Nat Kellogg, CFA

President

This week’s chart of the week looks at the growth in mid-west farmland prices. Our chart shows the increase in farmland prices in Illinois, Indiana, Iowa and the Federal Reserve 7th District, which includes all three of these states. While this may surprise many investors, mid-west farmland has been one of the best performing investments over the last decade, up 12.3% annually. Higher crop prices and a shrinking supply of available high quality farmland drove this increase in farmland prices. Since both of these trends seem likely to persist into the future, institutional investors have begun to invest in farmland to take advantage of these trends. However, as our chart shows, the other driver of higher prices has been the persistent fall in interest rates which lowers the carrying costs (i.e. interest payments) of owning farmland for both farmers and investors. Given the recent rise in interest rates over the last few months it seems reasonable to question if farmland prices can continue their upward trajectory without the benefit of further reductions in interest rates.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.06.2025

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

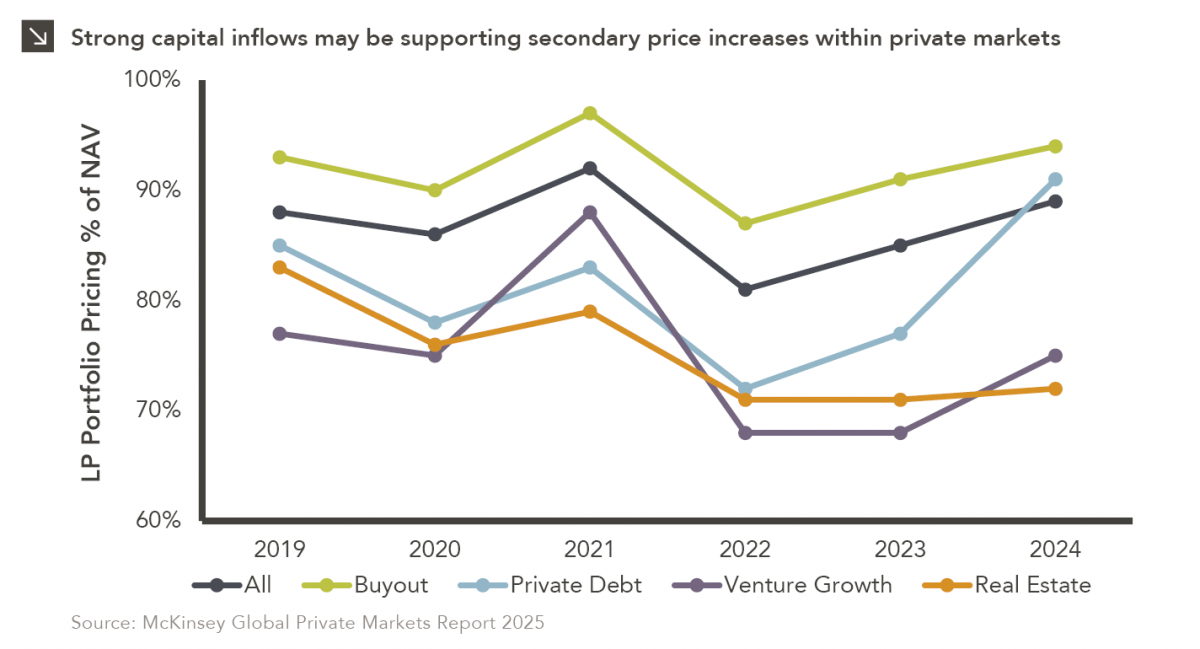

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >