Evan Frazier, CFA, CAIA

Senior Research Analyst

Large-scale government programs aimed at stabilizing the nation’s economy in the wake of the pandemic, higher interest costs, and an increase in healthcare and retirement benefit spending have fueled higher deficit levels in recent time. To that point, the nearly $2 trillion U.S. federal budget deficit in the fiscal year that ended in September represented 6.4% of GDP, which was the largest such figure ever outside wartime periods or global crises (e.g., the Global Financial Crisis, COVID-19, etc.). Based on forecasts from the Congressional Budget Office, 2025 will be the third consecutive year that the United States will see a federal budget deficit in excess of 6% of GDP. The overall national debt has ballooned to more than $36 trillion as federal spending continues to outweigh tax revenues. This week’s chart outlines these dynamics above.

There are several risks posed by excessively high debt levels, including higher inflation, lower economic activity, and the potential that the nation will be equipped with fewer financial tools to handle geopolitical challenges as a large portion of U.S. debt held is by foreign investors. One risk that incoming Treasury Secretary Scott Bessent and other officials have highlighted is “rollover risk,” or the possibility that a drop in investor appetite at Treasury auctions would render the government unable to raise cash to pay for rapidly maturing debt. Bessent has made reducing the federal deficit a top priority via a combination of spending restraint, deregulation, and tax cuts aimed at fueling economic growth. While significantly reducing the federal budget deficit over the next four years may prove challenging for policymakers, it should be noted that the U.S. did manage to shrink its fiscal gap from 9.8% of GDP in 2009 to 4.1% in 2013 at the end of the Global Financial Crisis. That said, this moderation in the deficit came during a period of extreme economic recovery, which is a decidedly different environment than the current climate. Readers should note that efforts to return the federal deficit to historical levels will likely span years and different presidential administrations, though the structural advantages of the U.S. economy provide a buffer against the risks detailed above.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.17.2026

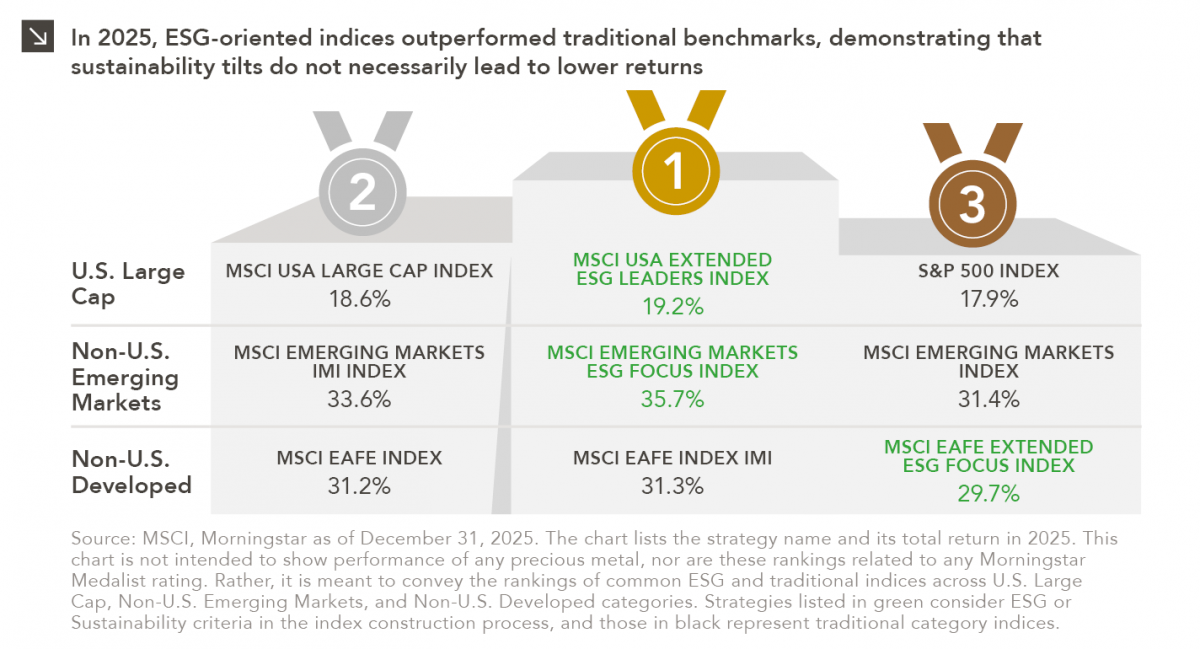

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

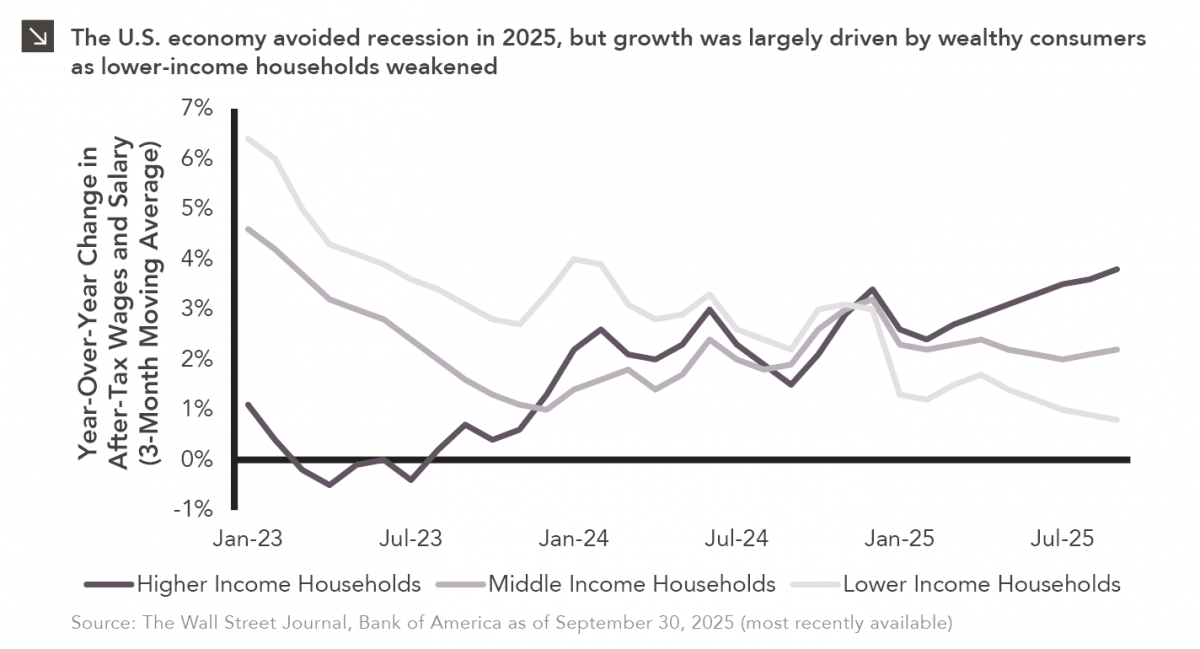

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >