Thomas Neuhardt

Research Associate

Get to Know Thomas

With the first Federal Reserve rate cut of the current loosening cycle in the rear-view mirror, investors are now questioning how markets will react to a new era of macroeconomic policy. While each rate cycle is unique, examining how the S&P 500 and Bloomberg Aggregate indices have responded to prior instances of rate cuts can give investors some insight on what to expect going forward. To that point, this week’s chart highlights the returns of these benchmarks following the first cut of last six periods of easing by the Federal Reserve. Although rate cuts have historically portended higher near-term equity returns, there have been two instances of negative S&P 500 Index performance in the wake of Fed easing. Specifically, the 1- and 3-year returns following rate cuts in 2001 (the Dot Com Bubble) and 2007 (the Global Financial Crisis) were both negative. That said, performance of the Bloomberg U.S. Aggregate Bond Index was positive during both of those periods, as well as during the other four easing cycles shown in this week’s chart. Even during the 3-year period following July of 2019, which included six months of rate hikes in 2022, the fixed income benchmark returned 0.4% on an annualized basis. In summary, although Fed rate cuts have historically coincided with recessions in the U.S., investors can gain comfort from that fact that both equities and bonds have fared relatively well amid periods of monetary policy loosening.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

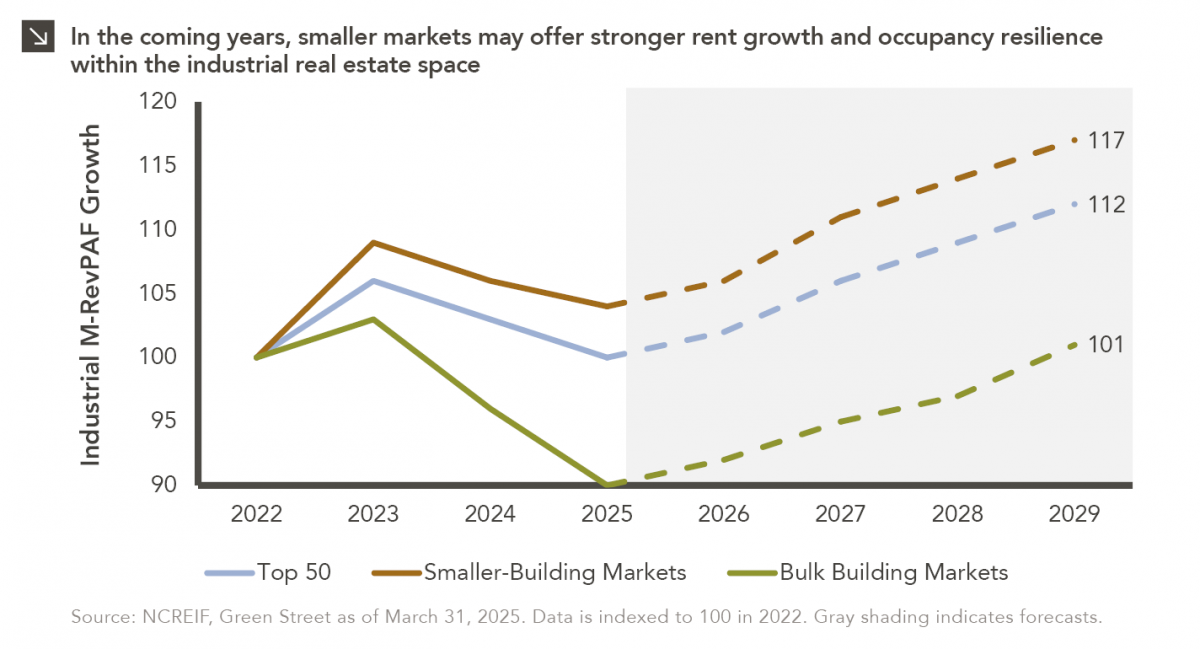

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >