10.22.2025

3Q 2025 Market Insights

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

Across the private equity industry, valuations have continued to trend higher over the past few years with U.S. buyout valuation multiples reaching 11.8x EV/EBITDA in 2017. These elevated multiples have been supported by an environment of strong economic growth, favorable private market fundamentals, and significant levels of capital available to finance transactions. While buyout multiples may appear elevated relative to their historical averages, EV/EBITDA multiples are still 30% below the average valuation for U.S. small cap companies in the public market. Throughout this growth cycle private valuations have not risen as significantly as they have in the public markets. This valuation discount has provided value-sensitive investors a relative value trade as they seek to rebalance their portfolios.

Going forward, the significant reduction in U.S. corporate taxes that went into effect in 2018 will most directly benefit small U.S. companies as nearly all of their revenues are generated domestically. Throughout the first five months of 2018 we have seen strong growth from both public and private companies, which has led to an acceleration of earnings and cash flow generated by these companies. With less taxes to pay for every dollar of EBITDA, the growth of earnings has made private multiples even more attractive to institutional investors, and will likely drive even greater interest in private equity allocations.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

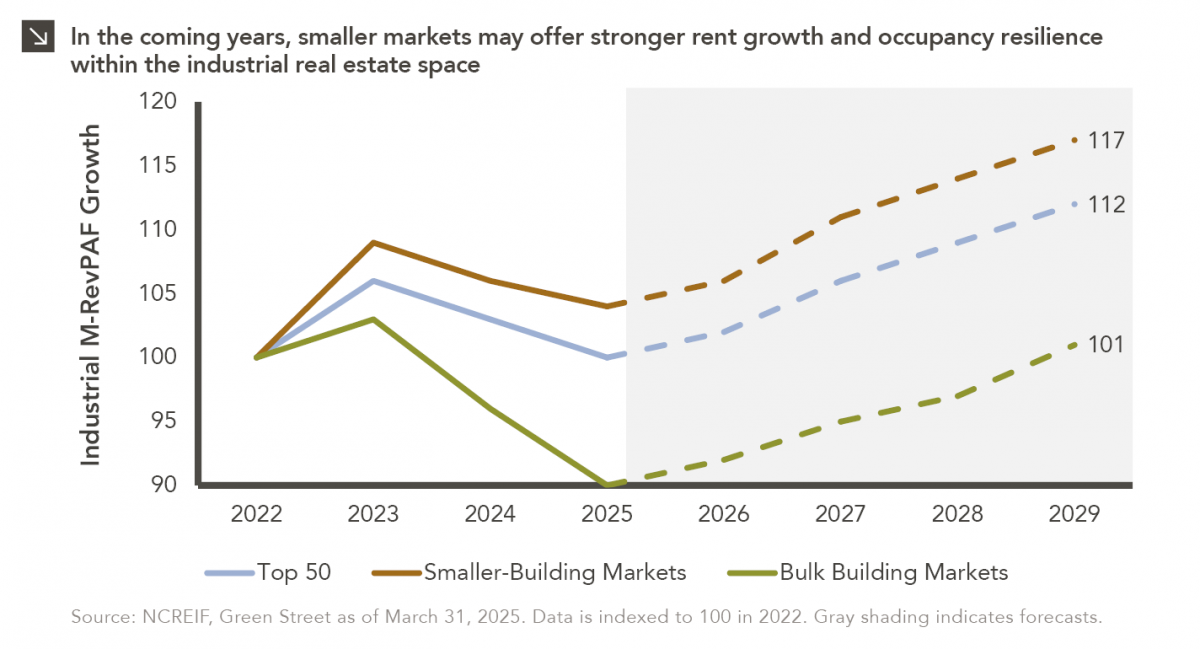

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >