Chad Sheaffer, CFA, CAIA

Senior Research Analyst

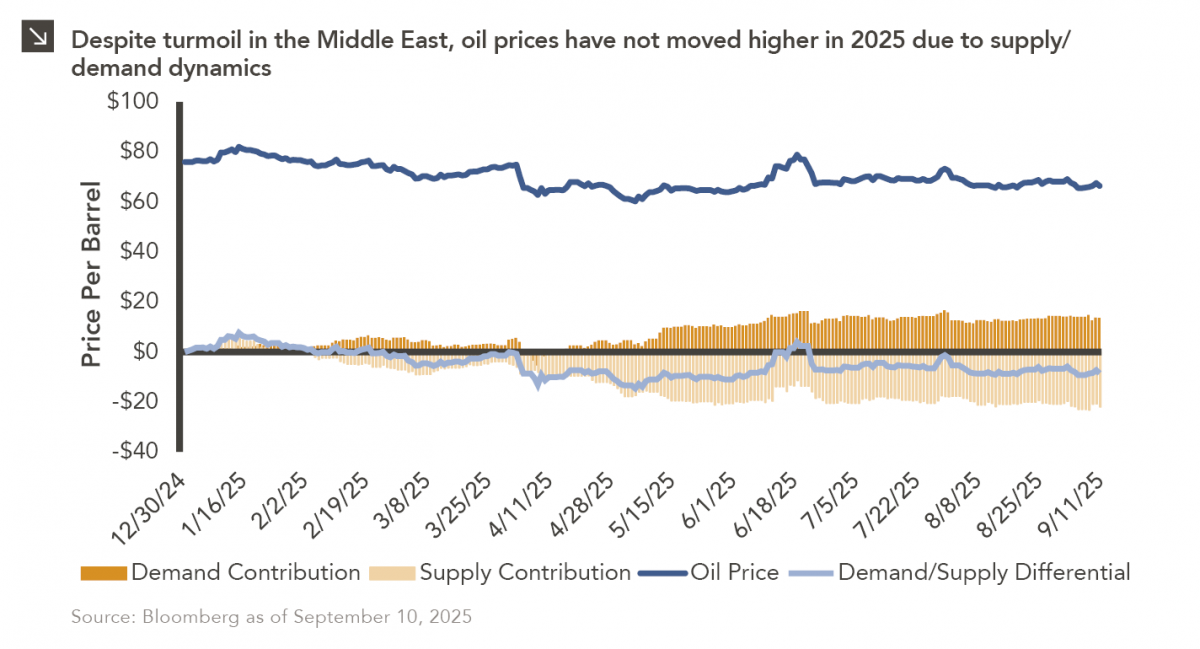

Tensions in the Middle East spiked last week following a major escalation in the conflict between Israel and Iran, raising concerns over the stability of the global energy supply chain. To that point, the Strait of Hormuz — a vital chokepoint for global oil and gas flows that connects the Persian Gulf and the Gulf of Oman — has become increasingly fragile amid new reports of electronic interference with navigation systems and a tanker collision near the strait earlier this week. Roughly 20 million barrels of crude oil pass through the Strait of Hormuz each day, accounting for roughly 27% of the world’s maritime oil trade and 20% of total global oil consumption. Additionally, around 20% of global liquefied natural gas (LNG) is transported through the area, primarily from Qatar. Despite the heightened conflict and concerns that Iran could attempt to block the Strait of Hormuz, tanker traffic has remained relatively stable, with 111 vessels reportedly transiting through the Strait on June 15. This figure is down only slightly from 116 on June 12, and consistent with the recent daily range of 100 to 120 vessels.

Most of the material exported through the Strait of Hormuz is delivered to Asia, with roughly 84% of the crude oil and 83% of the LNG being shipped to the region last year. China, India, Japan, and South Korea accounted for approximately 69% of these flows, making Asia particularly vulnerable to supply shocks. While the U.S. has reduced its reliance on Middle East crude oil imports in recent years, with only 6% of its oil imports coming via the Strait, concerns remain for potential inflationary pressures and global GDP headwinds if regional conflicts escalate further.

In response to recent events, Brent crude oil has climbed to over $78 per barrel, and any further escalation could trigger additional volatility in energy prices and, by extension, global financial markets. Indeed, the Strait of Hormuz remains one of the most strategically significant and sensitive corridors for the global economy and investors should continue to monitor developments within the region given the potential for broader economic impacts.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.06.2025

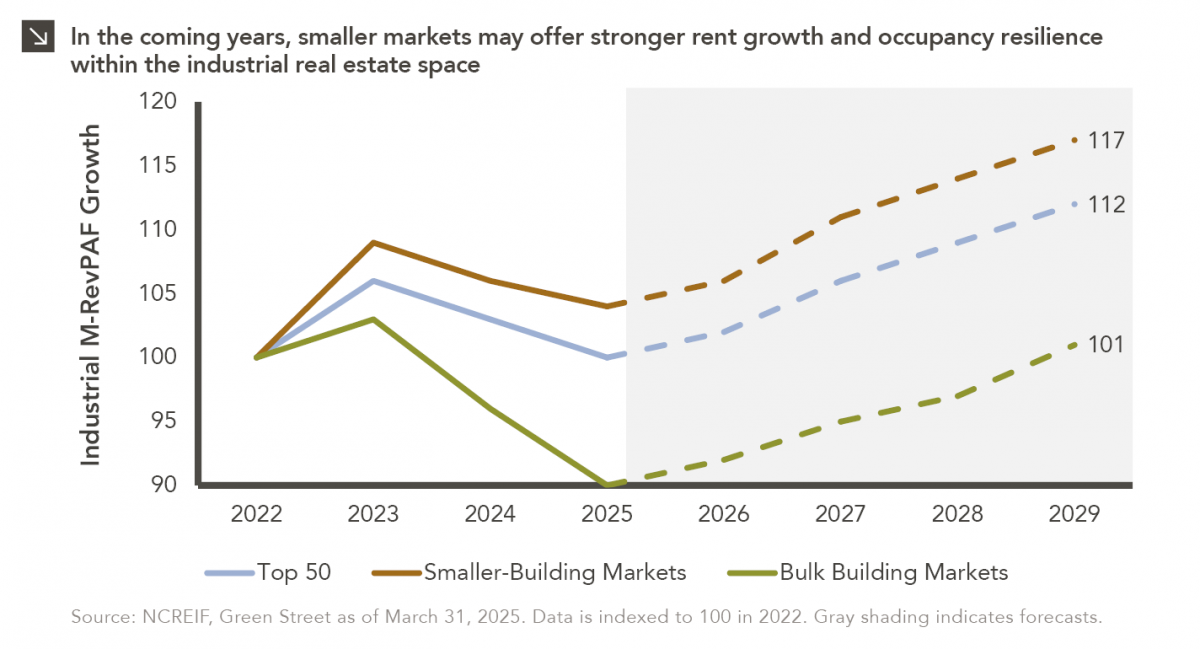

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

10.01.2025

Please join Marquette’s research team for our 3Q 2025 Market Insights Webinar analyzing the third quarter across the…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >