09.22.2025

The Running of the Bulls

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

GDP growth turning positive in the first quarter, May unemployment down to 5.8% from 14.8% in April 2020, and the S&P 500 reaching a new all-time high in May are all signs of economic recovery. More than 22 million jobs gained over the past 10 years were wiped out by COVID, and as of May, 13 months after the April 2020 bottom, 66% of those jobs have been recovered. While the same degree of recovery took 22 months following the Global Financial Crisis of 2008, the recent increases in payroll have actually fallen short of expectations.

Nonfarm payrolls increased 559,000 in May, falling below expectations for 675,000. This follows an even larger miss in April, when an increase of 278,000 jobs fell well below expectations for 1 million.¹ At the same time, the number of job openings has mounted to 9.3 million,² a record high and 2.3 million more than before the pandemic. Labor supply is not keeping pace with demand. According to the May Consumer Confidence Survey, 46.8% of consumers — up from 36.3% — say that jobs are “plentiful,” and only 12.2% — down from 14.7% — say that jobs are “hard to get.” The labor participation rate is down to 61.6%, the lowest level since 1976, excluding the recent period since the coronavirus outbreak.

From here, vaccination rates, wage growth, and the expected September expiration of additional unemployment benefits will dictate employment trends. Jobs progress will in turn influence how the Federal Reserve approaches raising interest rates and tightening monetary policy. Meaningful progress has been made, and these factors, among others, will continue to shape the economic recovery.

Print PDF > The Labor Market Is Healing, but More Slowly Than Expected

¹ Bloomberg

² As of April, latest available

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

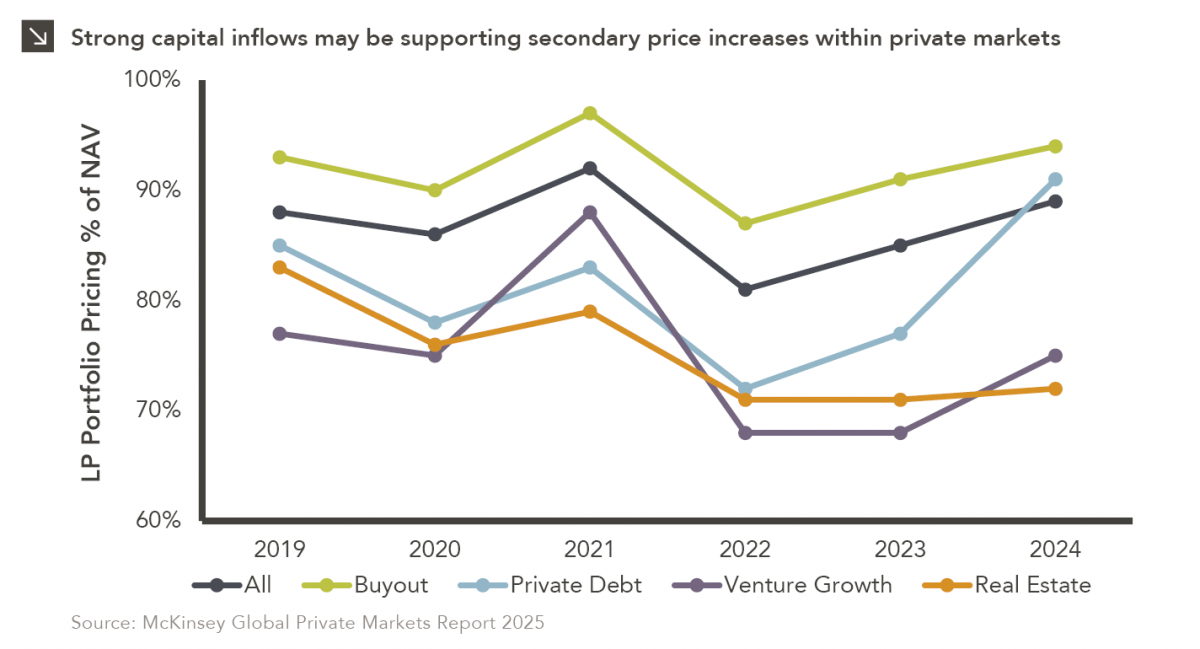

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

08.26.2025

July 31, 1997 is a date which will live in infamy. On this day, FedEx Express Flight 14 crashed at…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >