Christopher Caparelli, CFA

Partner

Under the Fed’s zero interest rate policy, high yield bonds have enjoyed a terrific run of performance. For the five-year period ending June 30, 2014, the Barclays U.S. Corporate High Yield index produced an impressive annualized return of 14.0% per year. However, returns in this more speculative portion of the bond market have been disappointing since last summer, when the high yield spread over Treasuries reached a multi-decade low of 221 basis points. The index fell 0.4% in the twelve months ending June 30, 2015, and has continued to show weakness, falling another 1.9% through the middle of August.

This week’s chart examines the past relationship between high yield spreads and rate tightening cycles.1 Although there certainly isn’t a perfect correlation, tightening activity by the Fed has often caused high yield spreads to widen, significantly impacting total return potential. It is no secret that low and stable interest rates are good for speculative companies that are active in the debt markets. While a rake hike doesn’t spell impending doom for the entire high yield universe, some of the more speculative borrowers who have become accustomed to borrowing at ultra-low rates could be in trouble, particularly if the Fed embarks on a prolonged period of successive rate hikes. As we prepare for the first Fed rate hike — likely later this fall — it will be important to pay close attention to high yield exposure within investment portfolios as well as manager positioning within the high yield space.

1 Most recent rate tightening lines refer to the end of QE 1 and 2 and the start of the Fed’s tapering

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

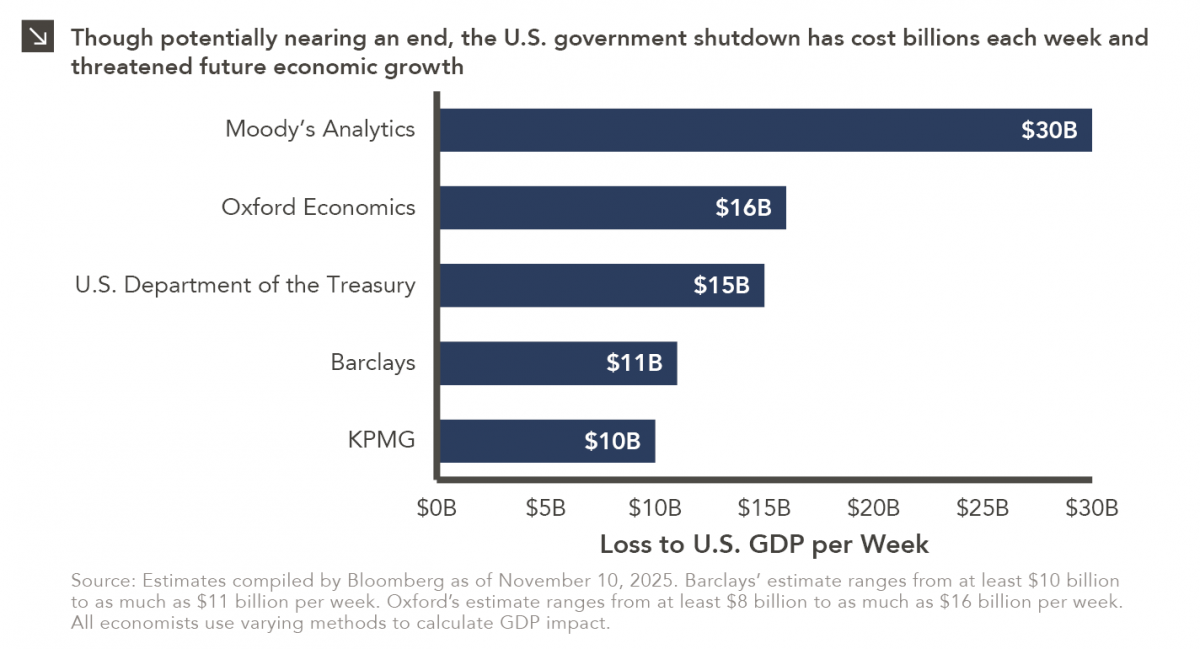

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >