10.27.2025

Don’t Make Me Repeat Myself

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

2019 was certainly a profitable year for investors as traditional and alternative asset classes delivered positive returns. As we enter 2020, there are a litany of questions facing global markets ranging from the U.S. election to trade disputes to global monetary policy, all of which will undoubtedly influence investment returns. The following newsletters examine the primary asset classes we cover for our clients, with in-depth analysis of last year’s performance and more importantly, trends, themes, and projections to watch for in 2020.

We hope these materials can assist you and your committees as you plan for the coming year, and please feel free to reach out to any of us should you have further questions about the articles. We have also produced a 2020 Market Preview video if you would like to hear a high-level summary of the market previews. Here’s to another positive year from the markets in 2020!

U.S. Economy: Signs of Slowing?

by Greg Leonberger, FSA, EA, MAAA, Partner, Director of Research

Fixed Income: The New Roaring Twenties — Will It Be Different This Time?

by Ben Mohr, CFA, Director of Fixed Income

U.S. Equities: Climbing the Wall of Worry

by Robert Britenbach, CFA, CIPM Research Analyst, U.S. Equities

Non-U.S. Equities: Big Expectations, Little Wiggle Room

by David Hernandez, CFA, Senior Research Analyst, Non-U.S. Equities

and Nicole Johnson-Barnes, CFA, Research Analyst

Real Estate: What Will Happen Next?

by Jeremy Zirin, CAIA, Senior Research Analyst, Real Assets

Infrastructure: The Energy Revolution Is Driving the Future of Infrastructure

by Jeremy Zirin, CAIA, Senior Research Analyst, Real Assets

Hedge Funds: Rising Geopolitical Risks and a U.S. Election Could Lead to Tempered Expectations

by Joe McGuane, CFA, Senior Research Analyst, Alternatives

Private Equity: As Asset Class Grows, Continues to Deliver for Investors

by Derek Schmidt, CFA, CAIA, Director of Private Equity

Private Credit: An Asset Class Coming Into Its Own

by Brett Graffy, CAIA, Research Analyst

To read the above files in one combined document > 2020 Market Preview

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

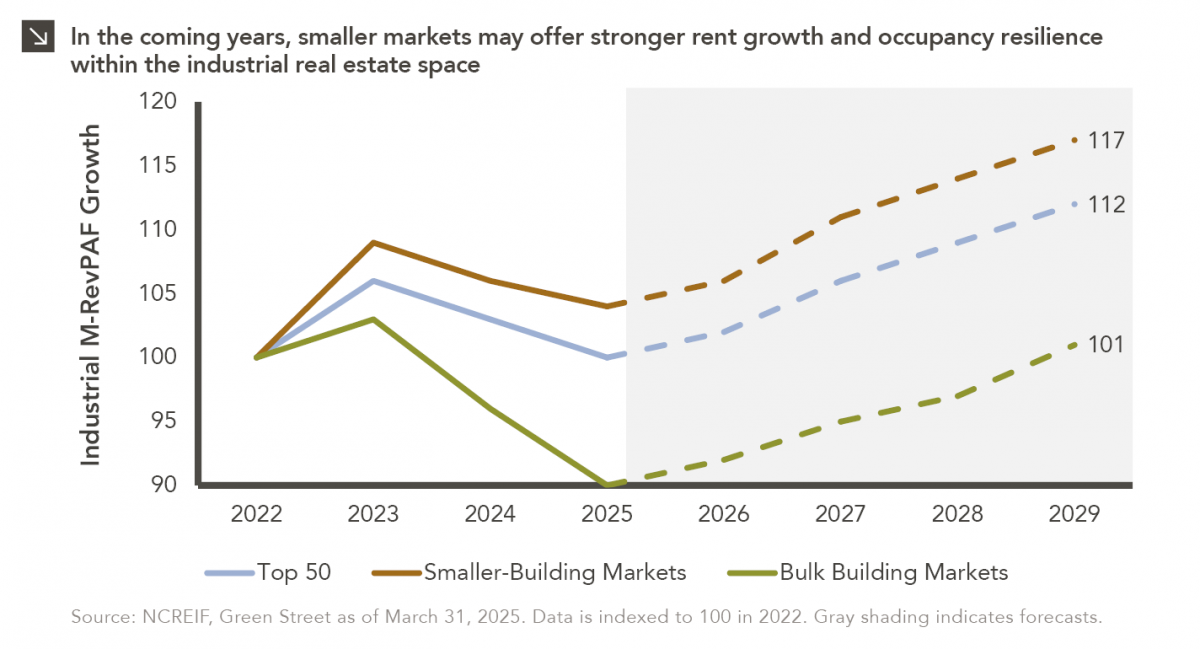

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >