Andrew Taylor

Research Associate

Get to Know Andrew

According to the most recent Bank of America Global Fund Manager Survey, gold has surged to the top of the list of the most crowded hedge fund trades, with 49% of respondents identifying a long position in the metal as the highest conviction play on Wall Street. This represents a significant shift in sentiment, as April marks the first month in two years that a long position in the Magnificent Seven technology stocks (i.e., Apple, Amazon, Google, Microsoft, Meta, NVIDIA, Tesla) did not top the list. This pivot reflects rising caution across investors given ongoing market volatility, persistent inflation, and uncertainty around future monetary policy. The move into gold, a traditional safe-haven asset as described in the last edition of our Chart of the Week series, suggests that fund managers are becoming increasingly defensive and seeking protection from potential further deterioration in risk assets. Indeed, the Magnificent Seven basket has fallen roughly 23% on a year-to-date basis as of this writing, and now just 24% of fund managers believe it to be the top trade given elevated valuations and the extent to which these companies are exposed to a global supply chain that has fractured due to tariffs. Conversely, gold has surged more than 28% since the start of 2025 given heightened risk aversion on the part of investors. It is important to remember, however, that gold is not necessarily a viable long-term investment given its lack of cash flows and the extent to which speculation drives its price.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

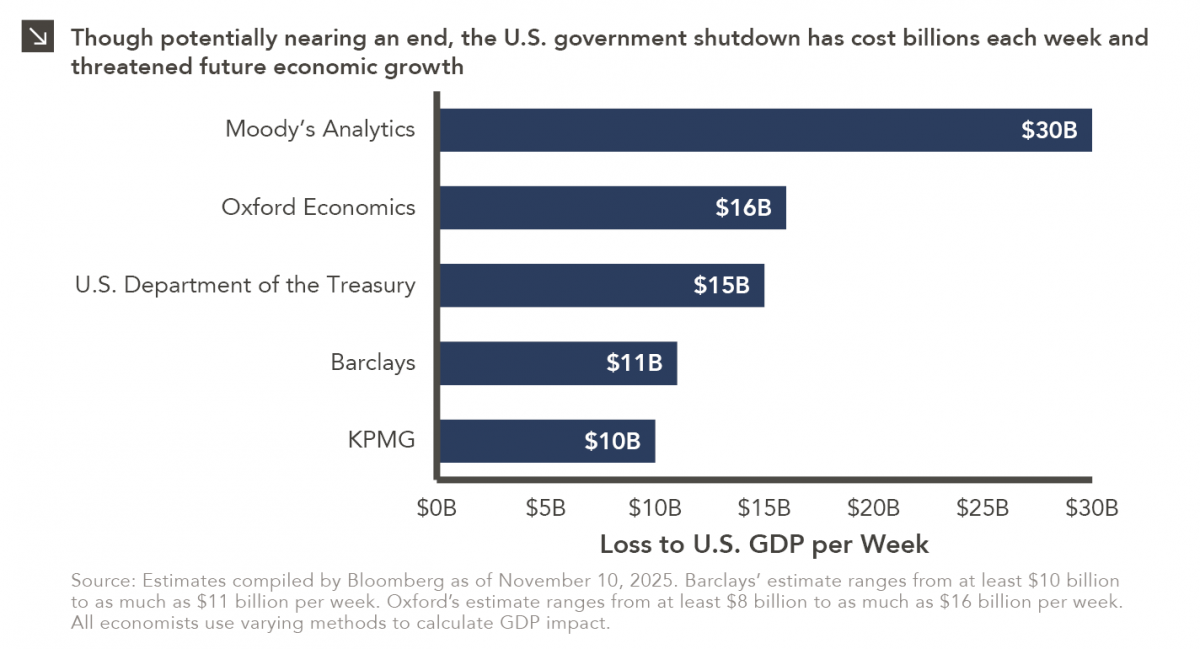

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >