Nic Solecki, CBDA

Client Analyst

Get to Know Nic

In May of 2024, we published a Chart of the Week titled “Is Bitcoin Fairly Valued?” At the time, bitcoin and the broader digital asset space demonstrated mixed performance amid heightened market volatility, shifting liquidity conditions, and geoeconomic uncertainty. Recognizing the challenges in determining bitcoin’s fair value, we applied standard valuation principles to estimate bitcoin’s fundamental value at that time. While bitcoin and the broader digital asset space have once again exhibited mixed performance amid a shifting macroeconomic backdrop, much has changed over the last year and recent developments suggest that a reassessment of bitcoin’s fair value could be timely.

To better understand why this reassessment could be relevant for institutional investors, here is a brief and non-exhaustive recap of the key developments in the U.S. crypto space this year:

Unsurprisingly, crypto markets responded enthusiastically to the news. By the end of January, the MVDA 10 Index and the MSCI Global Digital Asset Index were both up roughly 10% as bitcoin traded north of $100,000. Then, February arrived, bringing a notable shift in broad market sentiment and volatility, causing digital asset prices to fall alongside public equities. By the end of February, bitcoin was down roughly 18% while some broad crypto indices were down as much as 28%. So where does bitcoin currently stand?

Applying the discounted cash flow (DCF) method used in our prior analysis, bitcoin’s fair relative value range¹ is illustrated above in light teal, with its upper and lower bounds highlighted, respectively, in orange and green. While bitcoin appears to have closed February at undervalued levels, as of March 24, bitcoin appears to be slightly below and advancing toward its fair value range. That said, it is important to clarify that this point-in-time DCF method is just one of several potential valuation approaches, and other estimates may vary. Valuations for both floating fiat currencies and cryptocurrencies are dynamic, constantly adjusting to inflation, nominal yields, and broader macroeconomic conditions. Going forward, future inflation trends and market dynamics will provide further opportunities to validate this fundamental approach.

1The discounted terminal values of bitcoin are based on a discounted cash flow model that incorporates U.S. Treasury yields, inflation rates, and imputed risk premiums.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

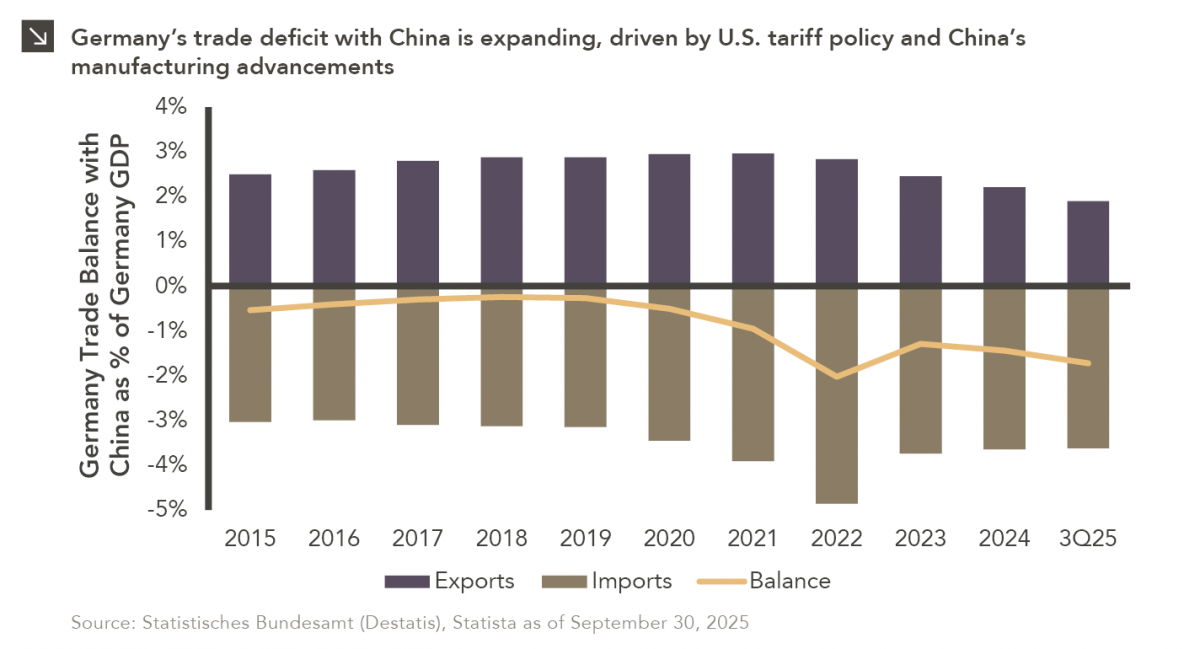

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >