Christopher Caparelli, CFA

Partner

Over the last few weeks, renewed concerns over the European debt crisis coupled with the release of negative economic data in the U.S. has led to a significant sell-off in global equity markets. As a result, U.S. Treasuries – which still serve as a favorite safe-haven despite last summer’s downgrade – have set record low yields across the curve. The nominal yield on the 10 year U.S. Treasury Bond set an all time record low of 1.47% on June 1, 2012, leading many to wonder how much further yields will fall before finally rebounding. Most important is that the new low pushed the real yield on the instrument further into negative territory. When adjusted for inflation, investors are actually losing money when they purchase 10 year Treasury bonds. The Federal Reserve continues to run an extremely inflated balance sheet which has contributed to keeping rates artificially low for quite some time now. While convention says yields must rise at some point, how long investors will be willing to accept a negative real yield on ten years’ worth of U.S. Government debt is anyone’s guess.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

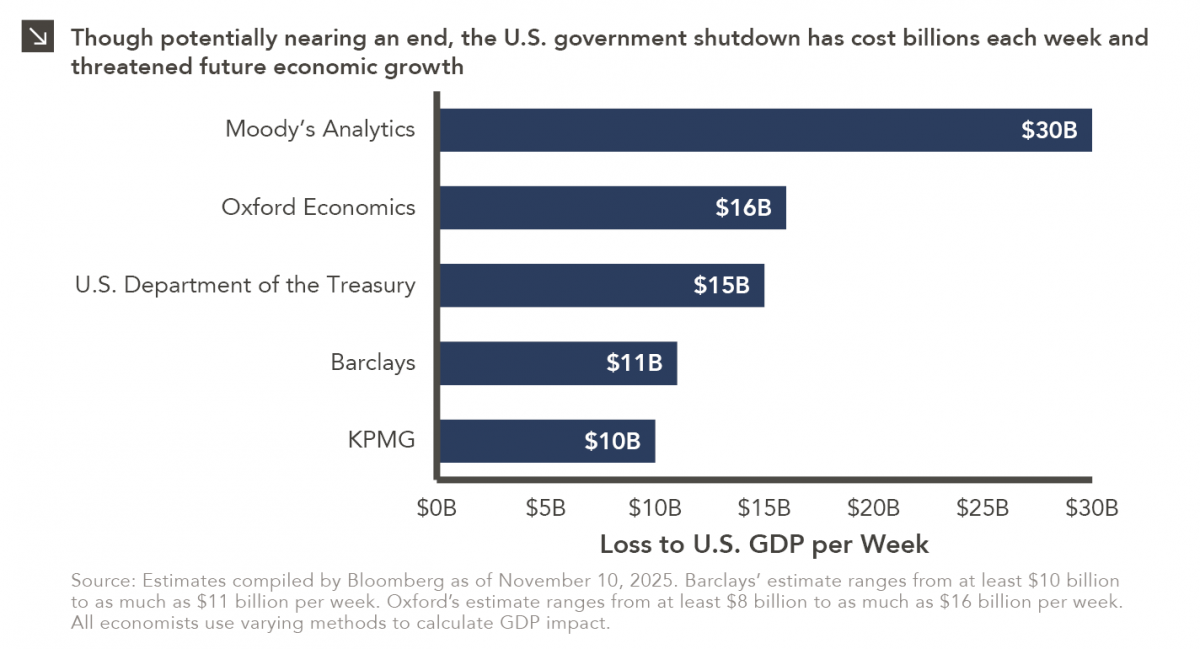

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

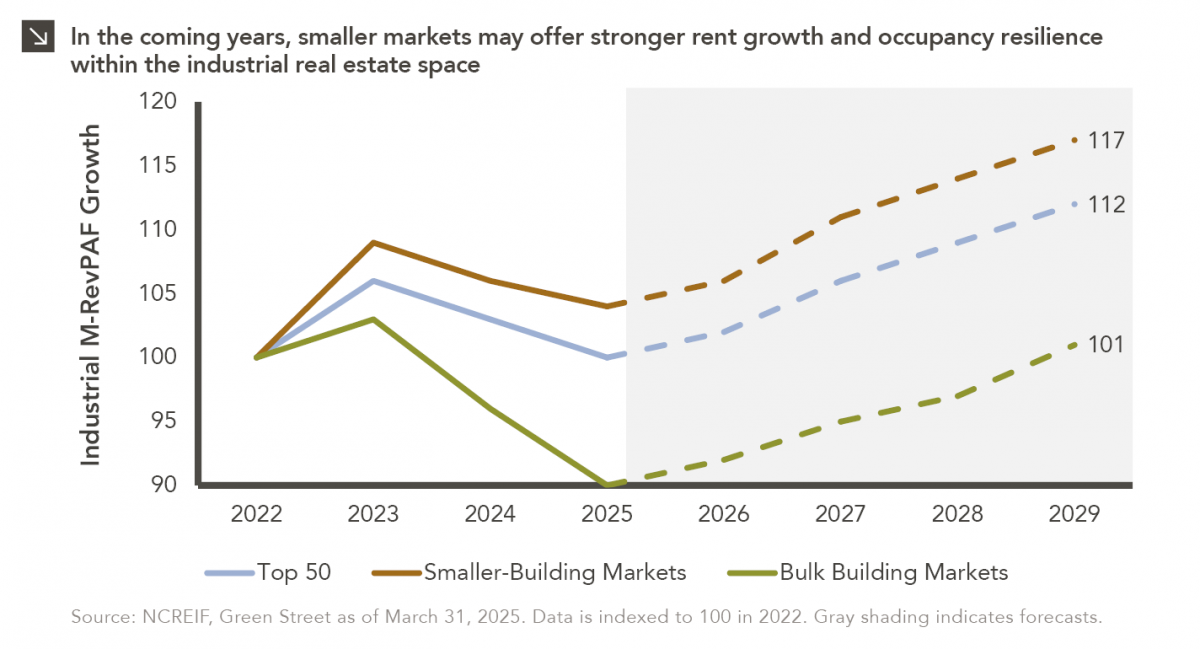

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >