Peter Como, CFA, CAIA

Associate Research Analyst

Get to Know Peter

A few weeks ago, the Bureau of Labor Statistics reported that total nonfarm payrolls rose by 336,000 during the month of September. This figure was roughly double that of the Dow Jones consensus estimate and more than 100,000 higher than the job gains posted during the previous month of August. These increases occurred across a variety of industries, including leisure and hospitality (96,000 job adds), health care (41,000 job adds), and professional, scientific, and technical services (29,000 job adds). Government employment also increased by 73,000 during the month. Additionally, the unemployment rate remained constant at 3.8% in September, and both of these data points can be observed in this week’s chart.

The robust job gains notched in September beg the natural question: How will a strong domestic labor market impact upcoming decisions of the Federal Reserve as it relates to the path of interest rates? Clearly, labor market data is supportive of “higher for longer” messaging, especially since inflation remains above the central bank’s long-run target of 2%. Based on futures markets, most forecasters believe that it is not until the middle of 2024 that the Fed’s policy rate will ultimately come down. In the more immediate term, futures markets indicate the likelihood of a pause at the next FOMC meeting, however, any decisions after that will depend on additional inflation and labor market data. Marquette will continue to monitor dynamics within the domestic labor market, assess current and future Fed policy, and provide guidance to clients accordingly.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

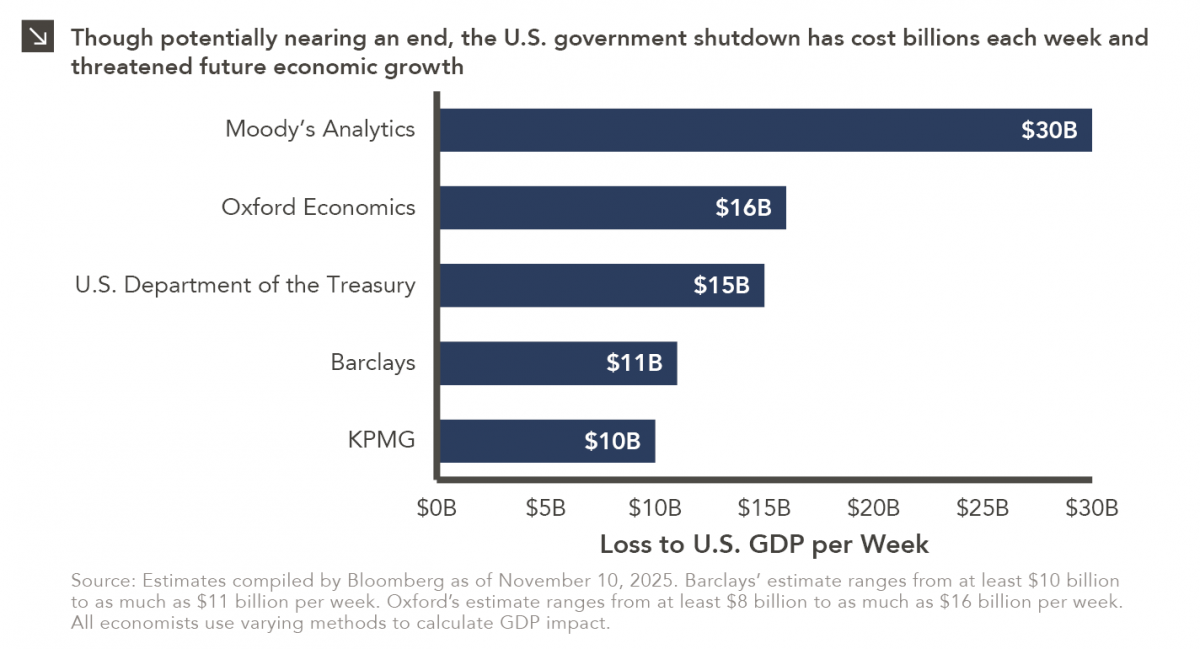

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >