02.23.2026

The Seller Becomes the Buyer

Most have traditionally viewed a successful exit for a venture-backed start-up as either an IPO or an acquisition by a…

In this week’s chart, we take a look at the CITI Economic Surprise Index. As a matter of background, the CITI Economic Surprise Index is a composition of various economic indicators that are released; anything above 0 indicates that economic reports are beating expectations and anything below 0 is underperforming estimates. Since its peak in mid-January, the index has been on a steady decline and just reached its lowest point since June of last year.

The start of 2014 saw several key economic indicators fall short of expectations including retail sales, new jobs, manufacturing, and the consumer confidence index; such trends help explain the decline. On the bright side, many experts have blamed the historically dreadful weather conditions as key contributors to such pull-backs in economic activity, and expect a rebound once spring arrives. Indeed, the market appears to agree: after a negative January (-3.5%), the S&P 500 returned 4.6% in February, shrugging off much of the poor economic data. Given the optimistic outlook shared by most economists for 2014, it is expected that the Economic Surprise Index will swing back to positive territory as winter gives way to spring.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.23.2026

Most have traditionally viewed a successful exit for a venture-backed start-up as either an IPO or an acquisition by a…

02.18.2026

Healthcare systems have faced an onslaught of challenges in recent years. They had to navigate the operational and financial headwinds…

02.17.2026

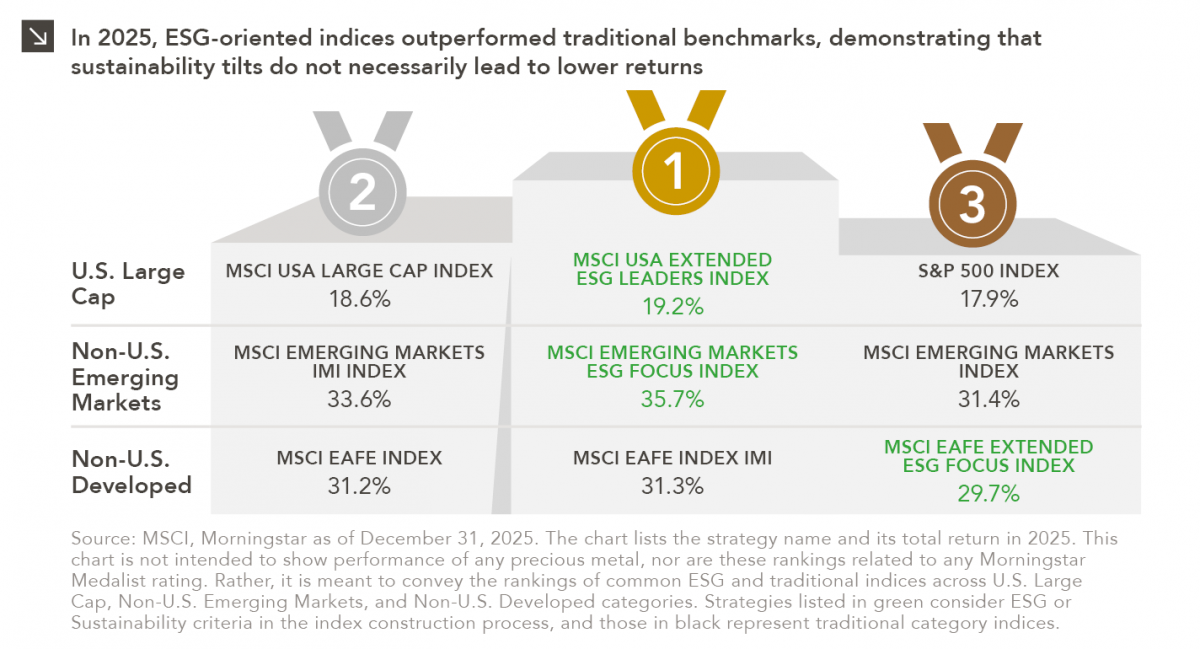

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

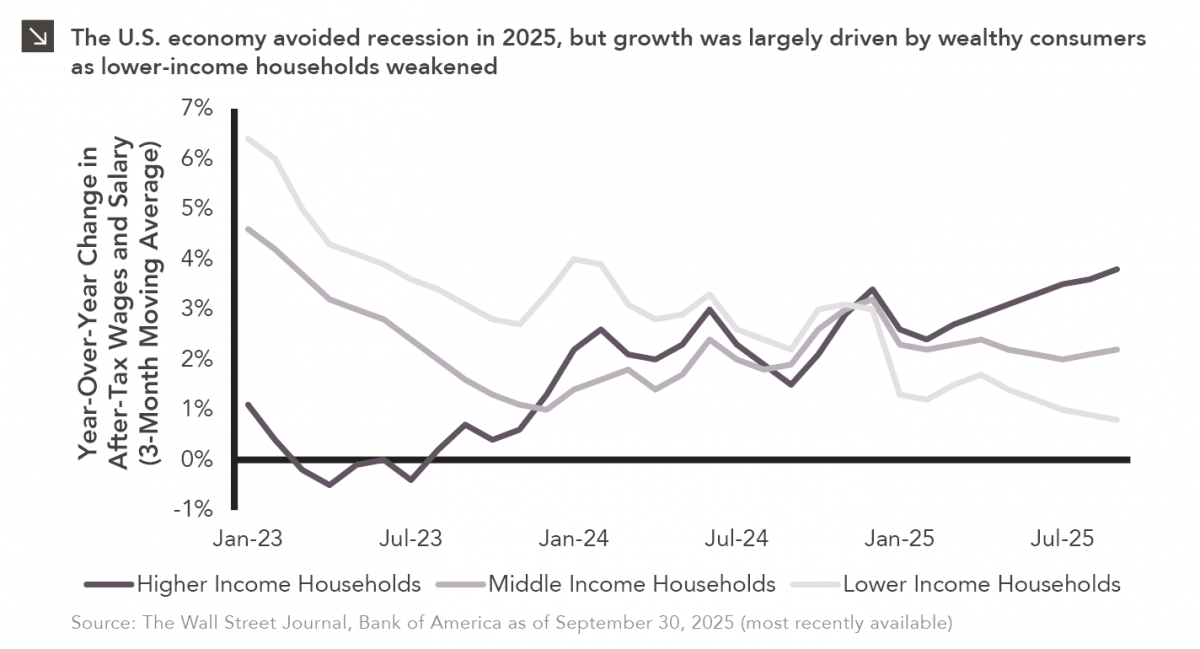

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >