Christopher Caparelli, CFA

Partner

As investors turn the calendar to 2015, one of the big uncertainties for the coming year is Fed policy and its impact on interest rates. In October, the Fed formally wrapped up its quantitative easing program, which saw the size of the central bank’s balance sheet grow from a pre-crisis $800 billion to almost $4.5 trillion. Now, the Fed can once again focus on the more traditional policy tool of manipulating short-term interest rates. Against a backdrop of steadily improving economic fundamentals and low inflation, the Fed has pledged to keep the Fed Funds rates low for a “considerable” period of time. Investors have loosely interpreted such Fed-speak to mean that the first rate hike is likely to occur sometime in the second half of 2015.

For a more precise estimate of the market’s interpretation, we can turn to the futures market for potential guidance. As of November 28, the futures market was predicting that the effective Fed Funds rate will rise from its current level of 0.10% to 0.25% by August of 2015, reaching a level of near 0.50% by the end of 2015. Unfortunately, as our chart of the week shows, the futures market has historically been a poor predictor of future interest rates. Since the 2008 Financial Crisis, futures contracts on the effective Fed Funds rate have serially overestimated the actual level of interest rates. So while 2015 is supposed to finally be the year that interest rates rise off historic lows, the futures market cannot be counted on to accurately predict the timing and magnitude of any increase.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

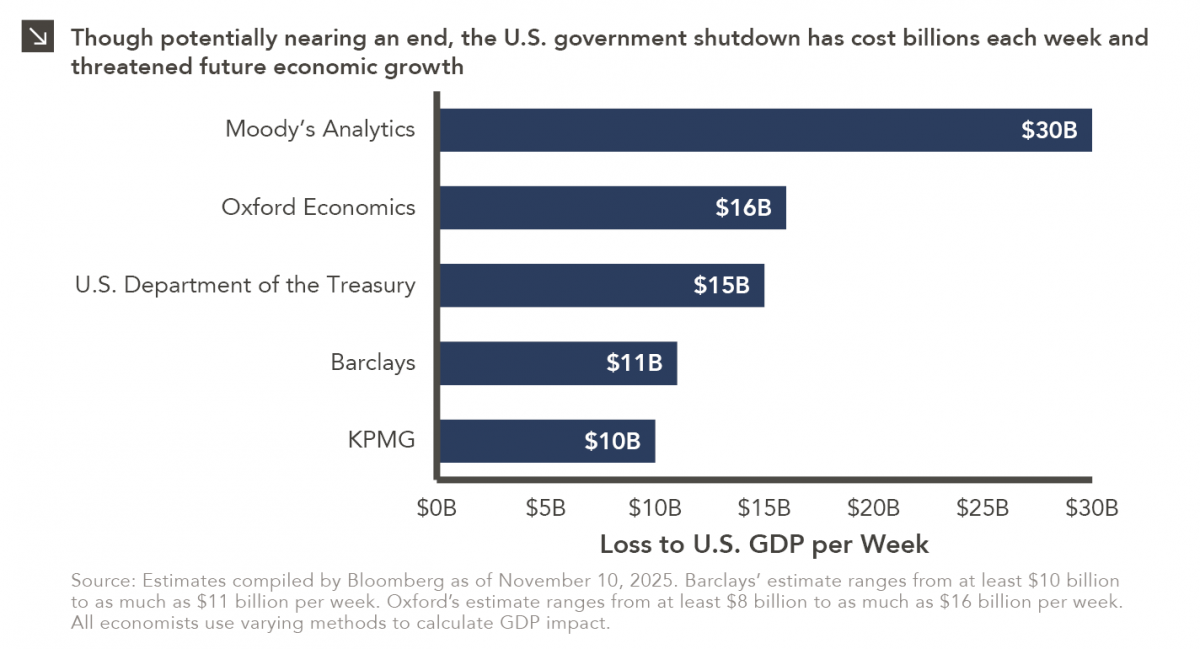

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >