09.15.2025

Oil Pressure?

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

The most recent headlines related to tariffs have been positive, with the U.S. and China reaching a 90-day pause on May 12 and domestic equities surging in response to this news. Despite this reprieve, however, U.S. farmers may still have reason for concern. To that point, current duties on the second highest U.S. agricultural export, soybeans, remain almost as high as those from 2018, a year that saw U.S. soybeans become a major casualty of another trade conflict triggered by American tariffs on Chinese goods. The U.S. soybean industry was hit hard as a result, suffering an immediate loss of market presence in China. This trend can be observed in the chart above. During a recent hearing before the U.S. Senate Finance Committee, the president of the American Soybean Association expressed fears that current trade restrictions could lead to a loss in market share for U.S soybean farmers similar to that of 2018.

China accounts for roughly 60% of global soybean imports and around half of total U.S. soybean exports, meaning tariffs will almost certainly impact U.S. farmers negatively. Additionally, the Chinese government has endeavored to increase its partnership with Brazil, which is currently China’s largest soybean trading partner. Earlier this month, the leaders of both countries met in Beijing to emphasize the importance of the relationship and sign new trade agreements. Even before this summit, Chinese companies have worked to expand infrastructure within Brazil (e.g., building railroads and water ports) with the goal of bolstering the agriculture supply chain. Additionally, one the largest state-owned conglomerates in China, COFCO, is in the process of building an export terminal in the major Brazilian port city of Santos, which is expected to increase capacity from 5 million tons to 14 million tons. This port is key when it comes to the exporting of commodities such as corn, sugar, and soybeans. It remains to be seen how much stronger the trade relationship between China and Brazil will become in the coming years.

In conclusion, recent tariffs have both redefined international trade relationships and underscored the vulnerability of domestic farmers. Readers should note that uncertainty surrounding the global macroeconomic landscape is likely to persist, and commodities like soybeans could exhibit elevated levels of volatility amid a reshaping of world trade.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

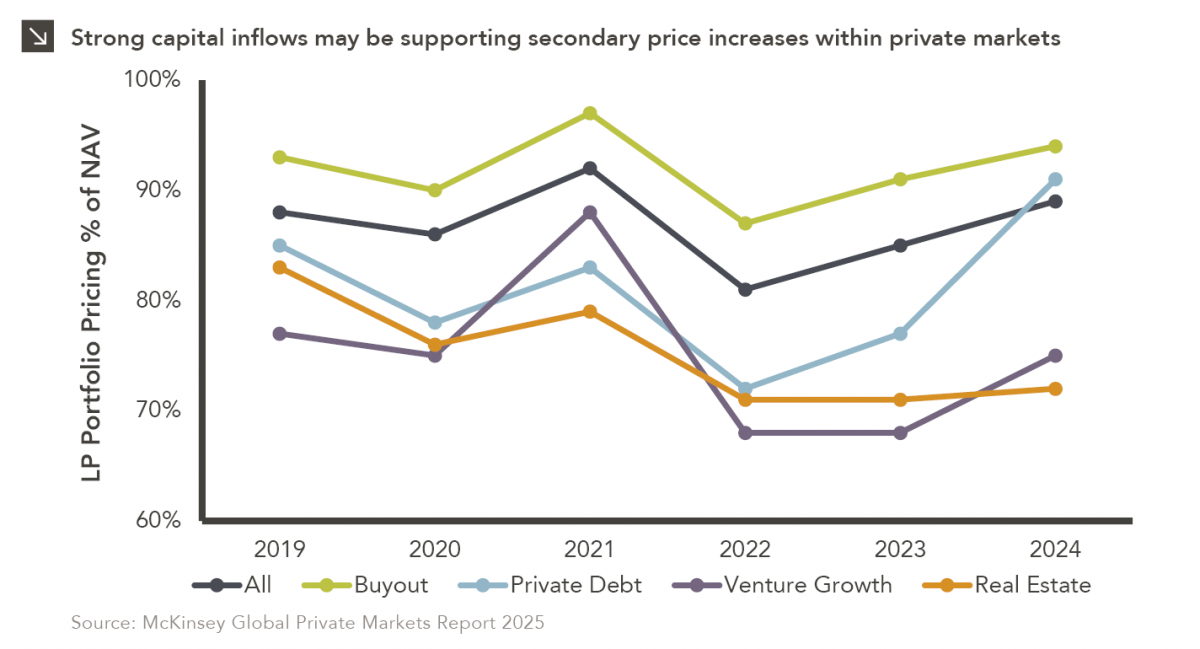

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

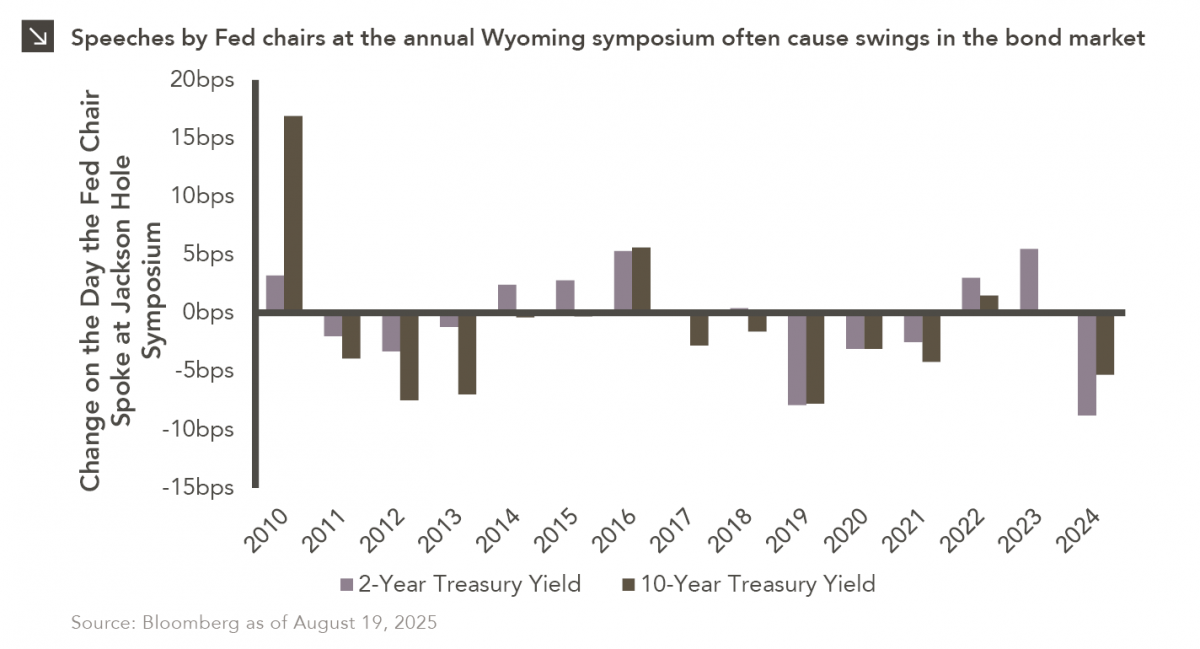

08.19.2025

Predictions that the Federal Reserve is set to lower interest rates will be put to the test this week as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >