Jesus Jimenez

Principal

This week’s Chart of the Week examines the importance of personal consumer expenditures (PCE) on the U.S. economy. From 1970 to 1st quarter 2013, PCE has grown from 60% to 69% of GDP as the health of the economy has become more dependent on consumers. While many factors can account for the PCE figure, one of the more telling data points is the personal savings rate: if consumers are spending more, they must naturally be saving less. Not surprisingly, the personal savings rate has declined from 12.3% in 1970, indicating a trend of consumers saving less and spending more. Savings rates hit all time lows leading up to the recent recession as consumers spent outside of their means in an overheated economy. In reaction to the economic downturn, consumers became conservative and increased their savings, applying further negative pressure to an already troubled economy. Currently the savings rate has trended back down, a sign that fear has subsided and investors are spending more. This coupled with favorable trends in housing and consumer confidence are positive indicators for future economic growth.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

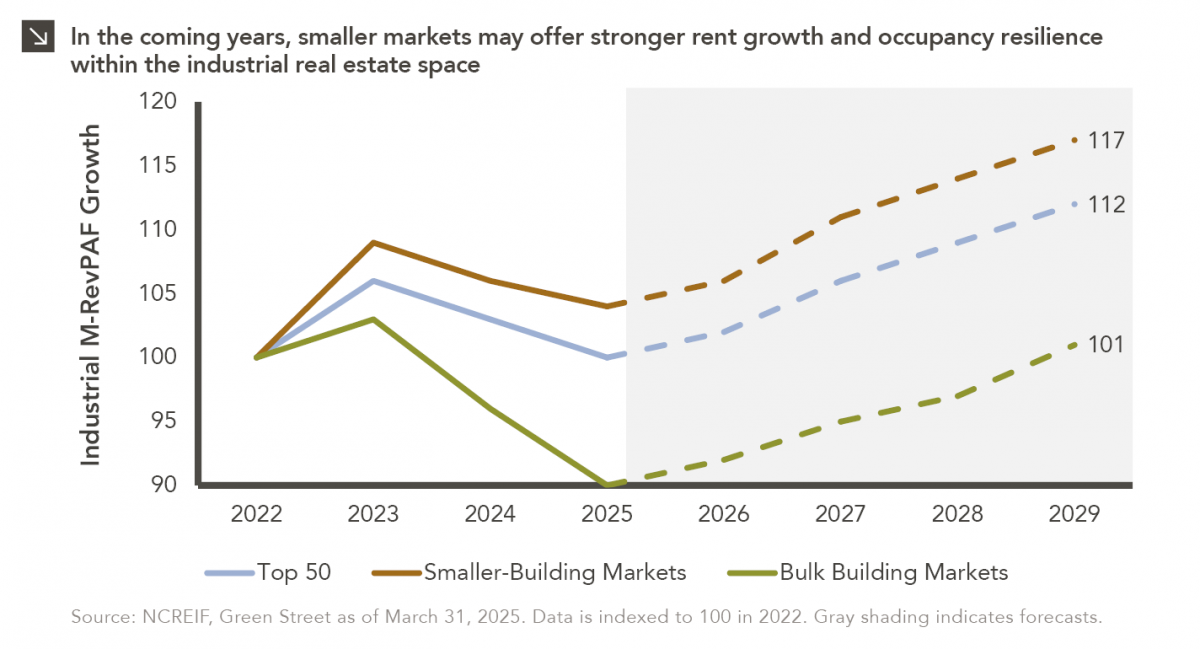

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >