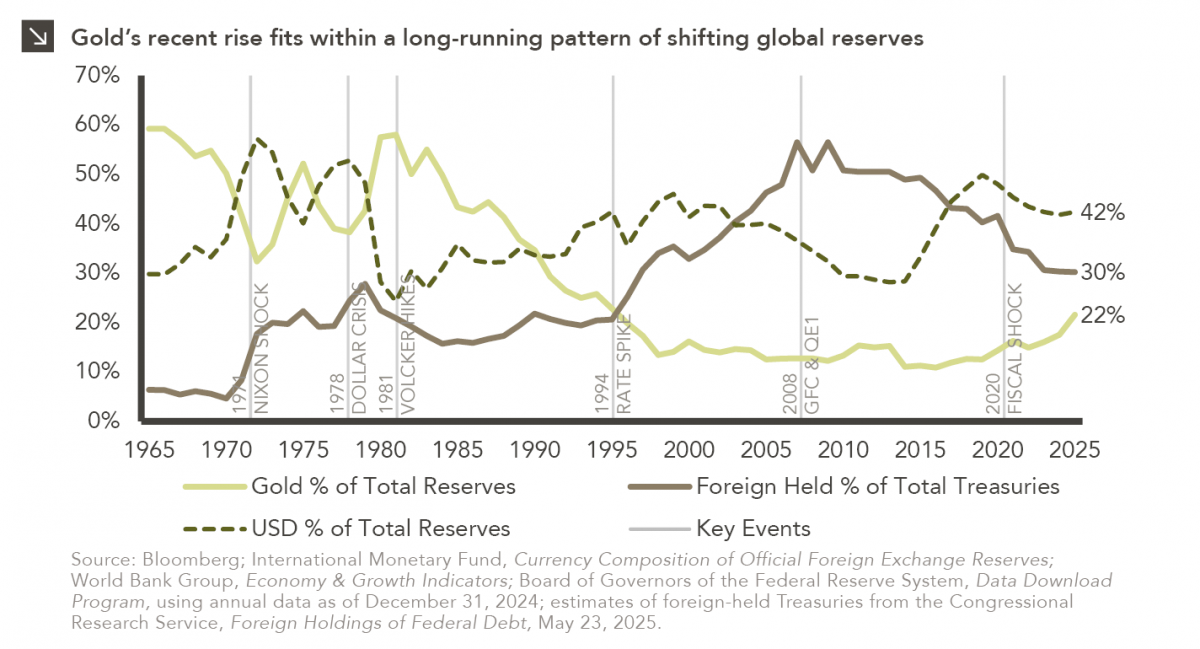

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

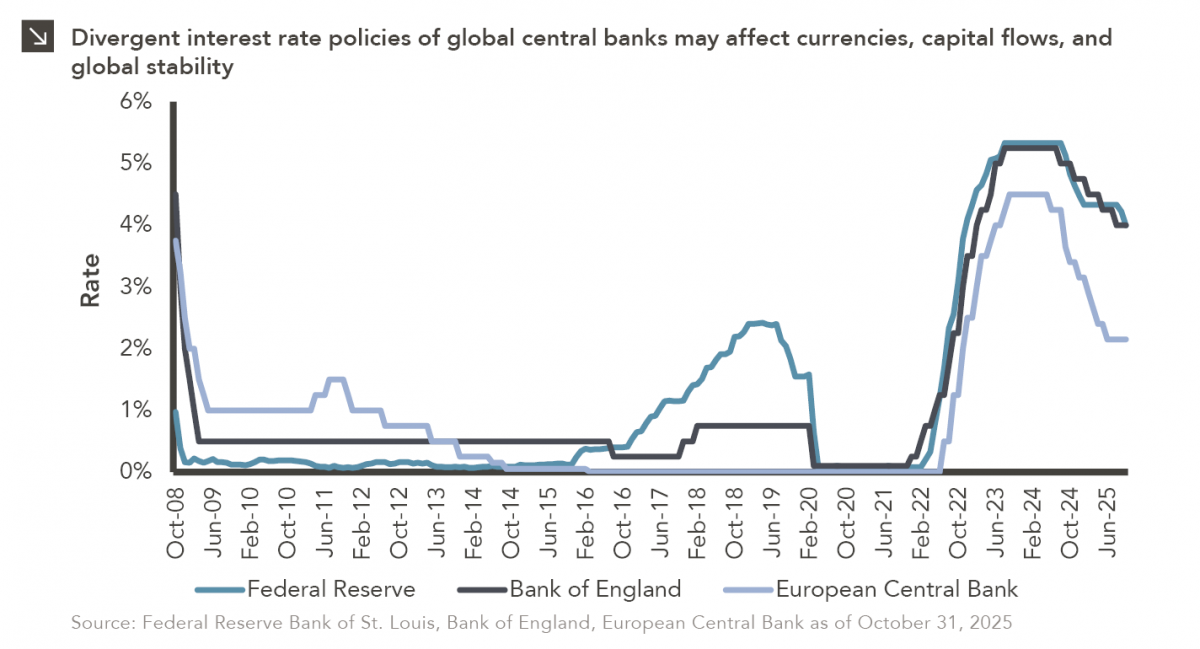

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >