Jessica Noviskis, CFA

Portfolio Strategist, OCIO Services

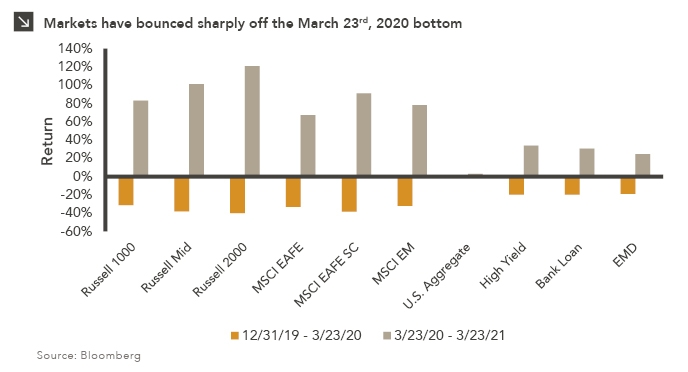

What a year it has been. Officially one year after the equity market’s bottom on March 23rd, 2020, all major indices in the chart above have at least recovered back to ending 2019 levels. The groups that were hit the hardest have also rebounded the strongest, with returns over the last year exceeding 100% for some. Small-cap equities stand out, especially in the U.S. — up 121% over the last year and up 33% over the almost 15-month period since 2019. U.S. mid-cap equities are up 101% over the last year, up 25% over the full period, and U.S. large-cap equities are up 83% over the last year for a 26% return over the full period. Small-cap stocks have also outperformed internationally — the MSCI EAFE Small Cap Index is up 91% over the last year and 18% since 2019, while the MSCI EAFE Index is up 67% over the last year and 12% for the full period. Emerging markets, some of the hardest hit by the crisis last year, have more than recovered, up 78% over the last year for a 22% return since 2019. Fixed income returns have been more muted. Investment grade bonds stayed positive in early 2020 as equity markets fell precipitously and are up another 3% since. High yield bonds, bank loans, and emerging market debt were hit harder but still held up better than equities. Each group has recovered those losses but remains in positive single-digit territory over the full period.

From here, we expect returns will likely moderate. As the vaccine roll-out continues we expect further economic re-openings and renewed growth across the globe, but it seems highly unlikely capital markets returns can continue at this pace beyond the initial recovery.

Print PDF > One Year Ago, Would Anyone Have Predicted This?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

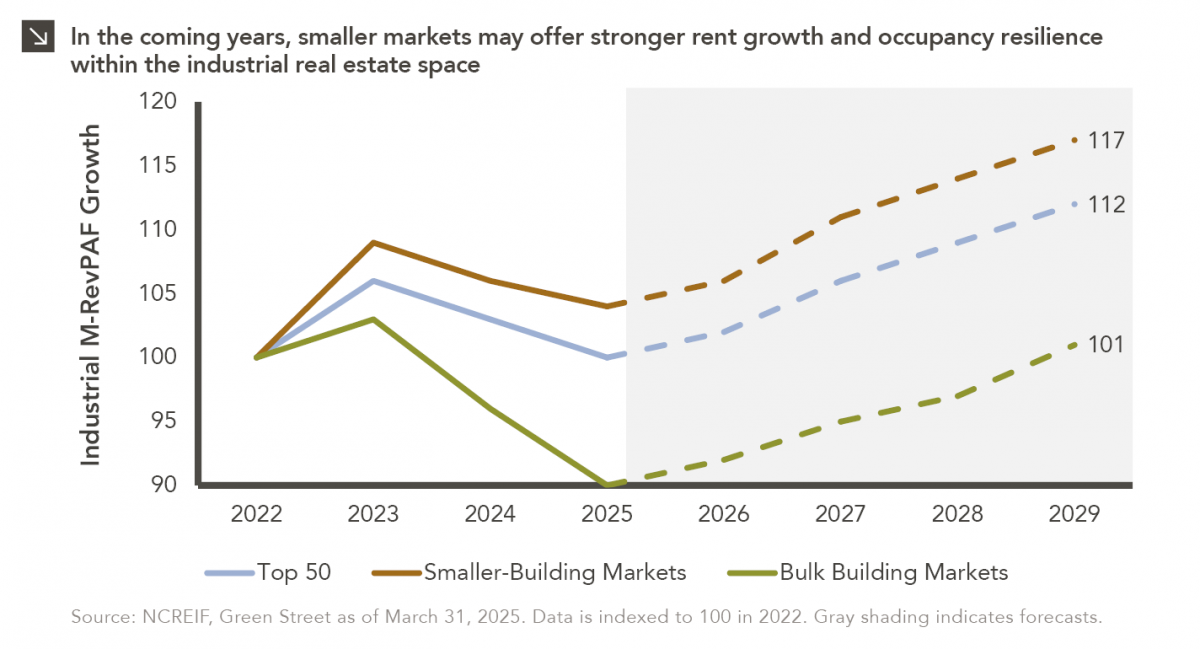

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >