09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

In late March, one of the busiest waterways in the world came to a standstill after the Ever Given, a 1,300-foot container ship, became lodged in the Suez Canal. Nearly 30% of the world’s daily shipping container freight passes through the Suez Canal, and with supply chains already disrupted amid the COVID pandemic, the timing could not have been worse. While only a one-week stoppage, with approximately 7% of the world’s oil and 12% of global goods trade flowing through the canal, it is estimated that each day lost delayed more than $9 billion worth of goods.¹

In this Chart of the Week, we analyze the impact that the Suez Canal closure had on maritime shipping costs and the contribution to inflation. The chart above shows the daily price movement of the Shanghai Containerized Freight Index (SCFI). As one of many proxies for global trade and ocean freight health, the SCFI reflects the weekly shipping spot rates of Shanghai container exports along 15 major trade routes, including Shanghai to the United States (east and west coasts), Europe, South Africa, and South America. In contrast to the highly-cited China Containerized Freight Index (CCFI), the SCFI focuses solely on exports in these 15 individual trade routes, rather than nationwide import and export container transport, which would include more contractual and futures rates. Rates surged throughout 2020 amid increasing demand for goods over services and tighter supply. The blockage, which may take months to fully recover from, combined with pent-up demand and economic re-openings has exacerbated the imbalance and sent SCFI spot shipping costs up another 20% over the last month. Rising inflation has been an increasing concern for investors this year and, given current dynamics, we do not expect the contribution from higher global shipping rates to abate anytime soon.

Print PDF > The Lasting Effects of a Temporary Trade Stoppage

¹Lloyd’s List Intelligence

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

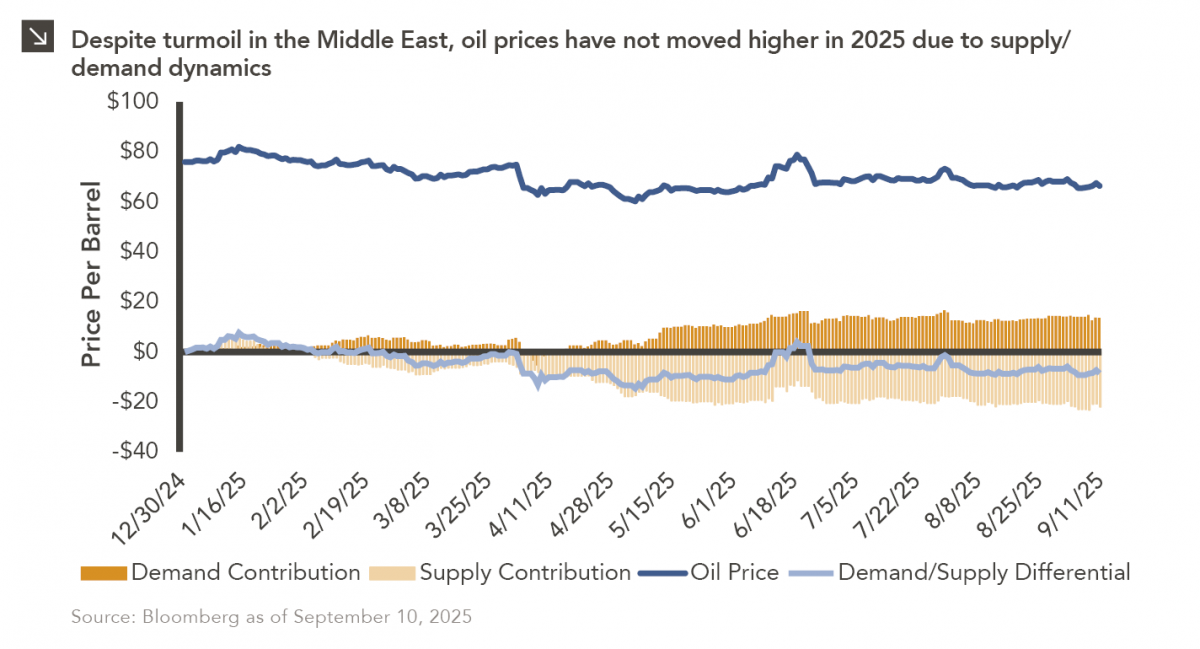

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

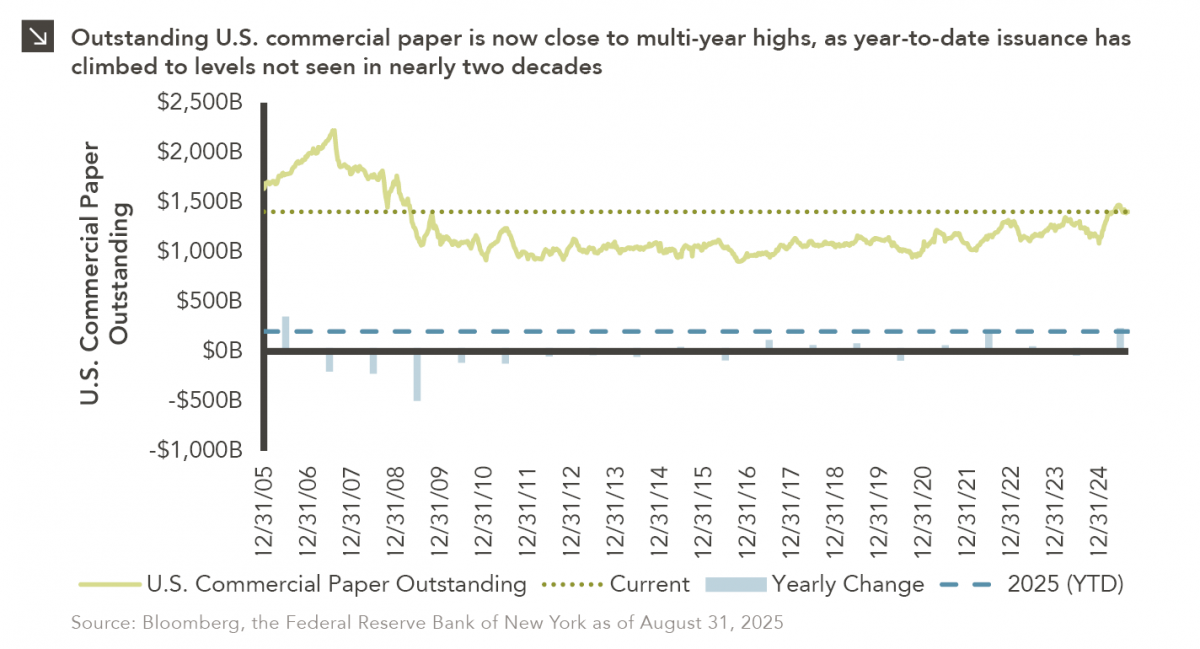

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

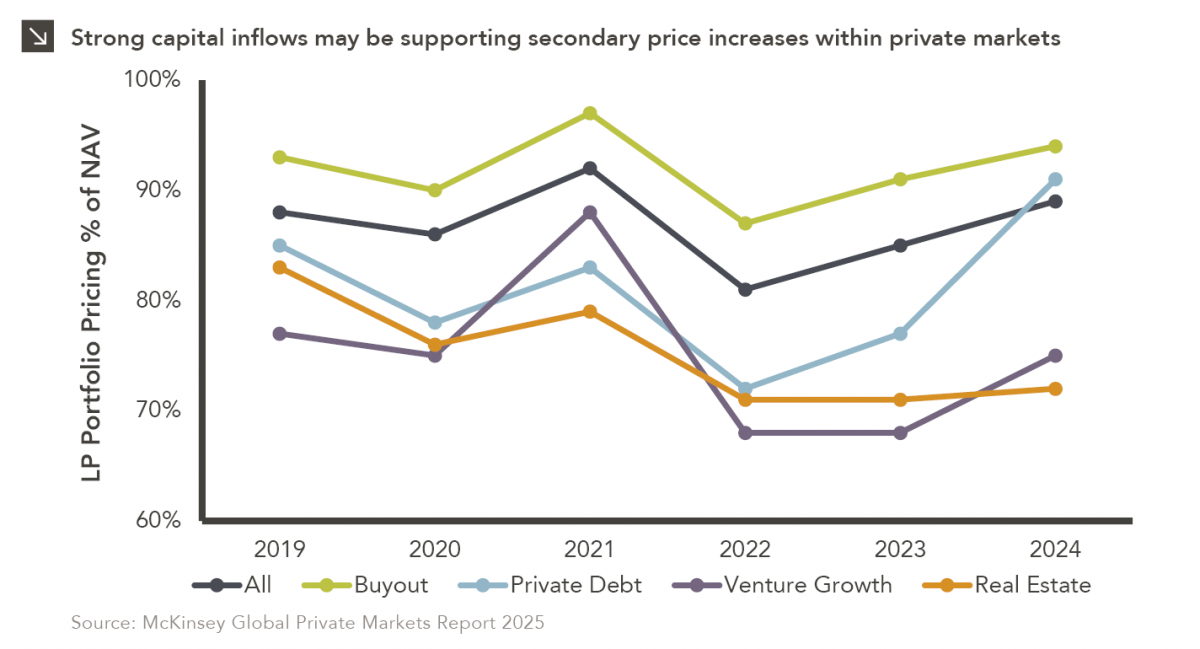

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >