09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

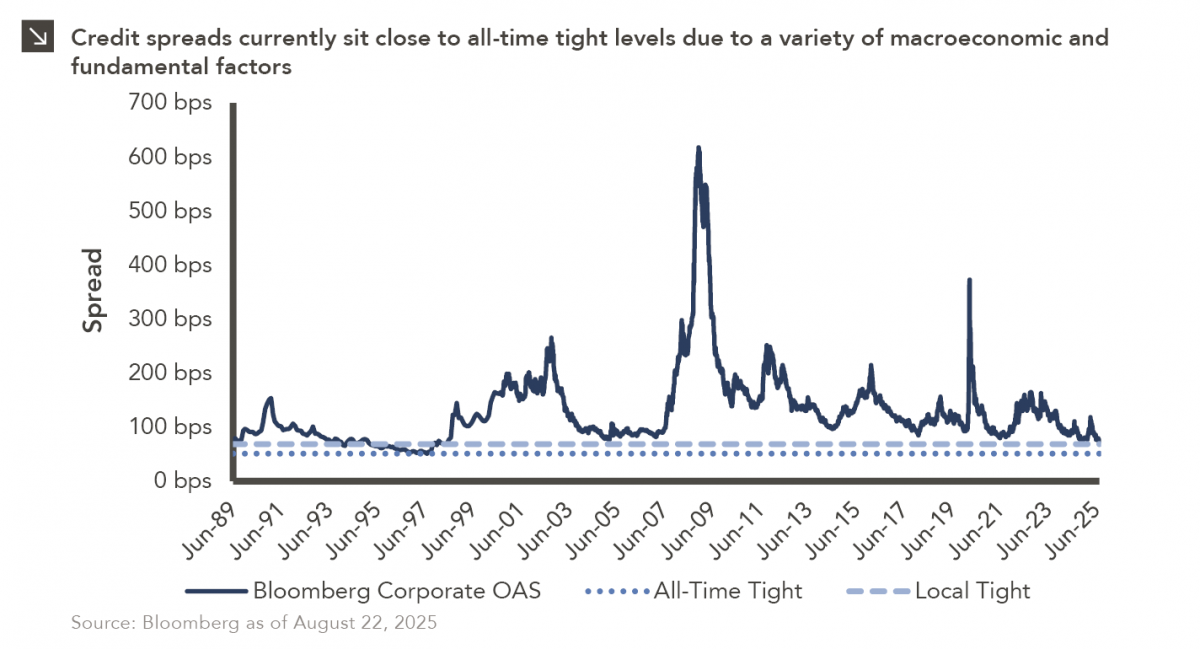

Spreads for industries that were beat-up during the early 2020 COVID panic — energy, retail, and transportation — as well as for industries that proved more stable — financials, technology, and utilities — are now generally tighter than pre-pandemic levels in the bank loan and high yield markets. From here, spreads could tighten further as issuer fundamentals continue to improve, widen in a correction, or be volatile, blowing out and tightening back in throughout the economic recovery.

While a lot of progress has been made on the vaccination front, there is still more work to do. The fully vaccinated rate in the U.S. is currently 39%, not yet at 70% herd immunity. Globally, the fully vaccinated rate is only 5%, not even close to 70% herd immunity. While this leaves the economic recovery vulnerable, markets are forward-looking. In the bank loan and high yield markets, maturities have been pushed off, which is a positive, thanks to the large volume of issuance over the past year. Leverage levels of bank loan and high yield issuers are currently high, but due to decline, another positive, as earnings rise in the economic recovery. Use of proceeds from bank loan and high yield issuances¹ and aggressive issuance² are at benign levels, and defaults have been declining — more positive indicators. On the negative side, equity valuations are already at all-time highs and continuing to rise.

In summary, fundamentals are attractive, but valuations are not. We could potentially see spreads tighten further, but uncertainty is high, and we could also see a correction given the high valuations and frothy sentiment. While further spread tightening will be accretive to returns, it will limit short-term future price appreciation for fixed income strategies. Overall, this is a dynamic that bears watching, particularly as economic growth accelerates and the pandemic continues to fade.

Print PDF > Spreads Largely Pricing in a Full Recovery

¹ Such as towards refinancings (a sign of conservativism) versus acquisitions and LBOs (a sign of frothiness).

² Such as CCC bank loan and high yield issuance and 2nd lien bank loan issuance.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

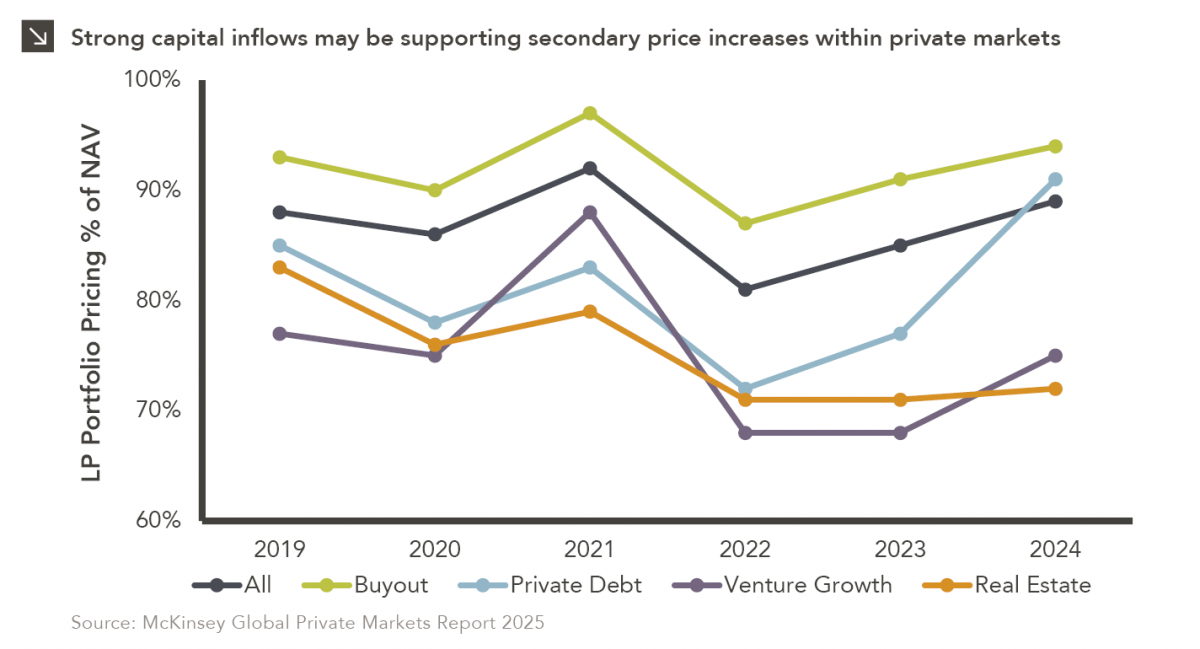

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >