09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

North American private equity managers have consistently outperformed the Russell 3000 as well as other broad equity indices over the last 20 years.¹ Key value drivers that have contributed to this outperformance include information asymmetry, a longer-term strategic focus, use of leverage, improved management and governance, and effective value creation plans. But for private equity managers to continue to achieve these outsized returns, they must first find the right opportunities and then be able to effectively monetize their investments.

In the U.S. there are approximately 17,500 private companies with annual revenue greater than $100 million, compared to roughly 2,600 public companies above the same revenue threshold. For every one public opportunity at this level, there are almost seven private opportunities. There are also more than 340,000 private businesses with revenue between $5 and $100 million. As private markets continue to grow and evolve, private companies will be able to access capital with greater ease than they have historically. This, in addition to the disadvantages of going public, should extend the trend of companies staying private for longer. This sets the stage for private equity managers to continue to deliver attractive risk-adjusted returns, with a robust opportunity set and a number of unique investment advantages.

Print PDF > Can Private Equity Outperformance Persist?

¹Pitchbook as of Q320, latest data available.

Sources: Capital IQ, Forbes, and PitchBook

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

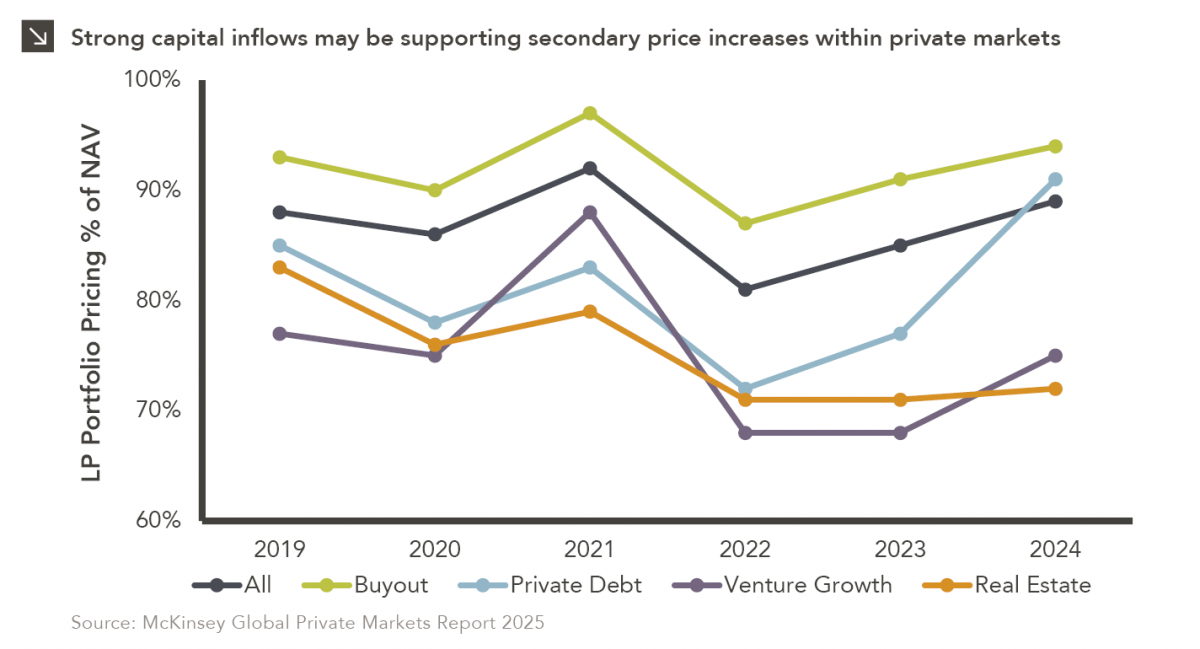

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >