Chad Sheaffer, CFA, CAIA

Associate Director of Private Credit

As investors and economists meticulously analyze data to predict future actions of the Federal Reserve, the domestic economy has maintained resiliency thanks in part to robust consumer spending in recent months. That said, challenges exist for the American public, including the fact that consumer interest payments now constitute an increasing proportion of U.S. household incomes. According to the Bureau of Economic Analysis, this figure, which excludes payments related to mortgage debt, reached 4.3% as of the most recent report published on July 31. Incidentally, this marks the highest level observed since 2008 during the Global Financial Crisis.

To this point, U.S. households have managed to withstand these increases in debt servicing payments while simultaneously confronting elevated levels of inflation. However, there are warning signs that this resilience may not be sustainable, particularly among lower-income households that have depleted robust savings amassed during the pandemic. One indication that households are beginning to feel financially squeezed is the fact that delinquency rates have escalated over the last few quarters. According to the Federal Reserve, new 30+ day delinquency rates for consumer credit card debt and auto loans have spiked since bottoming out in late 2021, reaching 7.2% and 7.3%, respectively, as of June 30. While current rates of delinquency remain well below those observed in the aftermath of the Global Financial Crisis, both figures now exceed pre-pandemic levels and may be poised to continue rising.

There is also another challenge with which millions of citizens must now grapple — the resumption of student loan payments, which were reinstated earlier this month. Given this new reality, the proportion of total interest payments relative to household income will almost certainly increase, which may lead some consumers to rely more heavily on credit cards to maintain current spending levels. This type of waning consumer strength would likely have significant ramifications for securities markets and the broader economy, and Marquette will continue to monitor indicators related to these dynamics as we head into the fall.

Print PDF > Feeling the Squeeze

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.17.2026

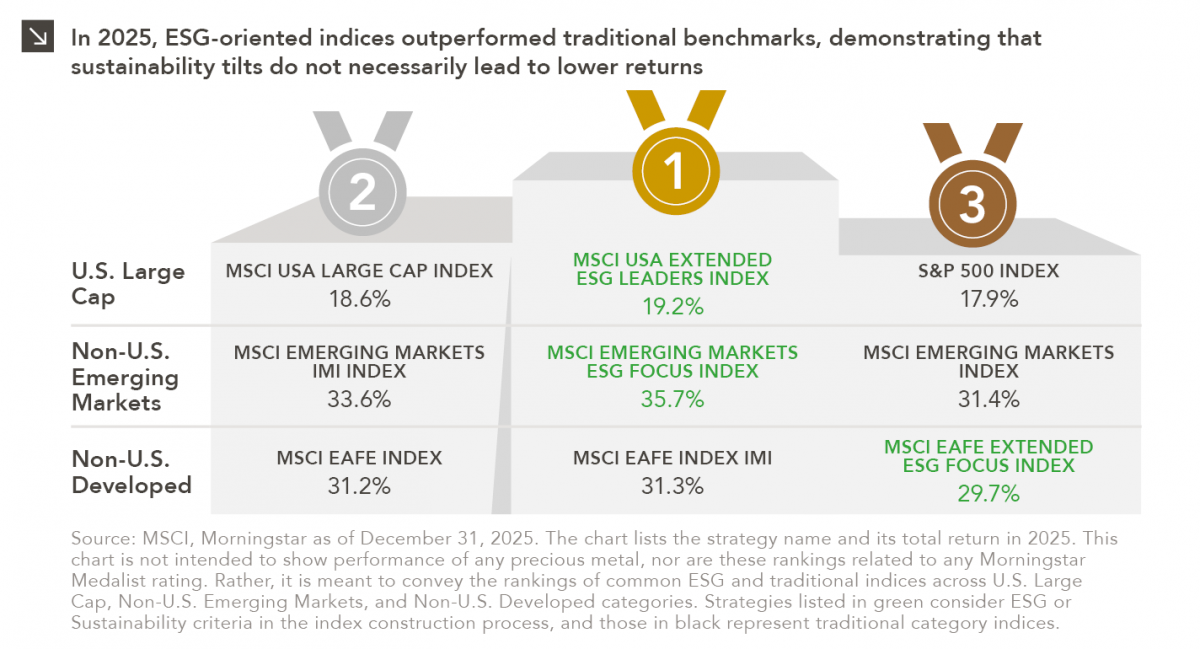

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

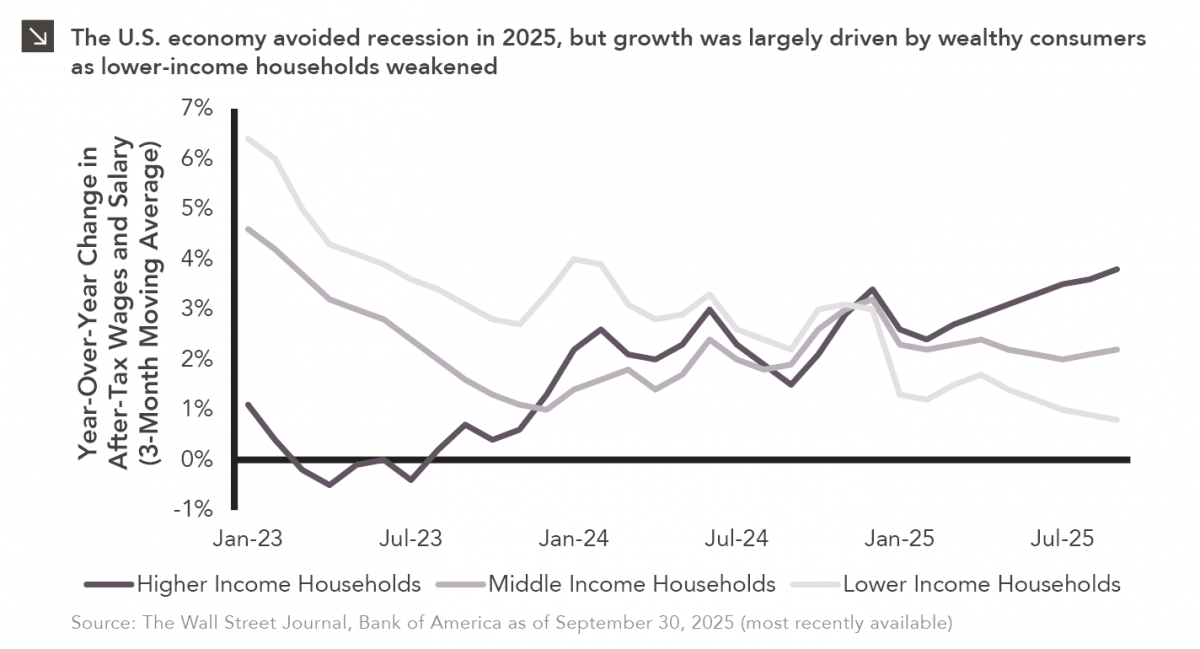

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >