Eddie Arrieta

Associate Research Analyst

Get to Know Eddie

As a result of policy uncertainty, shifting sentiment, and a potential U.S. economic slowdown, the dollar has moved lower in 2025, amplifying non-U.S. equity returns for domestic investors this year. This week’s chart outlines this dynamic, highlighting the “return differential” between dollar-based and local currency returns for both developed and emerging market indices. The 8.2% differential for the MSCI EAFE Index, which tracks international developed markets, reflects stronger European currencies (e.g., the euro) that have been fueled by positive growth forecasts and increased defense spending (as noted in “Europe on Defense”). These factors have turned modest equity gains in local terms into significant returns for dollar-based investors. Similarly, Japan has seen a stronger yen in recent months. The MSCI Emerging Markets Index has seen a smaller differential than its developed counterpart this year, but U.S. investors have still benefited from currency effects across several emerging countries. The Brazilian real, for instance, has strengthened in 2025 thanks to a 50 basis point rate hike by the nation’s central bank earlier this month, which has attracted increased capital flows. Taiwan has also seen strengthening of its currency in recent days.

While a weaker U.S. dollar has served as a tailwind for domestic investors in non-U.S. equities, risks related to this trend should be noted. For instance, a weaker U.S. dollar can lead to higher import prices, which can exacerbate inflation and reduce the purchasing power of consumers. A weaker greenback can also discourage foreign investment and serve as a signal of a challenged economic environment. Given the current climate and the currency trends detailed above, it is critical that investors remain diversified across both U.S. and non-U.S. markets to reduce exposure to currency-specific risks and enhance portfolio stability amid global economic fluctuations.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.15.2025

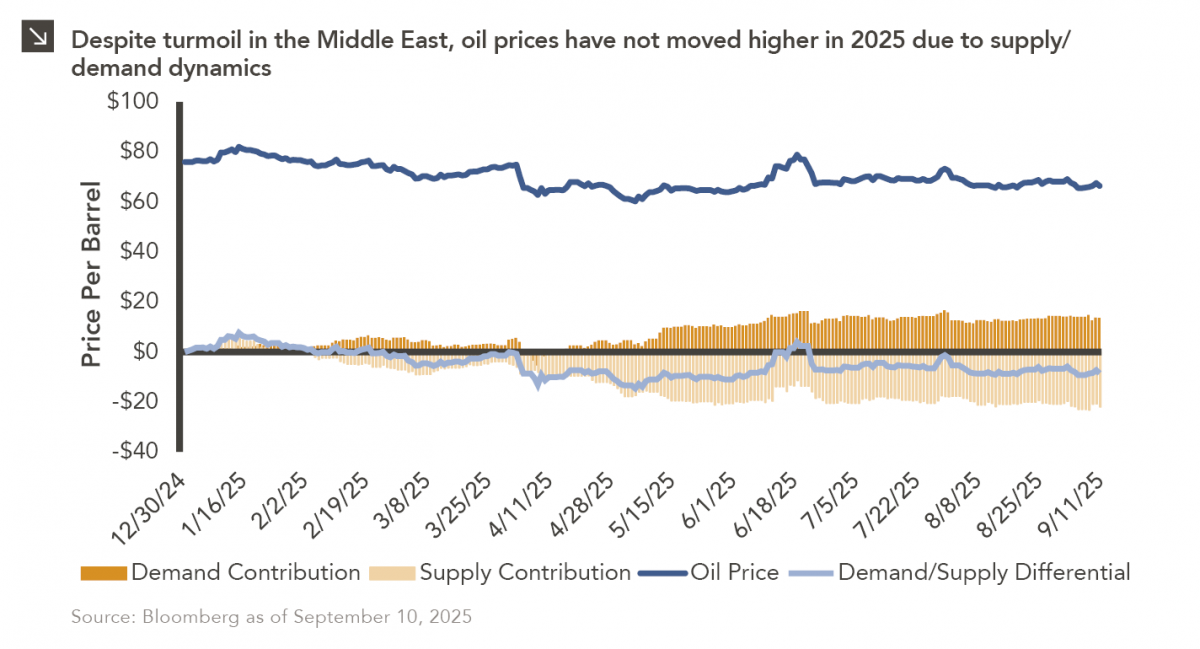

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

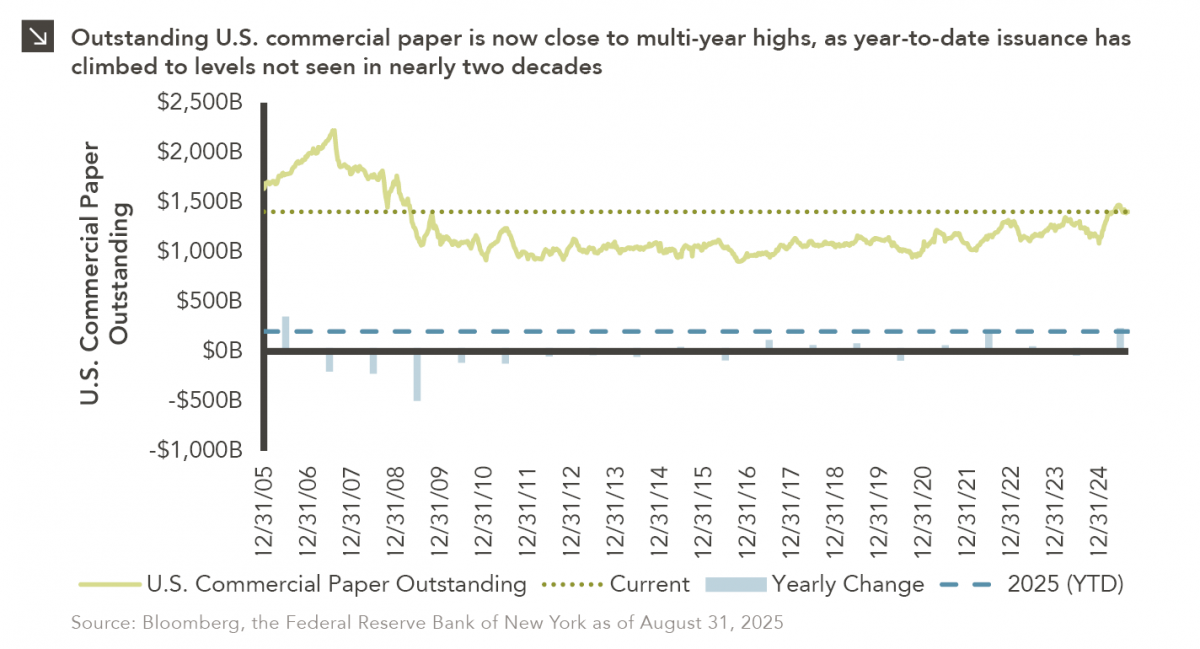

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

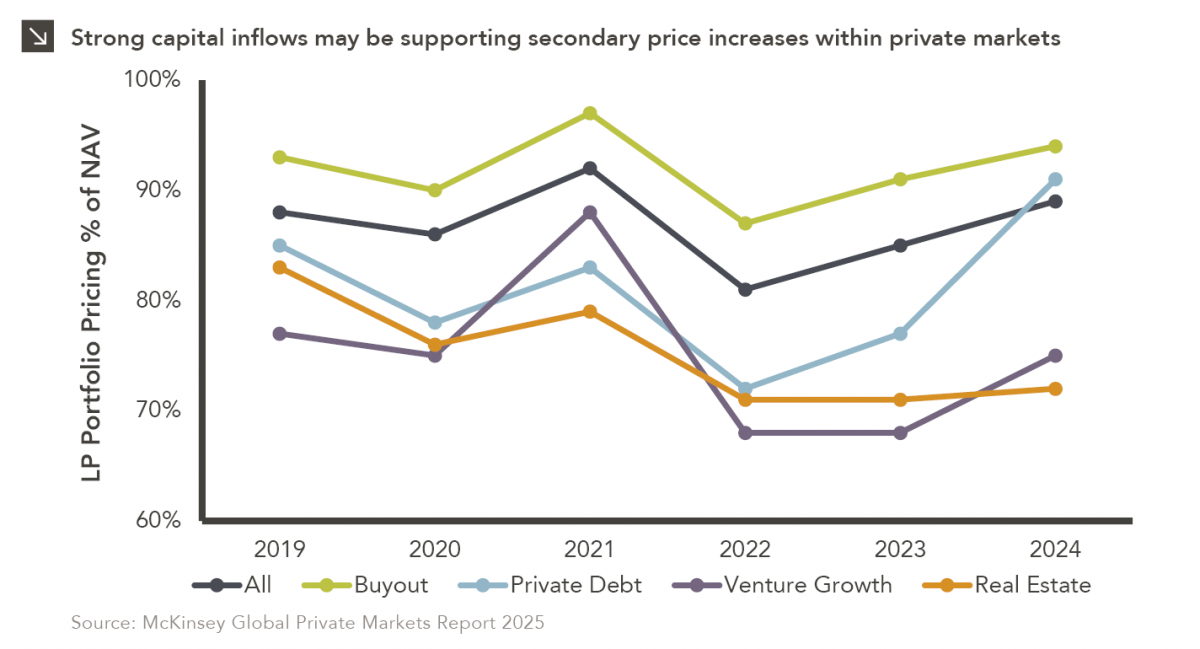

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

08.19.2025

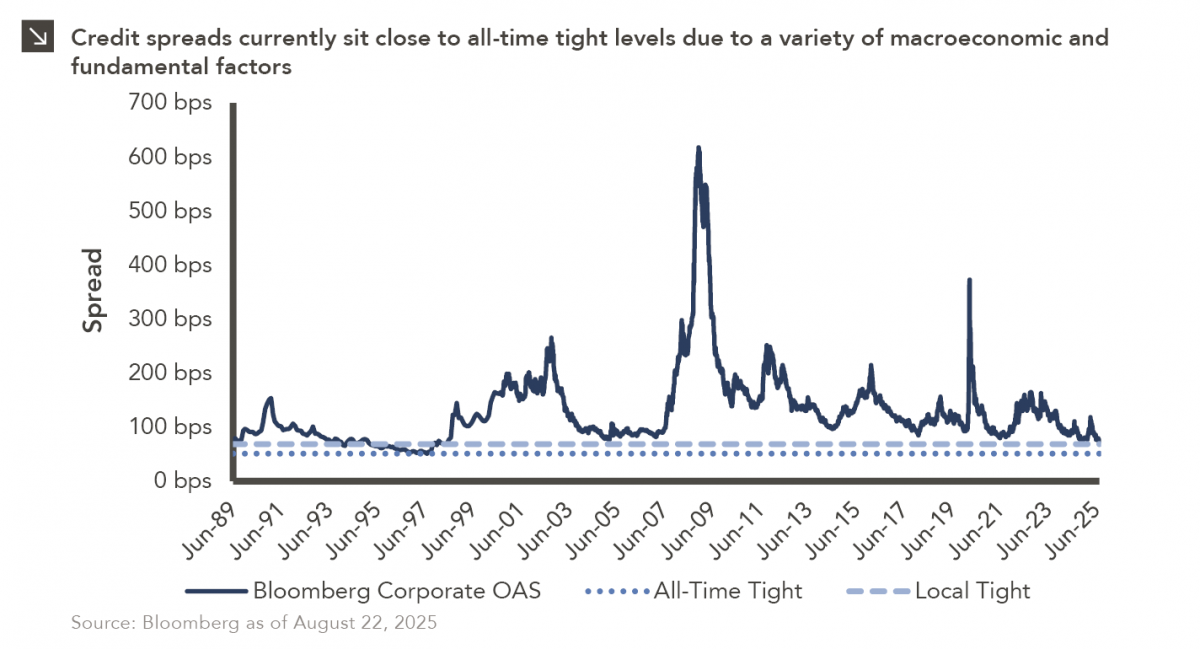

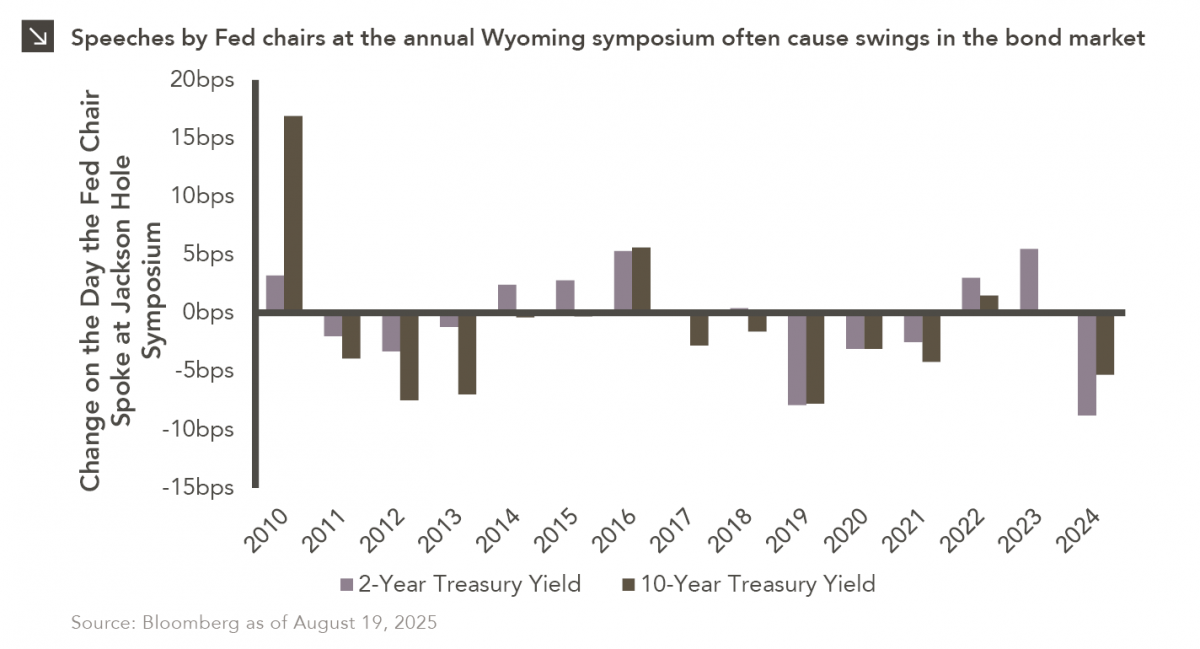

Predictions that the Federal Reserve is set to lower interest rates will be put to the test this week as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >