Evan Frazier, CFA, CAIA

Senior Research Analyst

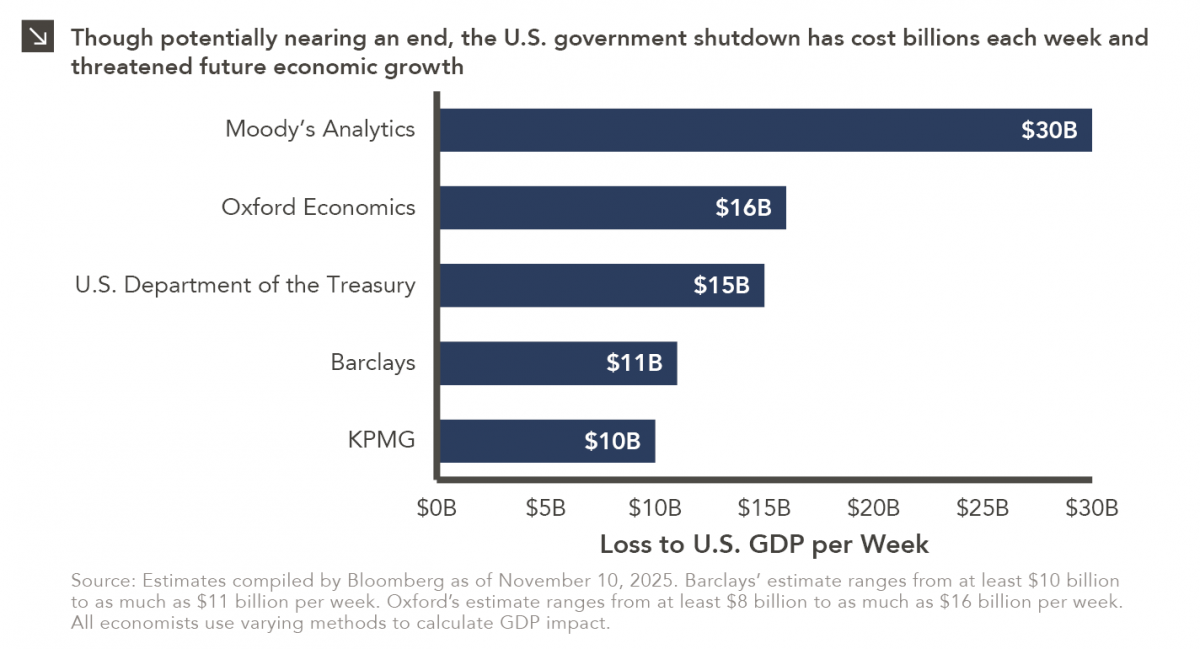

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as enough Democrats agreed to advance a bill aimed at resolving the weeks-long stalemate. While previous government shutdowns have only caused short-term economic impacts since furloughed employees eventually receive back pay and federal spending typically rebounds quickly once operations resume, experts warn that the current shutdown has proved more damaging for several reasons. First, the economy is in a more vulnerable position than it was during previous closures, with households already strained by inflation and labor market uncertainty. Additionally, the current impasse has affected not only federal employees but also millions of Americans who are seeing their food assistance disrupted just as the holiday season approaches. As can be seen in this week’s chart, analysts estimate that the shutdown has cost the U.S. economy anywhere from $10 billion to $30 billion per week, with total losses already surpassing those of any previous government closure.

Looking ahead, economists note that while some of the output lost to the shutdown might eventually be recovered once the government reopens, a growing share (particularly in private sector services and tourism) will likely be permanent. The Congressional Budget Office warns that the shutdown could shave as much as two percentage points off fourth-quarter GDP growth, threatening to amplify existing weaknesses in manufacturing and consumer sentiment. Forecasts from major financial institutions have also been revised downward in recent days, with many groups citing rising uncertainty over fiscal policy and declining confidence. As it relates to capital markets, previous government shutdowns have had little impact on equity performance, with the S&P 500 Index averaging a return of roughly 1.5% during closures dating back to the 1980s and generating a positive return in 8 of the last 10 shutdowns. While these figures suggest that investors have largely considered past shutdowns insignificant, economic fallout and weaker sentiment stemming from the current closure could weigh on stocks going forward. For reference, the S&P 500 Index has returned roughly 0.7% since the shutdown began on October 1 through the end of last week, despite four days that saw the benchmark drop by nearly 1% during the period.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >