09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

Add-on investments, a company acquired by a private equity firm to be added to one of its platform companies, have steadily increased in importance and popularity over the past two decades. In 2020, 71.7% of U.S. PE deals were add-ons, compared with 43.2% in 2002. After a dip in total deal count in 2020 amid the COVID-19 pandemic, we expect 2021 will see the highest number of add-on deals on record. These buy-and-build strategies can take different forms. Some involve large-scale roll-ups in which a platform company acquires a large number of smaller, often founder-owned companies. Others include more opportunistic M&A transactions that allow portfolio companies to pursue specific product or operational goals. The growth of add-ons across two decades of various market cycles can be attributed to a number of advantages: multiple arbitrage, giving larger firms access to out-of-reach market segments, helping portfolio companies enter new geographical markets, and doubling down on more profitable end markets.

The holding period for add-ons has also evolved. Historically, private equity has held platform investments that included add-ons longer than other portfolio companies. In recent years, the median exit times for portfolio companies with and without add-ons have converged to roughly five years. We attribute this to both private equity becoming more skilled at executing these buy-and-build strategies as well as buyers being increasingly willing to pay for the unrealized potential of recently-completed add-on acquisitions.

Print PDF > PE Pursues Buy-and-Build

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

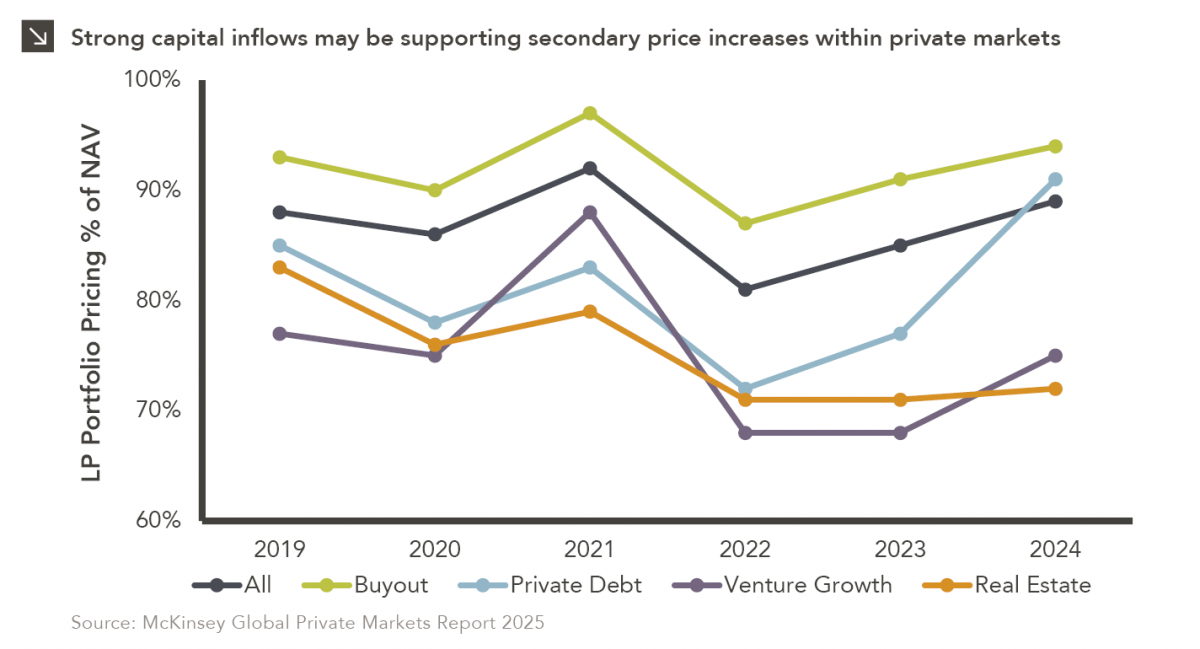

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >