Mike Spychalski, CAIA

Vice President

This week’s Chart of the Week illustrates the significant increase in yields on the 10 Year Treasury Inflation Protected Security (TIPS) over the past several weeks. From May 1, 2013 to June 19, 2013, the yield on 10 Year TIPS increased from -0.67% to +0.26% (an increase of 0.93%). Over that time frame, investors holding 10 Year TIPS contracts suffered losses of approximately 8.0% (there is an inverse relationship between prices and yields, so as yields increase, prices fall). This huge selloff in TIPS has largely been driven by the increase in yields on the 10 Year Nominal Treasury, which saw yields jump by 0.72% over the same time period (representing a loss of 4.9%). Much of the increase in the 10 Year Nominal Treasury yield has been attributed to expectations that the Federal Reserve Bank, which is currently purchasing $85 billion worth of Treasuries and Mortgage Backed Securities every month as part of its various quantitative easing programs, is going to start winding down its asset purchases in the near future. This was confirmed on June 19, when Federal Reserve Chairman Ben Bernanke announced that if economic data continues to come in line with the Fed’s current expectations, the Fed will begin to scale back the level of asset purchases later this year, and could end the asset purchases entirely by mid-year 2014.

However, the jump in nominal Treasury yields does not fully explain the recent increase in TIPS yields. The yields on TIPS are driven by two primary forces, nominal Treasury yields, and inflationary expectations. Thus, the increase in TIPS yields that is not explained by the increase in nominal Treasury yields is primarily attributable to falling inflationary expectations. This should not be surprising given that one of the primary goals of the Fed’s quantitative easing programs was to prevent deflation from occurring in the U.S. economy (i.e. increasing inflation). The simultaneous combination of higher nominal Treasury yields and falling inflationary expectations are the perfect storm that led to the significant losses in TIPS over the past several weeks.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

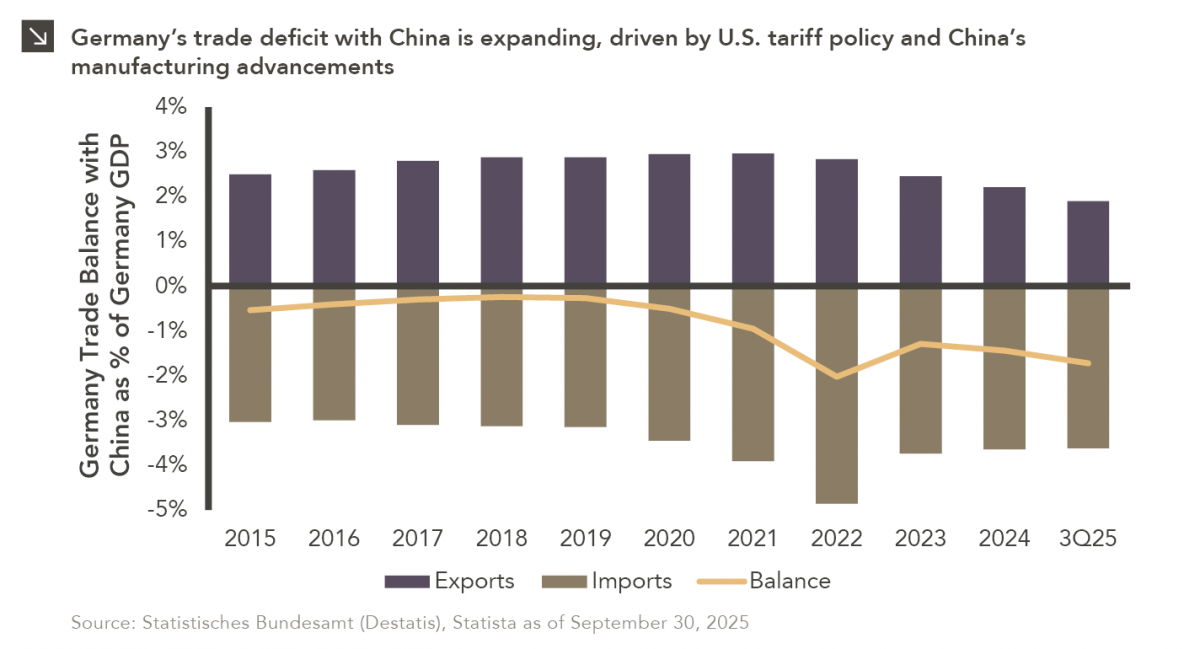

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >