02.02.2026

K-Shaped Conundrum

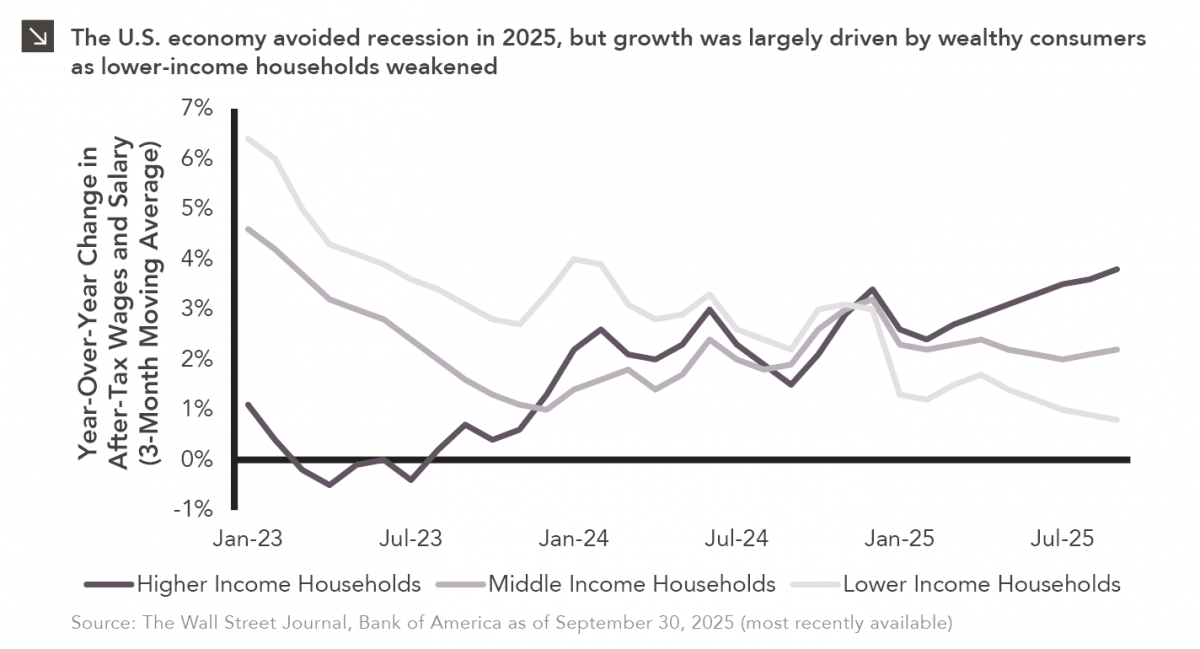

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

This week’s Chart of the Week examines the difference in average wages in the United States and China. As China has experienced substantial economic growth, it has also seen its average yearly wage for employed people in urban units rise from ¥9,333 in 2000 to ¥41,799 in 2011 (most recently available data). When converted and normalized into 2011 U.S. dollars, this is an increase from $1,472 to $6,468, which constitutes a 14.6% compounded annual growth rate in real dollars. On the other hand the U.S., like most other developed countries, has experienced stagnant real wage growth, fluctuating between $41K and $44K over the past decade.

A significant difference between the two wage levels remains with the average wage in the U.S. almost seven times higher than the average Chinese wage. However, many of the largest sectors of the Chinese economy are far more labor intensive and better represented by the U.S. minimum wage. The current minimum wage in the U.S. is $7.25/hr or $14,500 annually. Assuming there is no change in the U.S. real minimum wage, the Chinese average wage is on pace to surpass this in 2017.

While China has often been a cheap source of labor for businesses, wage increases could hurt the competitiveness of firms located in China. If Chinese wage growth continues on the current trend companies may decide that it is no longer optimal to produce in China. The effect this would have is twofold. As businesses leave China, the growth in the Chinese economy could slow. Secondly, this could lead to more jobs returning to the U.S., lowering unemployment and increasing wages.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.02.2026

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >