09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

This week’s chart shows that current valuations across equity and fixed income markets are lower today compared to where they stood at the end of September last year. The big takeaway here is that equities broadly appear to still be cheaper than bonds.

Japanese Government Bonds and German Bunds are some of the most expensive debt instruments currently available to investors. As it relates to the former, the Bank of Japan’s unprecedented stimulus has helped push Japanese Government Bond yields to record lows, and earlier this year, yields on securities with maturities up to five years turned negative for the first time. Looking ahead, the Fed’s willingness to delay an increase in U.S. interest rates should support demand for riskier assets and as a result, fixed income valuations may normalize over time. Compared to last year, the most precipitous drop in valuations has taken place in U.S. High Yield, U.S. Credit and U.S. dollar-denominated Emerging Markets Debt.

As it relates to equities, with the exception of the U.S., South Africa, and Mexico, valuations around other parts of the globe are on the lower end of their historical averages. Finally, valuations in Canadian, Spanish, and Taiwanese equity markets have come down the most over the past year as these markets have sold off over the near term.

Note: Percentile ranks show valuations of assets versus their historical ranges. Example: If an asset is in the 75th percentile, this means it trades at a valuation equal to or greater than 75% of its history. Valuation percentiles are based on an aggregation of standard valuation measures versus their long-term history.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

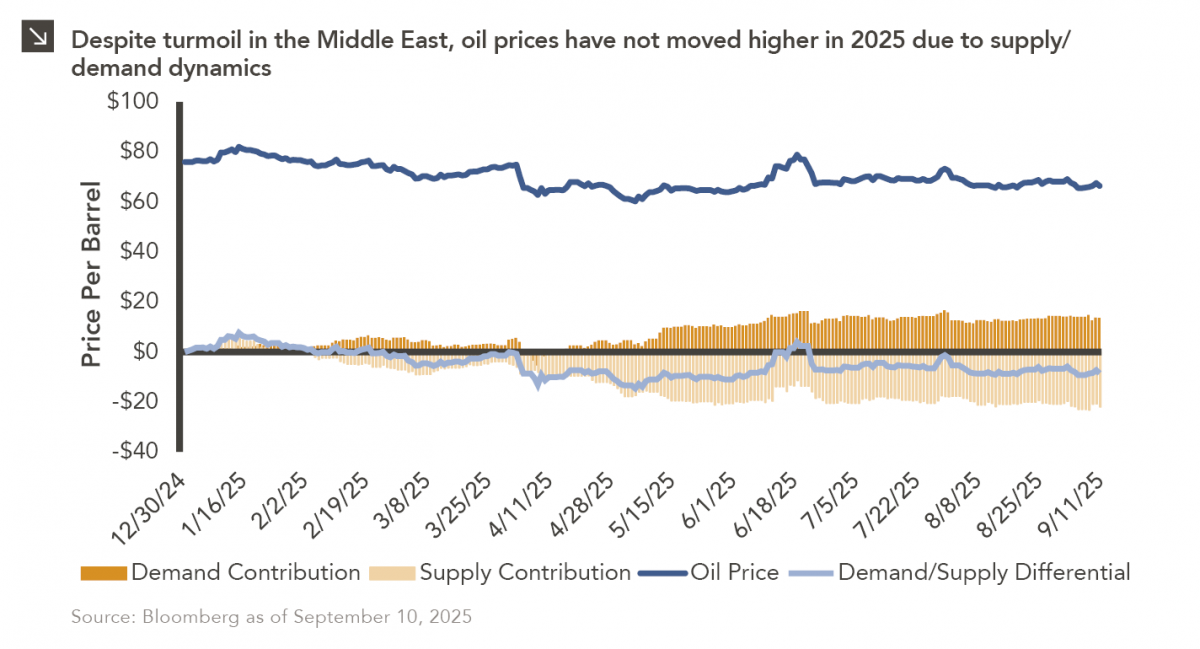

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

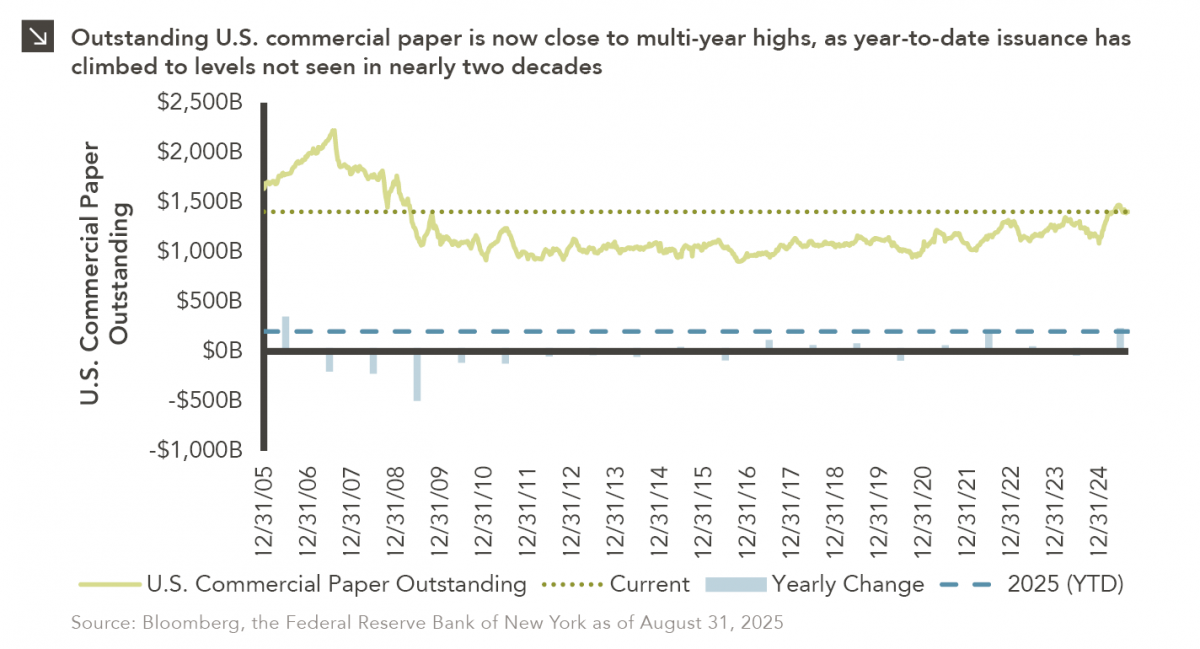

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

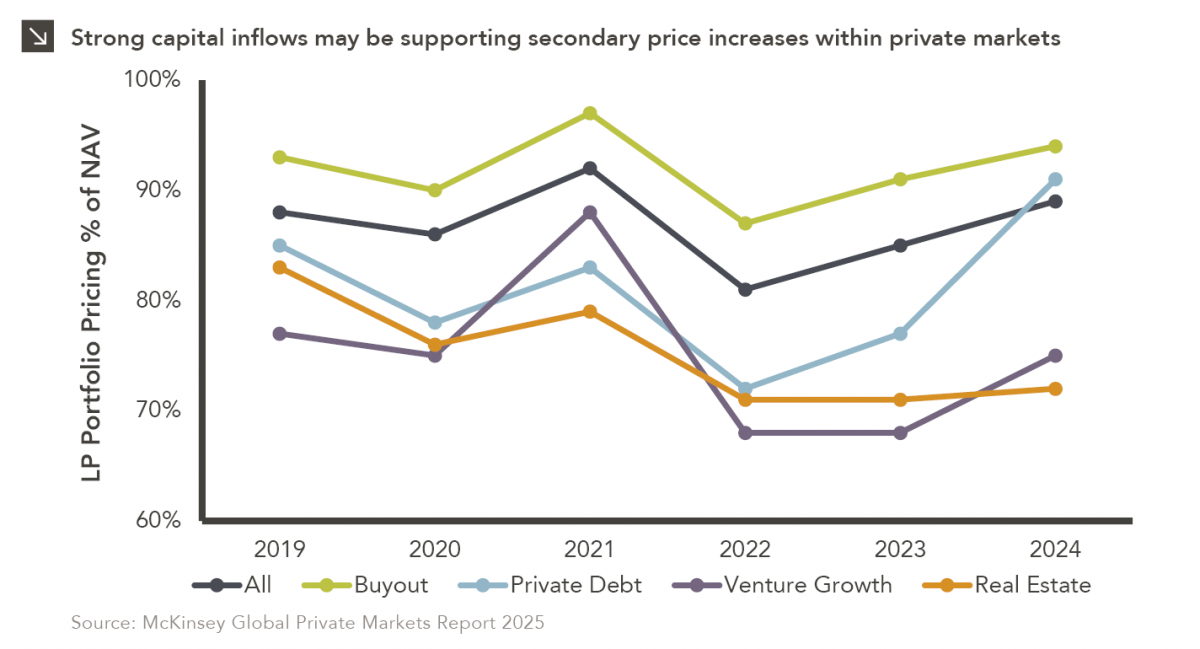

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

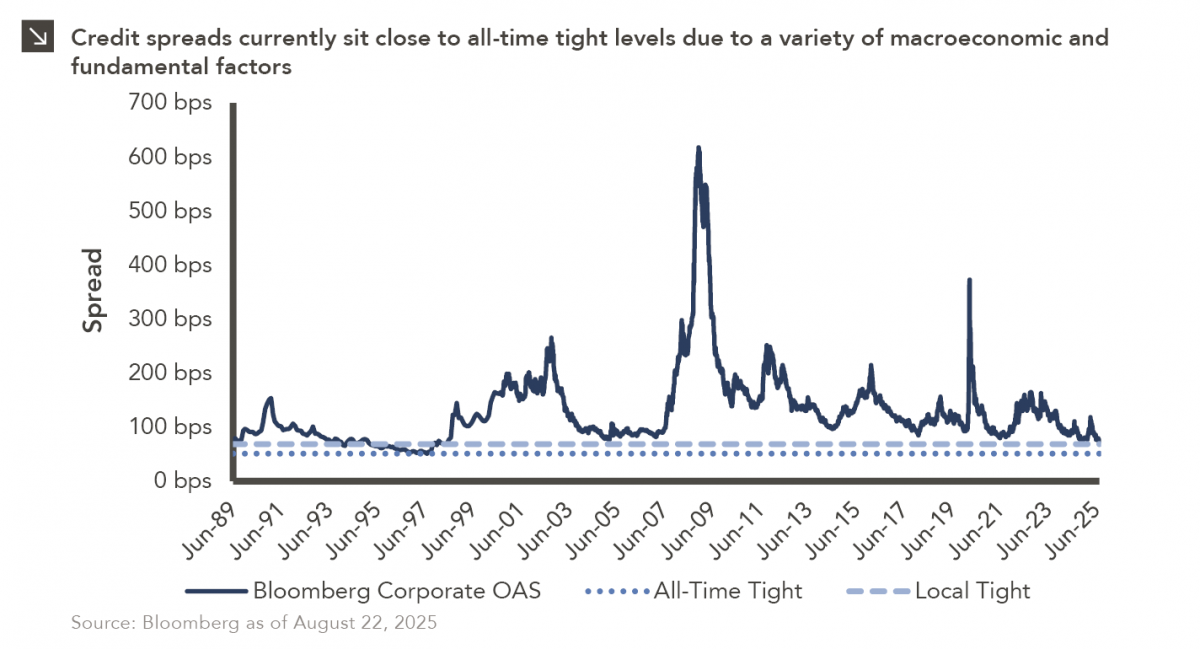

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >