Christopher Caparelli, CFA

Partner

Among the many factors the Congressional Budget Office (“CBO”) must estimate in budget projections provided to Congress, GDP is often the most important, as it provides a foundation for most other forecasts. While near term GDP growth can often be estimated with some accuracy based on current trends, longer term forecasts rely upon potential GDP. Utilizing the economic factors of labor input and physical capital, potential GDP is a measure of the maximum sustainable output of the national economy. It is the level that national output should be when the economy is at full employment and full resource utilization.

Going back to the 1950’s, real GDP has often plotted very near the CBO’s potential GDP forecast, often correcting any deviation quickly. Since the sharp economic downturn experienced in 2008, however, real GDP has remained below potential GDP, creating a sizeable output gap. In order to close that output gap, the national economy must grow at a faster rate than it has since 2008.

The various dotted lines on the graph contemplate constant forward growth rates in real GDP from the last recorded observation in the third quarter of 2012. Although it is unrealistic to assume the national economy will grow at a constant rate going forward, the analysis presents a hypothetical best/worst case scenario. If the national economy were to grow at a constant 5% annualized growth rate beginning in the fourth quarter of 2012, it would take the national economy until the third quarter of 2014 to realize its potential output. A 4% growth rate would reach potential GDP in the second quarter of 2015, and a 3% constant growth rate would reach potential GDP in the third quarter of 2020. If the national economy were to grow at a constant 2% rate – not far from the observed growth rates of the previous handful of quarters – the gap between real and potential output will continue to grow.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

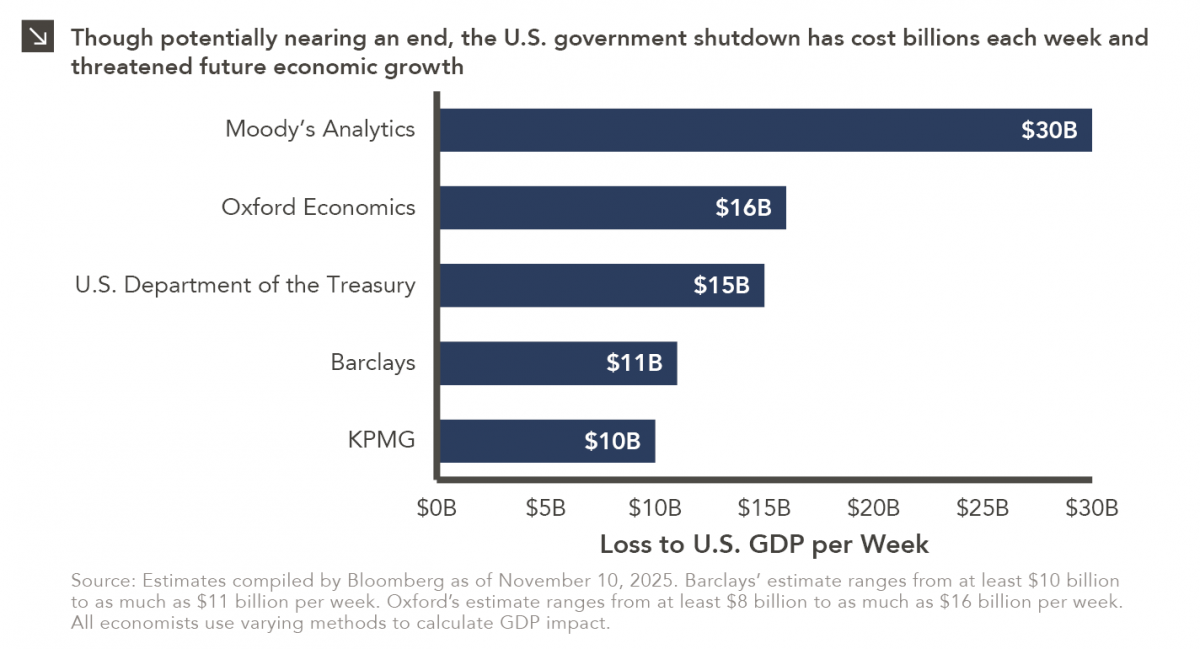

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >