10.27.2025

Don’t Make Me Repeat Myself

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

The ferocious appetite for Special Purpose Acquisition Companies (SPACs) continued its momentum throughout the first quarter of 2021. Investors could not get enough of this asset class as a record amount of capital flowed into the space. Through March, 2021 has already seen more SPAC IPOs than all of 2020, with over 300 new deals coming to market. Similarly, gross proceeds thus far through April are already over $100B, well past the $83B that was raised throughout 2020. The space has gotten so hot that sports celebrities like Shaquille O’Neal, Colin Kaepernick, and Alex Rodriguez have all put their names on SPACs that have recently hit the market.

Can this momentum continue? The Securities and Exchange Commission (SEC) might have something to say about it. Earlier this month, the SEC issued new accounting guidance that would classify SPAC warrants as liabilities instead of as equity instruments, as they are currently classified. Warrants are given to capital providers like hedge funds that put up the capital for SPACs before an IPO, to offer the capital provider more upside once the company goes public. SPAC IPOs have since slowed, as affected SPACs would have to restate their financials if this becomes law. With this risk on the table, investors may begin to look elsewhere to put their capital to work, dampening this SPAC market frenzy.

Print PDF > What’s Next for SPACs?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

10.13.2025

After a three-year drought, the IPO market is stirring again… but only for a select few. Just 18 companies have…

10.06.2025

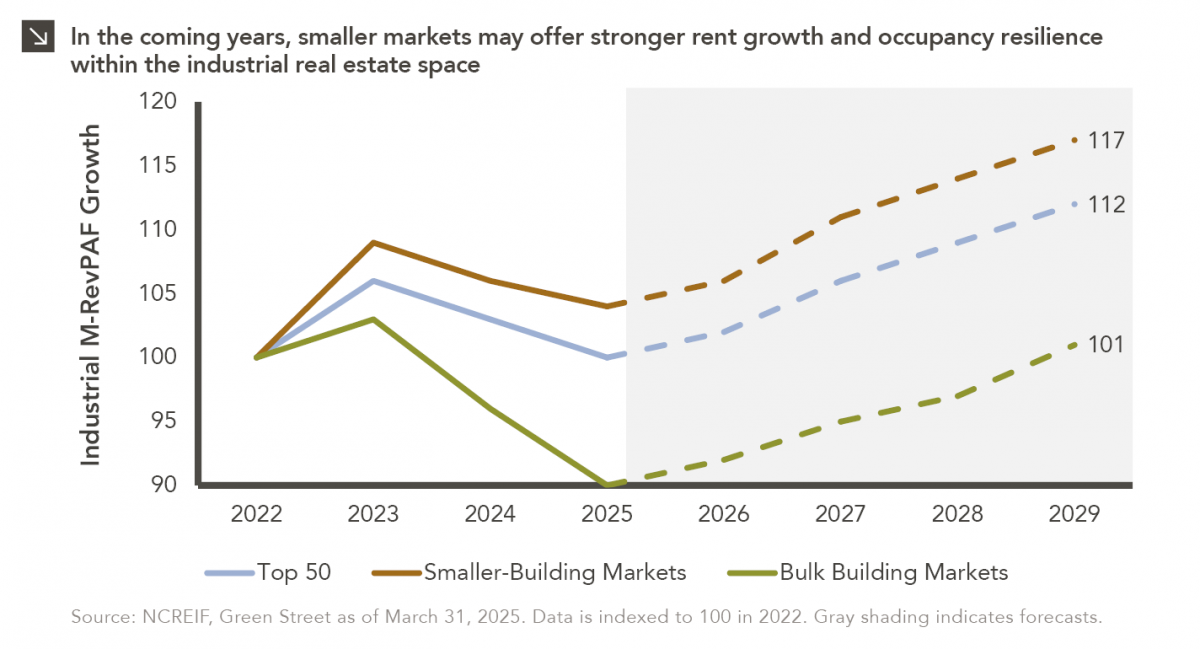

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >