James Torgerson

Senior Research Analyst

The Federal Reserve’s sharp tightening of interest rates over the last year has made financial market conditions significantly more restrictive. However, financial conditions may be even tighter than generally recognized based on the fed funds rate alone. The San Francisco Federal Reserve Proxy Rate is a measure that uses public and private borrowing rates and spreads to better reflect broader monetary policy. The proxy rate represents the fed funds rate that would typically be associated with current market conditions, assuming financial markets are driven solely by this rate.

As of the end of January, the proxy rate was 6.1%, notably above the effective fed funds rate of 4.3%. The higher proxy rate indicates that broader monetary policy is tighter than what is implied by the fed funds rate alone. The proxy rate also started increasing in November 2021, while the Fed did not begin raising rates until March 2022, showing that broader financial market conditions have actually been tightening for more than a year. With markets extremely sensitive to Federal Reserve policy decisions, but the long-term health of the economy dependent on cooling price pressures, a higher proxy rate may be a hidden positive for markets.

Print PDF > The Fed’s Effective Proxy Battle

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

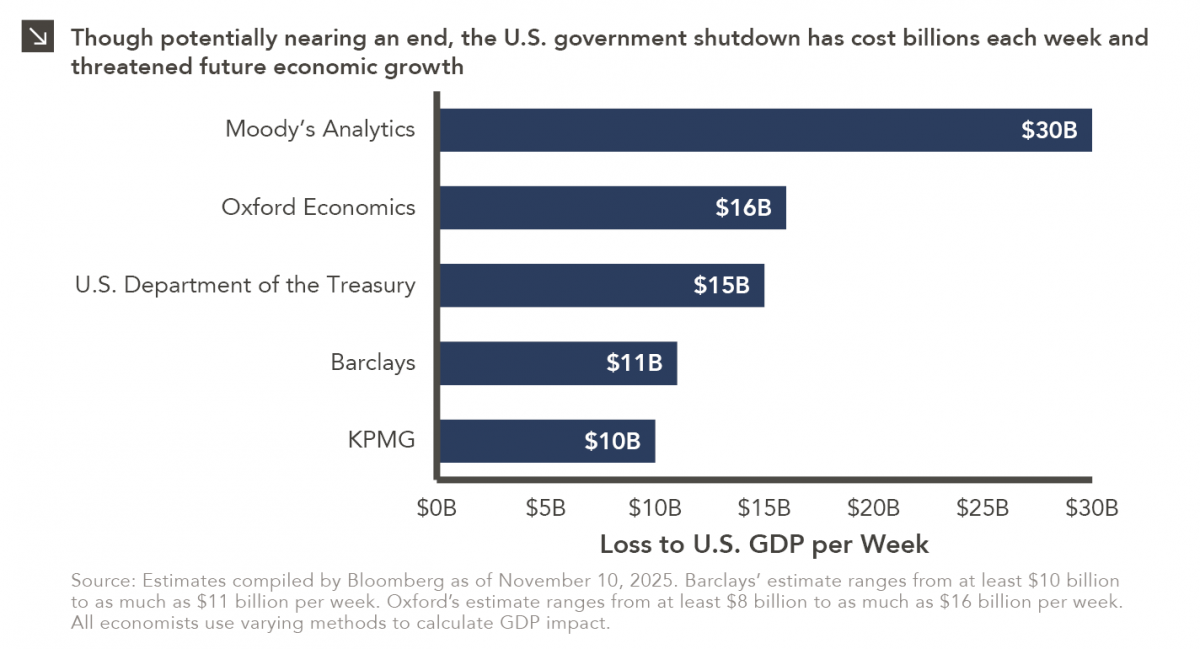

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >