Mike Spychalski, CAIA

Vice President

This week’s Chart of the Week deals with the sovereign debt crisis in Europe. Over the past several weeks the fiscal situation in Portugal has received a significant amount of attention, and there has been speculation that Portugal will be the next country to require a bailout package from the EU. Yields on Portuguese government bonds have been steadily rising throughout the course of the past year, and in recent weeks the yield on the Portuguese 10-year bond has been trending towards 7%. The 7% threshold is significant because both Greece and Ireland were forced to request a bailout package from the EU shortly after yields on their 10-year bonds exceeded 7% (based on a rolling 10-day average). The yield on Greek 10-year bond broke through the 7% threshold on April 16, 2010, and Greece requested a bailout package on April 23, 2010. The yield on the Irish 10-year bond broke through the 7% threshold on November 15, 2010, and Ireland requested a bailout package on November 21, 2010. Portugal had a successful bond auction on January 12, 2011, and yields on their 10-year bond have backed away from the 7% threshold. However, Portugal is still facing major fiscal issues over the near term. They have a significant budget deficit (9.3% of GDP as of 12/31/09), a high debt to GDP ratio (80% as of 9/30/10), a high unemployment rate (11% as of 11/30/10), and a low growth rate (1.4% as of 9/30/10). In addition, Portugal has over €20 billion (approximately $26 billion) in funding needs in 2011, and unless the market perceives a material improvement in Portugal’s fiscal situation, it will be difficult for the yield on their 10-year bonds to stay below the 7% threshold.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

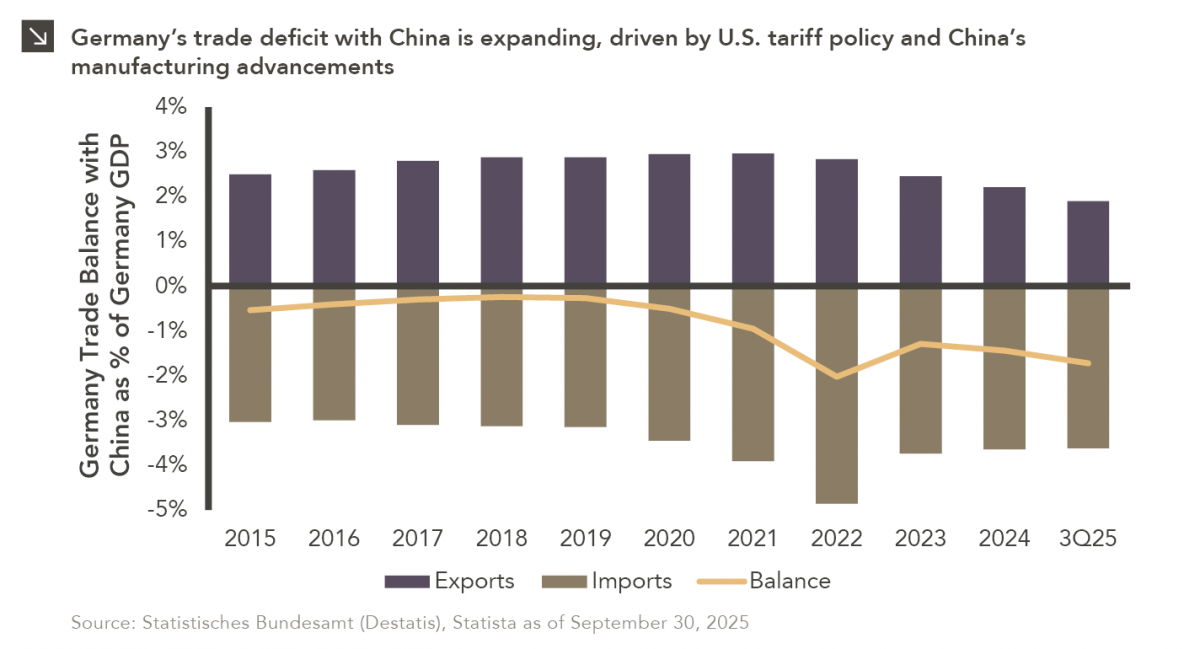

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >