10.27.2025

Don’t Make Me Repeat Myself

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Over the past 18 months, oil has been a significant drag on global financial markets. While oil producing countries have obviously been hit the hardest, the rest of the world has also struggled. But recently there’s been a mild resurgence in oil, with the WTI index now near $50 per barrel. This is still nowhere near its previous levels of over $100, but it is a significant increase from the low of about $26 seen earlier this year. This Chart of the Week examines what this means for different parts of the world by looking at the daily correlations between oil and MSCI countries’ indices over the past 18 months.

Not surprisingly, emerging markets, along with Canada, have the highest correlations due to their heavy dependence on oil exports. They’ve also had the worst performance over the past few years but stand to gain the most from rising oil prices. Developed markets though also have high correlations and even in the U.S. and Japan, which have the least significant correlations, oil is still a major factor. These correlations won’t necessarily hold up going forward, but the trend suggests that if oil continues its slow recovery financial markets will benefit across the board. While other issues may affect this recovery, such as a “Brexit” or Japan’s deflationary pressures, overall rising oil prices should be a boost to the global economy.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

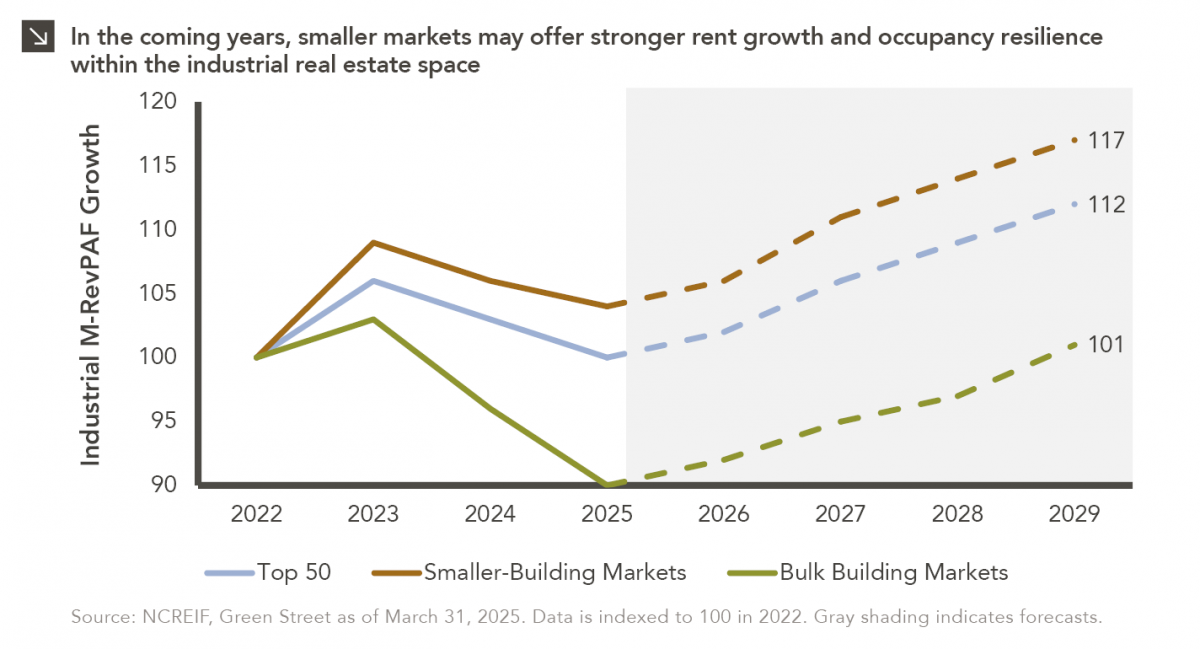

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >