Christopher Caparelli, CFA

Partner

In testimony before the House Financial Services Committee on November 4, Federal Reserve Chairwoman Janet Yellen remarked that a rate hike was still a “live possibility” in December, should economic data remain supportive. Prior to that comment, the market was unsure of any policy change at the Fed’s December meeting, with the Fed Fund’s Futures market implying a 50% probability of a rake hike. After Yellen’s comments, the probability of a hike in December jumped to nearly 70%, and currently sits at 80%, thanks to strong payroll reports over the last two months and further hawkish comments from FOMC members.

Despite this guesswork, Yellen and other members of the FOMC have stressed that the timing of the first rate hike in over nine years is less important that the pace of successive increases. While the futures market hasn’t been an overly reliable predictor of the future path of the Fed Funds rate, it is worth noting that the market appears to accept the Fed’s pledge to enact future increases in a slow and steady manner. Assuming a 0.25% increase on December 16 as a near certainty, the futures market doesn’t imply any meaningful probability of the next increase until the March 2016 meeting, with the most likely landing spot of the Fed Funds rate to be between 0.75% and 1.00% at the end of 2016. While a Fed Funds rate of 1.00% would be a notable shift from the Fed’s post-crisis zero interest rate policy, it would still be seen as highly accommodative in a historical context, and supportive of future economic growth.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

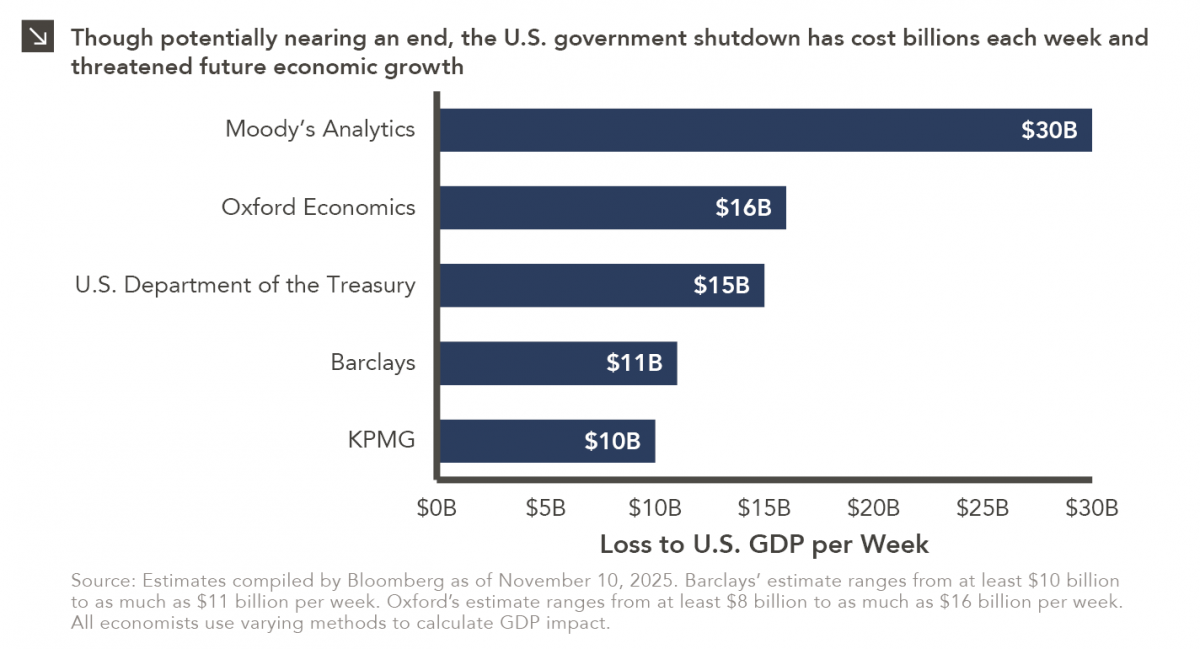

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >